OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

MEDIA HEADLINES

US ECONOMY BLOOMBERG New Economy Daily ... August 2nd 2022

Original article: Peter Burgess COMMENTARY Peter Burgess | ||

|

You're reading the New Economy Daily newsletter.

Written by Chris Anstey August 2, 2022 at 7:00 AM EDT The Soft Landing Squabble Hello. Today we look at a clash between economists and a Federal Reserve official over the outlook for the labor market, the risks to supply chains posed by the standoff over Taiwan, and how friendships can determine pay. Round Three Whether the Federal Reserve can soft-land the $25 trillion US economy is a genuine trillion-dollar question. Some high-profile economists are now embroiled in an intellectual spat over the right answer. On one side: former IMF chief economist Olivier Blanchard, Harvard University’s Alex Domash and ex-Treasury Secretary Lawrence Summers. On the other: current Fed Governor Christopher Waller and Fed economist Andrew Figura. The Blanchard-Domash-Summers team in a paper last month effectively torpedoed the idea championed by Fed Chair Jerome Powell and his colleagues that it’s possible to bring down inflation without major damage to the US job market.

relates to The Soft Landing Squabble Readers of this newsletter may recall that the argument was you can’t just rely on a tumble in job openings to alleviate wage — and thus inflation — pressure. “Empirical evidence” shows that’s never happened before. You essentially have to drive people out of jobs, too. Waller and Figura begged to differ, in a rebuttal paper released Friday. As Craig Torres wrote here, they cautioned not to assume that past is prologue, because of how unusual the economic developments during the pandemic have been. Their takeaway: it’s possible to slow the economy, prompting employers to cut back on job openings, without a major surge in unemployment. “We recognize that it would be unprecedented for vacancies to decline by a large amount without the economy falling into recession,” the Fed economists said. “We are, in effect, saying that something unprecedented can occur because the labor market is in an unprecedented situation.”

Federal Reserve Board Governor Christopher Waller Speaks At Center For Financial Stability Event ... Photographer: Bess Adler/Bloomberg Round Three came Monday. Blanchard-Domash-Summers acknowledged that: “Given that the current vacancy rate is outside of historical experience, anything is obviously possible.” But, looking at the episode most like the current one — back in 1969, when job vacancies were notably above the share of unemployed — there’s no reason to alter the original assessment. “The data support our conclusion that vacancies are very unlikely to normalize without a major increase in unemployment,” the trio wrote. The debate may become more than academic on Tuesday, with the latest reading on job openings. Economists predict a third straight monthly drop for June. Meanwhile, Credit Suisse strategist Zoltan Pozsar has a new report in which he appears to be in the hard landing camp, as he warns the need to beat inflation will result in interest rates above 5% and an L-shaped recession. (Editor note: Summers is a paid contributor to Bloomberg TV) —Chris Anstey The Economic Scene The burgeoning standoff between the US and China over Taiwan is throwing a spotlight on growing risks to one of the world’s busiest shipping lanes. Tensions are mounting with US House Speaker Nancy Pelosi expected to travel to Taiwan. Even a minor disruption in relations could ripple through supply chains, as Kevin Varley shows here. The Taiwan Strait is the primary route for ships passing from China, Japan, South Korea and Taiwan to points west, carrying goods from Asian factory hubs to markets in Europe, the US and all stops in between. Almost half of the global container fleet and a whopping 88% of the world’s largest ships by tonnage passed through the waterway this year, according to data compiled by Bloomberg.

Map ... Container vessel positions as of Aug. 2, largest 10% of fleet by DWT in blue. One warning sign: The Taiwan Taiex Shipping and Transportation Index slumped as much as 3.2% on Tuesday. But Tom Orlik of Bloomberg Economics gives three reasons to be hopeful that the differences over any trip by Pelosi won’t mark the start of a conflict between the world's two largest economies:

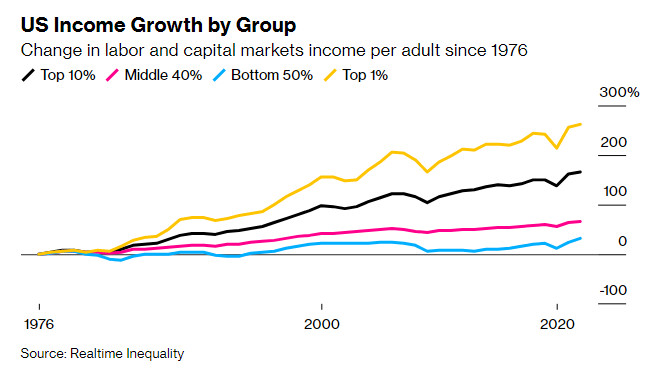

Change in labor and capital markets income per adult since 1976

Source: Realtime Inequality Hong Kong hurt | Economists downgraded their forecasts for Hong Kong’s economy, predicting it could contract for the third time in four years.

| The text being discussed is available at | and |