OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

US ECONOMY

NOT LIKE THE 1970s ... COMPLETELY DIFFERENT Why the U.S. economy shrank ... GDP fell at a 0.9% annualized rate between April and June

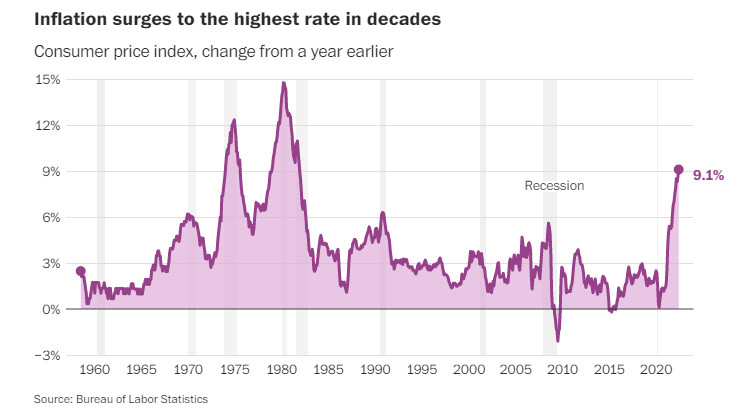

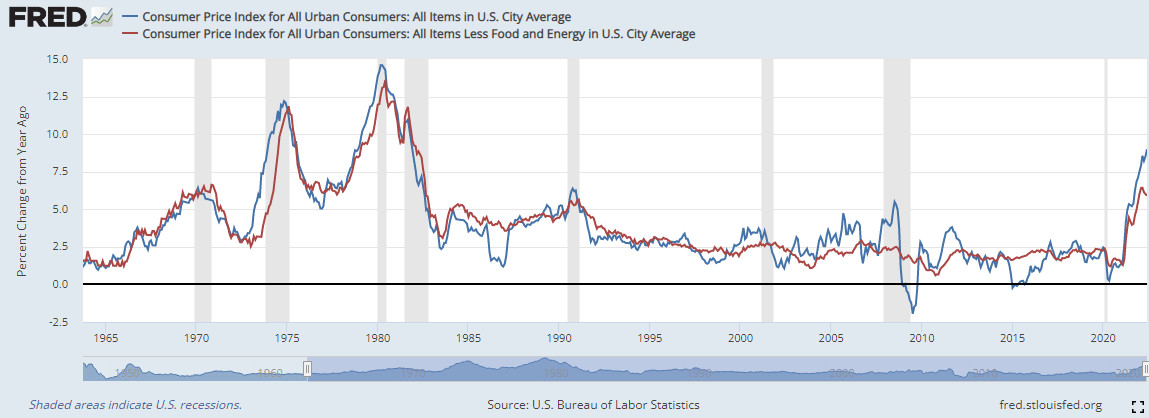

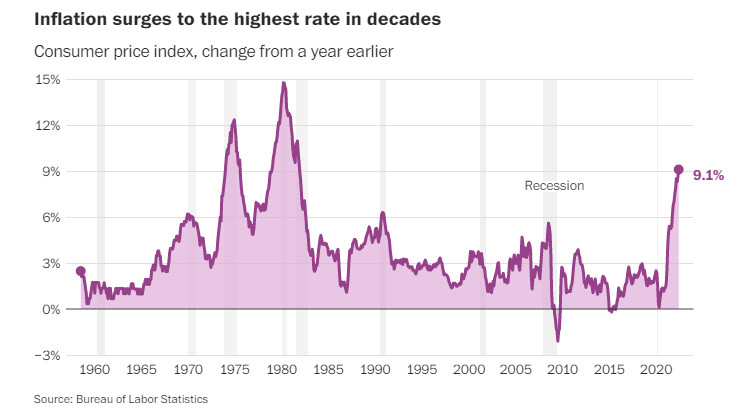

Consumer Price Index (CPI)

Original article: https://www.washingtonpost.com/business/2022/04/29/why-gdp-economy-shrank/ Peter Burgess COMMENTARY President Biden and the Democratic administration have done a surprisingly good job of handling the multiple issues that have come up in the last two years starting off with the ridiculous situation of the former President unwilling to relinquish power and being implicated in the violent attack on the US Capitol on January 6th 2021. In my view the Federal Reserve took an important step in March of 2020 when they added a huge amount of liquidity into the US banking system. This was not done at such scale in the 2008/2009 banking crisis and they did not intend to make the same mistake as the Covid pandemic roiled the world economy. The Fed now (August 2022) has the task of pulling back from this without too much negative impact, and it is not obvious to me that higher and higher interest rates is the way to go. During the peak of the Covid pandemic in 2020 and 2021 the structure of the US economy and the world economy changed significantly driven largely by (1) consumer behavior and changes in buying patterns and (2) the response of producers and supply chains to changes in consumed demand. At the macro level the fiscal support provided by Government largesse helped much of the population and mitigated somewhat the worst of a demand crash while at the same time the producers cut back on their production at all sorts of places in the supply chains creating considerable chaos. The supply side of the global economy has been fine tuned over many years to maximize profit in many cases by eliminating all resilience. Some sectors of the global economy suffered massive economic disruption and hardship during the pandemic. These include hotels and restaurants (hospitality sector), airline travel and cruise ships, and the entertainment industry (plays, concerts, hoiday travel, etc). During the pandemic some sectors were disrupted and stressed up to and beyond reasonable limits. The education sector had to keep going, but with all sorts of constraints. The health sector was front and center in handling the illness and death associated with the pandemic. Some parts of the economy experienced boom conditions as the pandemic evolved. Many companies engaged with digital technology had record years. This was a a result of huge demand for all sorts of remote activities like ZOOM meetings that replaced conventional physical interaction. Banks and financial sector companies got advantage from the waves of government stimulus. Energy companies took a modest hit as economic activity slowed at the beginning of the pandemic ... but have rebounded to record levels of profitability. The real estate sector has changed considerable as a result of the pandemic and rethinking of life priorities. Much commercial real estate has lost value. Desirable residential locations have boomed in value. High gas prices have changed the profile of what are optimum residential locations. The affordability of housing both home ownership and rental has become an issue that has lttle hope of being quickly resolved. Good location land prices are very high and building materials are at record high prices as well. The conventional economic indicators have moved quarter by quarter as the pandemic evolved and then into the post-pandemic recovery period. In my view, a lot of the commentary about economic performance is wrong, and especially the analysis around inflation. The last time there was massive inflation in the United States was in the 1970s. This was often referred to as 'stagflation' because the economy was not growing and there were massive increases in the prices of almost everything. I was a fairly young corporate executive during the 1970s and was on the front line of responding to the economic turmoil of the time. In 1973 what I described at the time as the biggest economic event in all of history took place ... the petroleum exporting countries led by Saudi Arabia established a cartel to set the price for crude oil and made it stick. The Organization of Petroleum Exporting Countries (OPEC) increased the price of crude oil in 1973 from $3.50 a barrel to $13.50 a barrel ... cutting off oil shipments until they got the price they wanted. There were mile long lines of cars looking for gas outside gas stations all over the USA and industry and commerce was totally disrupted. Most companies went into some form of crisis mode because most companies were built on the assumption that energy would be very low price for ever and energy efficiency did not matter. Now it did, and the American economy as a whole became high cost and unprofitable. President Nixon and Congress legislated price controls to control massive post OPEC inflation. I think there were three phases of these price controls, none of which accomplished the control of inflation. At the time I was VP manufacturing for a company in Georgia USA that consumed 50,000 pounds of bronze very week. We had a long term contract to supply this material each week at a price that fluctuated with the market and were paying about 50 cents / lb. The contract has been in place for years and worked fine until it didn't. Under the Nixon price control rules they would have to deliver to us at 35 cents / lb ... and Nixon was able to take credit for getting inflation under control. But the reality for our company was that our reliable supplier had chosen to sell their product in Europe at world prices of $1.30 a lb rather than to our company at 35 cents a lb. I was forced to buy for our company in Europe ... and to add insult to injury had to fly the product from Europe to the USA in time for our production. The reality was that the Nixon price controls more than tripled my price rather than getting the price down by about 30%. Thnis is not so much a criticism of President Nixon, but more to hightlight the reality that goverment has little leverage over human and economic realities. In the 1970s, inflation was caused by production costs going up without the operating companies in the USA having any control whatsoever over the cost drivers. OPEC set the global price for energy (crude oil) and it tripled in price in 1973 and tripled again before the end of the decade. How OPEC achieved this is not talked about that much ... but I would observe that the major international integrated oil companies (like Exxon, Chevron, Shell, BP, Total and others) all gained from the cartelization of the international oil market, and some non-OPEC countries like the Netherlands and the UK (and later Norway) all got major benefit from the higher energy prices. Specifically these countries had invested heavily in offshore oil production which had a production cost that far exceeded the prevailing pre-OPEC price of $3.50 a barrel. The economic malaise of the 1970s has often been referred to a 'stagflation'. I prefer to think of it as the normal outcome of very specific issues in the economy ... and specifically with the global cartelization of the fossil fuel (oil) energy sector. Some economists think the economic changes in the 1970s were driven by the removal of the US$ from a 'gold standard' in The inflation that we have today (2022) is completely different. This is NOT what we have today ... yet I have heard hardly any commentator adddress this. The inflation we have today is a result of a multitude of factors, not a single one. Relative to top line GDP, wages in the United States have declined over the past 40 years and remain at quite low levels even though the unemployment rate is very low by historic standards and job vacancies are high. Most wages in the United States do not provide a decent standard of living and quality of life. Over the past 40 years the cost of housing has gone up substantially ... far more than wages. In the United States in this time period there has been more building of expensive housing than affordable housing. During this time period the cost of land and the cost of building construction has gone up. There is a shortage of trained workers in most of the construction trades. There has been rather little innovation in housing, and a wide variety of local rules and regulations constrain change and make innovation difficult. The early 70s was the beginnings of the digital revolution and methods of production were starting to change. Peter Burgess | ||

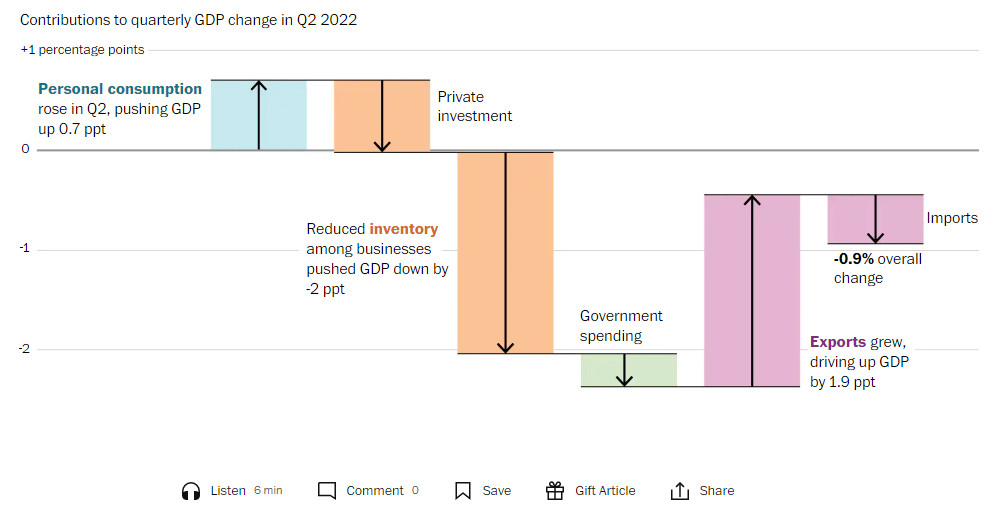

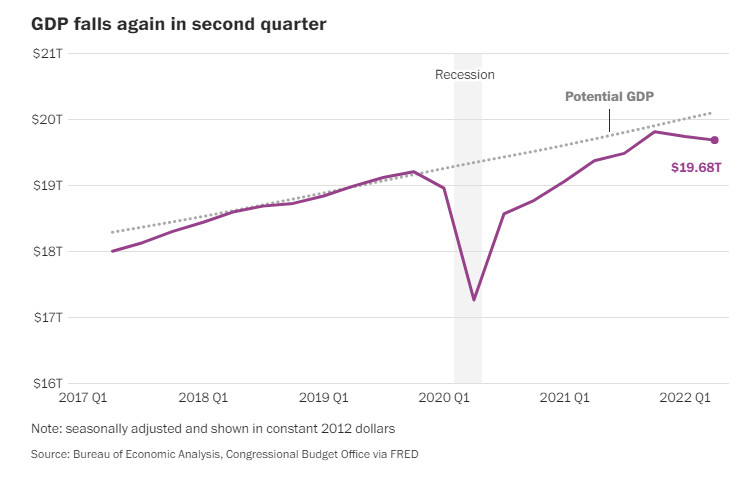

Contributions to quarterly GDP change in Q2 2022 By Alyssa Fowers, Abha Bhattarai and Rachel Siegel Published April 29, 2022 at 6:00 a.m. EDT ... Updated July 28, 2022 at 2:37 p.m. EDT The U.S. economy shrank at an annualized rate of 0.9 percent between April and June, marking two consecutive quarters of negative growth. Six months of contraction usually signals a recession. The contraction comes as other markers of the economy — such as the job market and consumer spending — are still showing signs of strength. That leaves policymakers, economists, businesses and families to make sense of how the economy is doing, and what the latest GDP report tells us about where we go from here. Here are some ways to think about the economic growth data, against the backdrop of high inflation, a tight labor market and growing risks of a recession. What’s behind the 0.9% figure?

GDP Falls To recap, the U.S. economy abruptly shrank at the beginning of the pandemic, then boomeranged in 2021. Last year, the economy grew by 5.7 percent, the fastest full-year clip since 1984. Economists didn’t expect the economy to keep that same momentum this year, as federal stimulus programs wore off, and the Federal Reserve moved to raise interest rates to slow growth and get a handle on soaring prices. But many were still caught off-guard by the stark reversal in the first three months of this year, when the economy slowed by an annualized rate of 1.6 percent. Businesses were cutting back on inventory purchases after overstocking for the holidays, and imports far outpaced exports. At the time, economists widely dismissed that slump as a fluke: Consumer spending — which makes more than two-thirds of the economy — remained healthy, and there were few signs of overall deterioration. But the economy appears to have taken a turn for the worse. The second-quarter GDP report shows declines across many parts of the economy, spanning both businesses and households, and could signal that the country is already in a recession. It isn’t a done deal, though. The official recession call will be made by a panel of experts at the National Bureau of Economic Research (NBER), which will take into account a number of factors such as unemployment (which is near record lows) and personal income levels (which are declining). Drop-off in inventory purchases After stocking up on too many goods last year — and miscalculating just how much stuff Americans would want to purchase — retailers are buying fewer items for their shelves. That slowdown in inventory purchasing, particularly for cars, is one of the big factors driving the second-quarter drop in GDP. Big-box retailers such as Target and Gap have all reported they have far more inventory than they need, which is why they aren’t loading up on more. But the looming problem is there’s new evidence that inflation is changing the way families are shopping, buying more necessities and fewer goods such as clothing and electronics, which is also reflected in the GDP report. Walmart rattled markets this week, when it slashed its quarterly and full-year profit forecasts. They said they could lose money because families are buying fewer of the things that Walmart tends to make money on, which could also happen at other retailers as demand weakens. That could lead to a bigger drop-off in inventory purchases in coming months. ‘Everything is halted’: Shanghai shutdowns are worsening shortages Slowdowns in construction The Federal Reserve has raised interest rates four times this year, most recently Wednesday, in hopes of calming the economy enough to curb inflation. One of the most direct impacts of those rate hikes has been a slowdown in housing and construction. As the cost of lending gets more expensive, that means loans to housing developers and would-be homeowners are also getting a lot more expensive. Indeed, housing starts in June fell to a nine-month low, and permits for new construction also fell, according to Commerce Department data from last week. Indeed the GDP report also showed that activity in single-family construction fell. Still, multifamily construction gained ground as rising rents burnish the appeal of apartment projects, cushioning the overall decline. Construction and investments in homes, as well as other types of buildings including hotels, warehouses and factories, contributed to the second-quarter contraction. There were notable declines in related areas, such as brokers’ commissions, that played a role in the shrinking economy. Declining government spending Government spending declined at all levels: federal, state and local. Although defense spending rose, it was outweighed by a pullback in other types of spending such as stimulus payments. At state and local levels, governments pulled back on investments in new buildings. The other major forces in the economy The GDP report comes as policymakers and economists are grappling with two major issues in the economy: soaring inflation and a tight labor market.

Inflation Inflation has risen to the highest levels in 40 years, with prices rising 9.1 percent in June compared with the year before. The Fed is racing to get control of rising prices before they become even more embedded in the economy. Republicans are hammering the Fed for being too slow to respond and are placing much of the blame on Democrats’ sprawling stimulus efforts from last year.

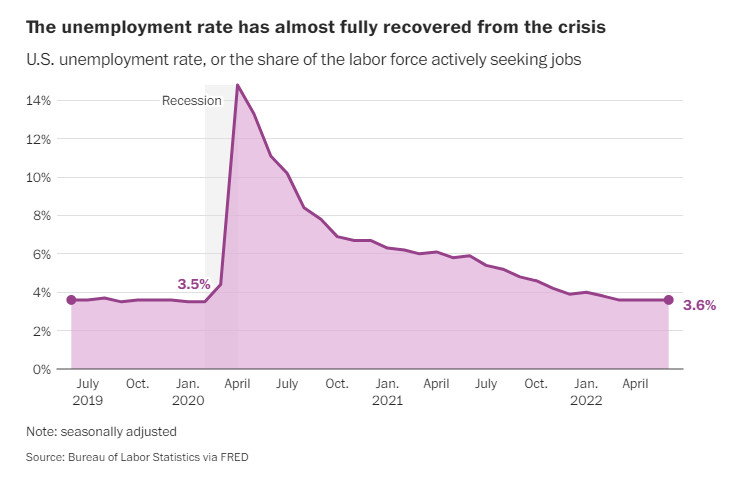

Unemployment Meanwhile, the job market has shown tremendous strength since losing 20 million jobs at the beginning of the pandemic. The unemployment rate remains remarkably low — 3.6 percent — and the job market has been a huge talking point for the Biden administration. But economists and policymakers also worry the job market is unsustainably hot. There are far more job openings than job seekers, and the mismatch has the Fed trying to tamp down demand for workers without causing people to lose their jobs. Written by:

| The text being discussed is available at | https://www.washingtonpost.com/business/2022/04/29/why-gdp-economy-shrank/ and |