OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

BLOOMBERG NEWS SUMMARIES

UK POLITICS AND FINANCIAL MARKETS UK financial markets in turmoil over policy choices by Truss government and Bank of England reaction Original article: Peter Burgess COMMENTARY Peter Burgess | ||

|

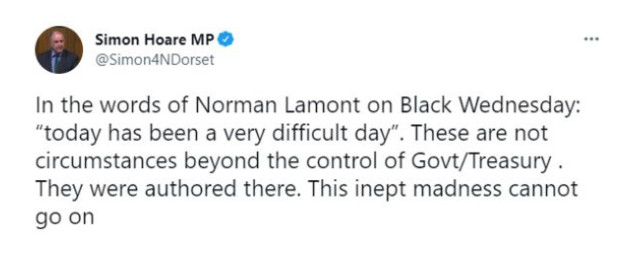

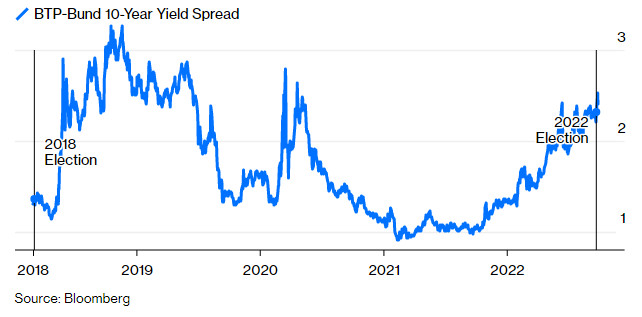

The UK is enveloped in a self-inflicted financial crisis. And while its origins go back years, some $500 billion has been wiped off of Britain’s stock and bond markets in only a few weeks—the tenure of Prime Minister Liz Truss. The mayhem unleashed by her unfunded tax-cut plan forced the Bank of England to intervene to prevent a meltdown in the bond market, while the pound plunged to a record low against the US dollar. Still, Truss isn’t reversing course despite howls of criticism from across Britain and around the world. The US Federal Reserve’s Raphael Bostic said the market fallout of Truss’s policies is stiffening headwinds already faced by the global economy. And German Finance Minister Christian Lindner said the UK government is putting “its foot on the gas while the central bank steps on the brakes.” None of this bodes well for Truss, who came to power only after a scandal-ridden Boris Johnson finally resigned. “When members of your own party accuse you of ‘inept madness,’” John Authers writes in Bloomberg Opinion, “you’re in trouble.”

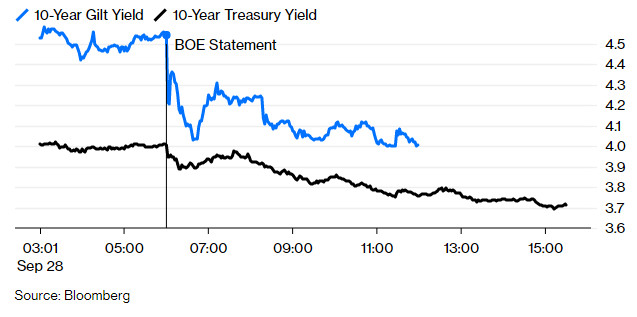

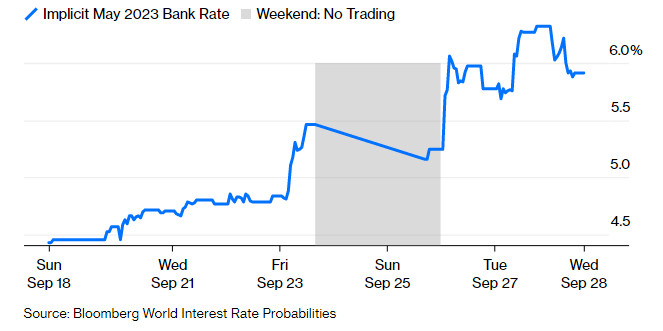

https://www.bloomberg.com/news/articles/2022-09-27/uk-markets-have-lost-500-billion-since-truss-took-over https://www.bloomberg.com/news/articles/2022-09-27/uk-markets-have-lost-500-billion-since-truss-took-over Liz Truss Took Over Stocks, bonds slumped following new fiscal measures on Friday UK markets feel like ‘the wild west,’ AJ Bell’s Hewson says 0:14 UK Faces ‘Deep, Long’ Recession: Deutsche Bank Economist Unmute WATCH: The UK faces a “painful” recession that could last “3 or 4 quarters,” according to Deutsche Bank.Source: Bloomberg BySagarika Jaisinghani September 27, 2022 at 6:24 AM EDTUpdated onSeptember 27, 2022 at 8:02 AM EDT Listen to this article 2:59 Share this article Follow the authors @sagarikareports + Get alerts forSagarika Jaisinghani In this article UKX FTSE 100 6,893.81GBP+12.22+0.18% GBP British Pound Spot 1.1170GBP+0.0053+0.4767% Follow us at @BloombergUK and on Facebook, and wrap up your day with The Readout newsletter with Allegra Stratton. The UK’s stock and bond markets have lost at least $500 billion in combined value since Liz Truss took over as Prime Minister, with investor confidence shattered by a shock tax-cutting budget. Taking the helm at a time when the UK economy was already grappling with the specter of recession, the Truss government’s new fiscal policies fueled concerns that inflation and borrowing would surge at a time of rapidly rising interest rates. That triggered a cross-asset selloff so severe that it sent the pound to a record low and sparked chatter about emergency action by the Bank of England. Read More: Britain’s Market Rout May Entice Foreign Bidders to UK Companies “Confidence in the UK has been sideswiped amid a pile-on of worries about the economic outlook and the direction of travel being taken by the Truss administration,” said Susannah Streeter, senior analyst at Hargreaves Lansdown. “Only a U-turn in the slash-and-spend policies is likely to significantly restore optimism, but the administration is digging in its heels.” UK stocks, bonds have dropped since Liz Truss took over as Prime Minister The FTSE 350 Index -- which comprises stocks in the export-heavy FTSE 100 and the domestically focused FTSE 250 -- has now lost more than $300 billion in market capitalization since Sept. 5, when Truss was confirmed leader of the Conservative Party. In that time, a UK government bond index has lost over £160 billion ($173 billion) in market value, according to data compiled by Bloomberg. The rate on 10-year government bonds has risen by over one percentage point to surpass 4% for the first time since 2010. “What the UK government has done is said, ‘to hell with the inflation outlook, let’s just think about growth’,” said Seema Shah, chief strategist at Principal Global Investors. “Bond yields are only going to go higher and undo a lot of that positive economic movement from the tax cuts,” she said in an interview. Read More: London’s Share of European IPO Haul Sinks to a 12-Year Low Sterling-denominated, investment-grade bonds have also lost $29 billion over the same time, dragging down the market value of a Bloomberg index that tracks the securities to the lowest level since March 2016. A gauge of sterling-denominated junk bonds -- of which British companies account for more than 90% -- has seen its market value drop by $1.4 billion. To be sure, with bond holders more likely to buy and hold until maturity, the selloff in bonds is relatively smaller when compared to other assets. On Tuesday, UK bonds had recovered some ground and the pound was headed for its biggest rally in months. UK stocks are at risk of narrowing their outperformance of European equities For stocks, the measures put at risk the FTSE 100’s outperformance this year, which has been reinforced by its exporter-heavy members. The index is down about 5% so far in 2022, compared with about a 20% slump in the Stoxx 600 Index, but its lead has narrowed in September. “Far from being the safe pair of hands investors have been used to, the UK seems more like the wild west at the moment,” said Danni Hewson, a financial analyst at AJ Bell. — With assistance by Greg Ritchie, James Hirai, and Tasos Vossos (Updates with strategist comments and Tuesday’s market action from fifth paragraph) https://www.bloomberg.com/news/articles/2022-09-28/boe-to-carry-out-purchases-of-long-dated-uk-bonds-to-calm-market https://www.bloomberg.com/news/articles/2022-09-28/boe-to-carry-out-purchases-of-long-dated-uk-bonds-to-calm-market BOE Pledges Unlimited Bond-Buying to Avert Imminent Gilts Crash 30-year yield falls most on record in wake of intervention Officials warned of risk to stability if dysfunction continued 0:29 BOE to Buy Long-Dated Gilts in Effort to Calm Markets Unmute BOE to Buy Long-Dated Gilts in Effort to Calm Markets ByDavid Goodman and Philip Aldrick September 28, 2022 at 6:15 AM EDTUpdated onSeptember 28, 2022 at 12:32 PM EDT Listen to this article 4:58 Share this article Follow the authors @_Davidgoodman + Get alerts forDavid Goodman @PhilAldrick + Get alerts forPhilip Aldrick In this article EUR Euro Spot 0.9802EUR-0.0013-0.1325% MCO MOODY'S CORP 243.11USD-3.45-1.40% Follow us at @BloombergUK and on Facebook, and wrap up your day with The Readout newsletter with Allegra Stratton. The Bank of England staged a dramatic intervention to stave off an imminent crash in the gilt market by pledging unlimited purchases of long-dated bonds. With the fallout from Prime Minister Liz Truss’s tax cuts still ripping through UK asset prices, the central bank had been warned that collateral calls on Wednesday afternoon could force investors to dump government bonds, according to a person familiar with its decision making. The BOE kicked off the plan on Wednesday afternoon by purchasing just over £1 billion ($1.07 billion) of securities maturing in 20 years or more, less than the £5 billion it said it was prepared to buy at each auction. Operations will continue every weekday until Oct. 14. After today’s auction, that means the bailout could reach £61 billion. The announcement of the purchases had an immediate impact on the gilt market, sending 30-year yields to their biggest drop on record. They earlier climbed to the highest since 1998. The central bank warned that continued dysfunction would threaten financial stability and even damage the economy. It also delayed the start of its plan to start actively selling its existing holdings of bonds, due to begin Monday. “The purchases will be carried out on whatever scale is necessary,” the central bank said, language reminiscent of former European Central Bank President Mario Draghi’s 2012 pledge to do “whatever it takes” to save the euro. The BOE decided to intervene to get ahead of a potential crisis that could have hit within hours. It was concerned collateral requirements on liability-driven investment strategies, such as those at pension funds, would have turned many into forced sellers of long dated gilts, according to a person familiar with the situation. The cash call would have happened this afternoon, turning the market one-sided and risking a precipitous collapse as funds were forced into a fire sale of assets. Investment banks and fund managers have warned the government in recent days of the problem. UK 30-year yield is set for a record drop two days after a historic jump Around £1 trillion of liability-driven investment strategies are invested in government and corporate bonds. The BOE feared that a sale to meet collateral demands would push prices lower and bankrupt some funds -- forcing more sales, and ultimately triggering a negative doom loop. The decision to break the potential run was taken on concerns that chaos in long-dated gilts would spread across the entire gilt curve. As a core market, on which business loans and mortgages are priced, the dysfunction would have led to far wider economic fallout. The initial assessment of the intervention from Bloomberg Economics was a blunt two words: “Panic Stations.” The rout in bond markets stems from the government’s determination to push through the biggest package of unfunded tax cuts in half a century in the face of widespread opposition from economists and investors. The International Monetary Fund on Tuesday urged Truss’s government to reconsider the plan, and Moody’s Investors Service warned that it could threaten the country’s credit rating. Historic Giveaway Kwarteng's tax cuts are the largest since Anthony Barber was chancellor Source: Bloomberg analysis of OBR, Treasury data Note: Figures show the five largest tax giveaways and the five largest tax-raisers since 1970 The bank said the purchases will be strictly time limited and “are intended to tackle a specific problem in the long-dated government bond market.” The BOE’s intervention, which will be financed by the creation of new reserves, is a market maker of last resort operation but looks like open-ended quantitative easing. The distinction is in the intention of the policy and how quickly the BOE sells the gilts back to the market. LISTEN: Bloomberg’s Jamie Rush discusses the BOE with Matt Miller and Paul Sweeney on Bloomberg Radio While QE is normally a monetary operation, the step was recommended by the BOE’s Financial Policy Committee, amid fears of a “material risk” to financial stability that “would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy,” the BOE said. Even so, it will have consequences for monetary policy and could mean officials decide they need to act in a bigger way in November, when markets are pricing in about 170 basis points of rate increases. QE was one of the policies criticized by Truss and her supporters during the summer’s leadership contest. “The MPC will make a full assessment of recent macroeconomic developments at its next scheduled meeting and act accordingly,” the BOE said Wednesday. “The MPC will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term, in line with its remit.” EXPLAINER: Why Bank of England’s Remit Has Become Political WHAT BLOOMBERG ECONOMICS SAYS... “The intervention buys time for Chancellor Kwasi Kwarteng to re-consider the government’s policies and for the MPC to take stock ahead of its November meeting. We expect a 100-basis-point rate increase on Nov.3, with risks skewed to a larger, earlier move.” --Read the full REACT here. The yield on 30-year bonds fell 106 basis points to 3.93% on Wednesday. Ten-year yields fell 49 basis points to 4.01% and the pound rose 0.8% to $1.0817. The return to bond buying comes just days before the BOE was due to start selling the mammoth holdings of government securities it built up since the financial crisis, which peaked at £875 billion. It said it would now postpone the plan until Oct. 31, but the annual target for an £80 billion reduction was unchanged. Just yesterday, BOE Chief Economist Huw Pill said the bank’s program of government bond sales should go ahead as planned next week if the market repricing stays orderly. — With assistance by James Hirai (Updates with concerns about collateral demands) https://www.bloomberg.com/news/articles/2022-09-30/uk-treasury-hasn-t-sought-to-speed-up-budget-watchdog-s-forecast https://www.bloomberg.com/news/articles/2022-09-30/uk-treasury-hasn-t-sought-to-speed-up-budget-watchdog-s-forecast Truss Meeting With OBR Ends With No Sign of Policy U-Turn Government faced intense criticism for avoiding OBR scrutiny Truss held talks with fiscal watchdog amid tax cuts fallout Chair of the OBR, Richard Hughes, left, Andy King, center, and Professor David Miles depart Downing Street after a meeting with Liz Truss on Sept. 30. Chair of the OBR, Richard Hughes, left, Andy King, center, and Professor David Miles depart Downing Street after a meeting with Liz Truss on Sept. 30.Photographer: Dan Kitwood/Getty Images ByEllen Milligan and Philip Aldrick September 30, 2022 at 6:11 AM EDTUpdated onSeptember 30, 2022 at 7:31 AM EDT Listen to this article 5:07 Share this article Follow the authors @EllenAMilligan + Get alerts forEllen Milligan @PhilAldrick + Get alerts forPhilip Aldrick In this article 2057703D TREASURY Private Company GBP British Pound Spot 1.1170GBP+0.0053+0.4767% 6647708Z BBC RADIO Private Company 3956452Z LABOUR PARTY/THE Private Company Open Follow us at @BloombergUK and on Facebook, and wrap up your day with The Readout newsletter with Allegra Stratton. Prime Minister Liz Truss’s government signaled it’s sticking with its plan for tax cuts after a meeting with the UK’s fiscal watchdog, dashing market expectations that a policy U-turn might be imminent. There are no plans to alter the timetable for Chancellor of the Exchequer Kwasi Kwarteng to publish a full forecast from the Office for Budget Responsibility on Nov. 23, alongside his medium-term fiscal statement, the Treasury said Friday in a statement following a meeting between Truss, Kwarteng and OBR Chairman Richard Hughes. The pound fell against the dollar, having earlier risen on market expectations that the government might reassess its fiscal plans. It was 0.4% lower at $1.1075 as of 12:30 p.m. in London. The unusual meeting between Hughes and the government’s top two figures comes after Truss’s new administration came under heavy fire from economists and politicians for announcing last Friday the biggest set of unfunded tax cuts in half a century, while declining an offer from the OBR to provide an independent forecast. The fallout was dramatic, with the pound plunging to a record low against the dollar earlier this week, and the Bank of England forced to intervene to prevent a meltdown in the bond market. Despite that, the outcome of Friday’s meeting shows Kwarteng and Truss are sticking to their guns. Earlier on Friday, Andrew Griffith, a junior Treasury minister, sought to justify the lack of a forecast last week by saying the government had more plans to announce that needed to be factored in. Unusual Meeting The details are yet to come on “a lot of measures about how we’re going to grow the economy,” he told BBC Radio 4 on Friday. “We’re going to hear in the coming weeks, plans for things like childcare, for housing, for making our infrastructure move, bringing forward plans in Parliament to tackle the endemic problems of strikes in some of our public services that are slowing down the rate of growth.” UK GDP Rebounds as Truss Holds Talks With Fiscal Watchdog Play2:55 WATCH: Truss is holding talks with the government’s fiscal watchdog today. Lizzy Burden reports.Source: Bloomberg Senior Tory Urges UK to Release Independent Forecast Faster The Treasury said the government and the OBR agreed “to work closely together throughout the forecast process and beyond.” While Kwarteng wouldn’t normally meet face-to-face with OBR officials this early in the forecast process, instead communicating by email, there are records of in-person meetings when a new chancellor has been appointed. But the presence of the prime minister at the meeting is extremely unusual. It has never happened before, as the chancellor would normally want to manage the process independently of any pressures from 10 Downing Street. Uncomfortable Moment? Truss will be hoping that visibly engaging with the fiscal watchdog will help to calm market nerves. Yet much depends on what the OBR makes of her economic plans, especially given the tax cuts were announced before accompanying policies were finalized. The government is still drawing up its medium-term fiscal plan, which is key to restoring its battered credibility with markets. In Friday’s meeting, Hughes is likely to have run Kwarteng and Truss through the early forecast and indicated what savings the chancellor will need to bring debt down as a share of GDP in the fifth year of the outlook, a person familiar with the process said. The latest in global politics Get insight from reporters around the world in the Balance of Power newsletter. https://www.bloomberg.com/news/articles/2022-09-27/truss-s-uk-tax-cuts-raise-concern-among-fed-german-officials https://www.bloomberg.com/news/articles/2022-09-27/truss-s-uk-tax-cuts-raise-concern-among-fed-german-officials Truss’s UK Tax Cuts Raise Concern Among Fed, German Officials Fed’s Bostic says reaction to plan shows a ‘real concern’ Germany’s Lindner says UK undergoing a ‘major experiment’ 0:29 Summers Calls UK Fiscal Policy 'Naive Wishful Thinking' Unmute Summers Calls UK Fiscal Policy 'Naive Wishful Thinking' BySimon Kennedy and Kamil Kowalcze September 27, 2022 at 6:20 AM EDTUpdated onSeptember 27, 2022 at 8:46 AM EDT Listen to this article 1:54 Share this article Follow the authors @simonjkennedy + Get alerts forSimon Kennedy @KowalczeKamil + Get alerts forKamil Kowalcze In this article GBP British Pound Spot 1.1170GBP+0.0053+0.4767% 2057703D TREASURY Private Company Follow us at @BloombergUK and on Facebook, and wrap up your day with The Readout newsletter with Allegra Stratton. The UK government’s tax-cutting blitz is drawing the concern of international policy makers, with a Federal Reserve official going as far as to say the subsequent fallout in financial markets adds to headwinds facing the world economy. Asked on Monday whether the downturn in UK markets increases the odds of a global recession, Fed Bank of Atlanta President Raphael Bostic said: “It doesn’t help it.” “What we have seen in the reaction to the proposed plan is a real concern, a fear that the new actions will add uncertainty to the economy,” Bostic said in an online discussion hosted by the Washington Post. “The proposal has really increased uncertainty and really caused people to question what the trajectory of the economy is going to be.” Speaking hours later at an event hosted by the Frankfurter Allgemeine Zeitung newspaper, German Finance Minister Christian Lindner also raised doubts about the UK’s biggest reduction of taxes since the early 1970s. The announcement prompted the pound to slide and bond yields to surge. Historic Giveaway Truss's tax cuts are the largest since Edward Heath was prime minister Source: Bloomberg analysis of OBR, Treasury data Note: Figures show the five largest tax giveaways and the five largest tax-raisers since 1970 “In the UK, a major experiment is starting as the state simultaneously puts its foot on the gas while the central bank steps on the brakes,” Lindner said. “I would say we wait for the results of this attempt and then draw the lessons.” The comments by policy makers from two of the largest economies adds to the drumbeat of criticism Prime Minister Liz Truss has received for the new stimulus, which is set to land with the economy already struggling with inflation around double-digits. On Tuesday, European Central Bank Governing Council member Mario Centeno also was critical. “I would admit that it would be an easy prediction that the response that is being given in the UK may also generate difficulties,” Centeno, who heads Portugal’s central bank, told a conference in Lisbon. Former US Treasury Secretary Lawrence Summers, a paid contributor to Bloomberg TV, has already blasted the policy as “naive,” while Nobel laureate Paul Krugman tweeted it was “stupid and cruel” and an “embrace of zombie economics.” — With assistance by Steve Matthews, and Joao Lima (Updates with Centeno in penultimate paragraph) Up Next The Nightmare Numbers Behind Britain’s Week of Market Panic https://www.bloomberg.com/opinion/articles/2022-09-29/uk-can-t-afford-to-look-as-ridiculous-as-truss-kwarteng-have-with-gilts-crisis https://www.bloomberg.com/opinion/articles/2022-09-29/uk-can-t-afford-to-look-as-ridiculous-as-truss-kwarteng-have-with-gilts-crisis The UK Cannot Afford to Look This Ridiculous The Bank of England may have saved gilts, but scorn and political danger for Truss and Kwarteng still have a long way to run — and could cut their careers short.

Ridicule is something politicians need to be very, very scared of.Photographer: Dylan Martinez/WPA Pool/Getty

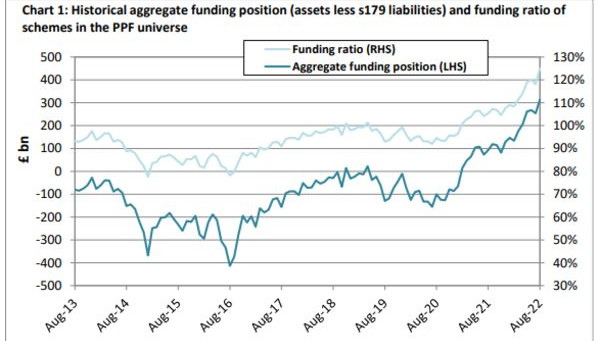

Between BOE annnouncements, the price of a 30-year gilt fell 24% The Bank of England’s Financial Policy Committee noted the risks to UK financial stability from dysfunction in the gilt market. It recommended that action be taken, and welcomed the Bank’s plans for temporary and targeted purchases in the gilt market on financial stability grounds at an urgent pace... The Monetary Policy Committee has been informed of these temporary and targeted financial stability operations.The message here is two-fold. First, this was a tactic adopted swiftly by the adults in the room to avert true disaster. The Bank is still the lender of last resort and can fulfill that role without asking permission from a nine-person committee. Second, the BOE really wants everyone to treat this move as involving no step back in its monetary policy, and hence no step to accommodate or fall into line with government fiscal policy. It’s unlikely to be viewed this way. Brian Hilliard, UK economist at Societe Generale, put it this way: We seem to have moved from a situation where market dysfunction is tackled directly by the MPC, which then gives the instructions, to one where the operational arm of the Bank listens to the concerns that the FPC has about financial stability and then it acts. These nuances won’t matter to the markets. ‘The Bank’ decided to buy gilts to calm the markets and that is QE. Bank Of England Announces Key Interest Rate Decision

Protecting a reputation for independence matters.Photographer: Jose Sarmento Matos/Bloomberg Bond and currency markets have reacted so poorly since the mini-budget, at least in part due to fears that the move added new fiscal stimulus to an economy that already had 10% inflation and a very low jobless rate. It’s difficult to see how this perception can be corrected by new monetary policy stimulus. At the CEPR Monetary Policy Forum hosted by Barclays earlier this week, BOE Chief Economist Huw Pill did highlight the BOE’s independence. But the fact pattern is clear. After bond markets rebelled at news of fiscal stimulus and larger government debt issuance, the central bank postponed its plans to reduce its balance sheet, and instead proceeded to expand it by buying government debt. The risk is that investors adopt a cynical interpretation; that the BOE is enabling the fiscal authority’s spending plans, even as financial markets have sounded the alarm.This is not a new dilemma for a central bank. Indeed, it’s been a recurring pattern during this century that central bankers tried to stand back and encourage (or force) elected policymakers to take necessary action on fiscal policy, only eventually to intervene when politicians’ inactivity threatened to create outright disaster. Mario Draghi’s “whatever it takes” comment only came after the eurozone’s debt crisis had been raging for more than two years and had felled a succession of governments; Ben Bernanke tried to leave bank rescues to the Treasury and Congress in 2008, before embarking on the many emergency policies that tided the financial system through its crisis. The BOE is in a similar position now. On principle, and for the sake of long-term policy, it would prefer not to be buying bonds. But with an imminent risk of a financial implosion, there was no choice. Better to tide the patient through with huge doses of debilitating drugs than let him die. Why They Did It The crisis the BOE stepped in to eliminate was triggered by the speed with which longer gilt yields rose after the government’s “mini-budget,” unveiled by the new Chancellor of the Exchequer Kwasi Kwarteng last Friday and featuring steep tax cuts with no detail of any spending cuts to help pay for them. This had already prompted several mortgage lenders to withdraw new offerings, an alarming incursion on the real world inhabited by most Britons. The heart of the darkness, however, was in pension plans. As in the global crisis, sharp moves triggered an accident for systemically important institutions that had taken on leverage in an opaquely technical way. It stems, ironically, from an impeccably prudent and conservative reform. For the last two decades, British pensions in the public sector and from large companies offering a final-salary or “defined benefit” on retirement have been required to match assets to liabilities. Intended to ensure that promises to pensioners could be honored, this in practice meant that pension funds had to buy a lot of gilts. This successfully bolstered their finances. The following chart comes from the Pension Protection Fund and shows that both in absolute amount of money and as a proportion of their liabilities, UK pensions ended last month in good shape, with assets comfortably enough to meet their promises:

Source: Bloomberg

Source: Bloomberg World Interest Rate Probabilities

Source: Bloomberg

Source: Bloomberg

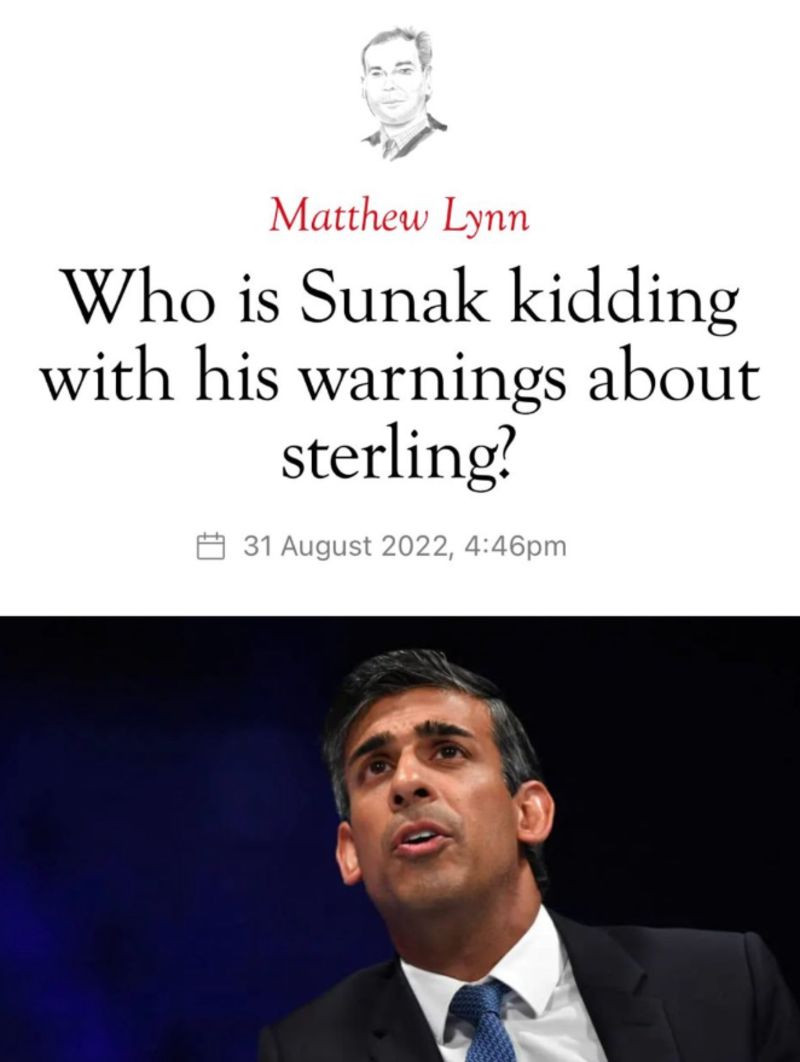

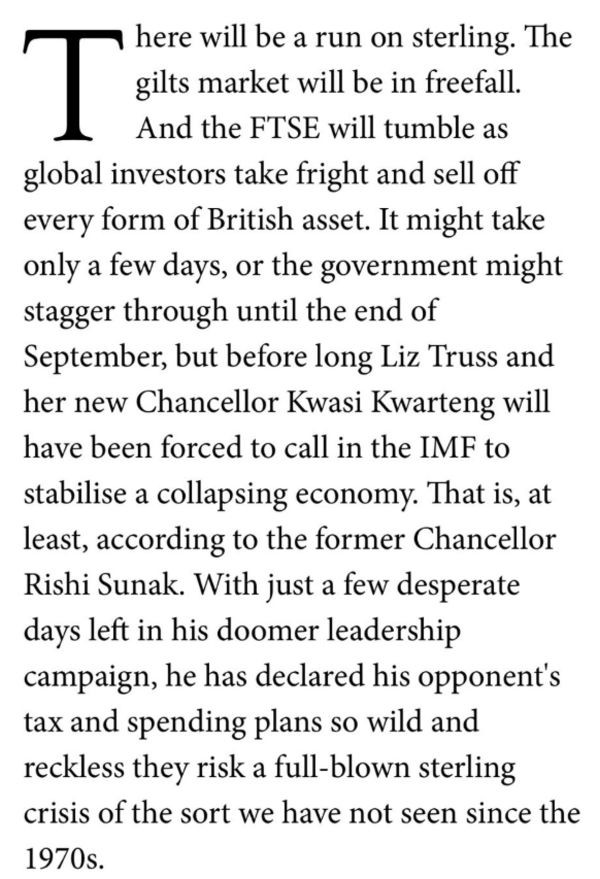

The first paragraph was meant to be funny. It now reads as prophetic and deadly serious: relates to The UK Cannot Afford to Look This Ridiculous Meant to show that Sunak was desperate and irresponsible, these words now make him look like the leader Britain should have had, and greatly increase the chance that he still, somehow or other, becomes the prime minister. More From Bloomberg Opinion: Daniel Moss: Will Powell Get Greenspan’s ‘Oasis’ Feeling? Mark Gilbert: Gilt Market Carnage Prompts Risky Bank of England U-Turn Lionel Laurent: Italy's Right-Wingers Spook Markets Less Than UK Want more Bloomberg Opinion? OPIN

| The text being discussed is available at | and |