OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

MARKET NEWS

CNBC CNBC Market News for October 7th, 2022 at closing bell Original article: https://www.cnbc.com/2022/10/06/stock-market-futures-open-to-close-news.html Peter Burgess COMMENTARY Peter Burgess | ||

CNBC MARKET NEWS

Dow drops 600 points, Nasdaq closes 3% lower as rates pop after September jobs report

UPDATED FRI, OCT 7 2022 4:26 PM EDT

Written by Tanaya Macheel and Samantha Subin

Sept. jobs report won’t stop Fed from hiking rates: Fmr. NEC chief economist

Stocks fell Friday as traders evaluated September’s jobs report, which showed the unemployment rate continuing to decline and sparked an increase in interest rates.

The Dow Jones Industrial Average fell 630.15 points, or 2.1%, to 29,296.79. The S&P 500 lost 2.8% to 3,639.66. The Nasdaq Composite slid 3.8% to 10,652.41, which is less than 1% above its low of the year.

Friday’s losses trimmed the gains for what started out as a big comeback week for stocks. The major averages still ended the week higher but gave back most of the gains from the rally that kicked it off. The Dow rose 2% for the week, while the S&P added 1.5%. The Nasdaq eked out a 0.7% gain.

The U.S. economy added 263,000 jobs in September, slightly below a Dow Jones estimate of 275,000, the government said Friday. However, the unemployment rate came in at 3.5%, down from the 3.7% in the previous month in a sign that the jobs picture continues to strengthen even as the Federal Reserve tries to slow the economy with rate hikes to stem inflation.

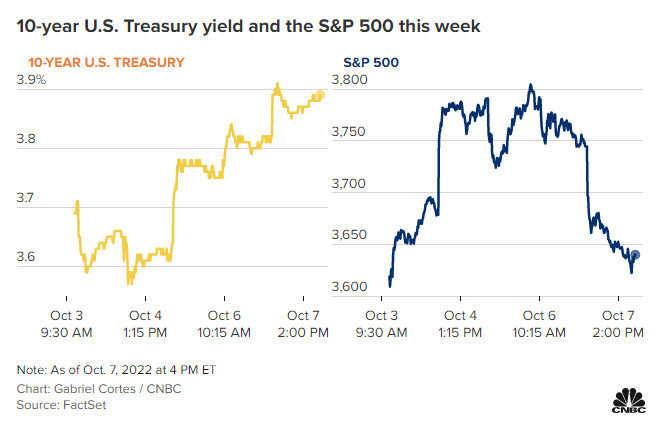

10-year U.S. Treasury yield and the S&P 500 this week

10-YEAR U.S. TREASURY ...................... S&P 500 Chart: Gabriel Cortes / CNBC Source: FactSet Note: As of Oct. 7, 2022 at 4 PM ET

------------------------- 7 HOURS AGO The only bull market this week might just be in the energy complex Asset prices may feel soft everywhere this week, but not in the oil patch. Maybe it has to do with OPEC+ agreeing midweek to cut future crude oil production. Early Friday, before September’s nonfarm payrolls were reported, November West Texas Intermediate crude oil contracts had risen above $90 a barrel and were 13% higher on the week. That means WTI was on pace for the biggest weekly gain since early March, shortly after Russia attacked Ukraine on Feb. 24. Look at individual stocks early Friday. Premarket, Exxon Mobil was higher by 17.6% in just the first four days of this week, on pace for its best week since at least 1972. That was the same year Standard Oil of New Jersey changed its name to Exxon. Marathon Oil had soared 26.5% in the first four days of the week and Halliburton was higher by 22.5%. For both of them, it was the strongest weekly performance since June 2020, and there was still one more trading day to go. The Energy Select Sector SPDR ETF had gained 15% week-to-date, on track for its best week since November 2020. November heating oil futures contracts were up almost 17% week-to-date and were on pace for the strongest weekly gain since late April. — Scott Schnipper and Gina Francolla ------------------------- 7 HOURS AGO Path to soft landing looks more challenging after jobs report, Lazard’s Temple says The Federal Reserve’s goal of achieving a soft landing for the U.S. economy amid rate hikes to tame high inflation is looking less likely amid continued labor market strength, according to Ron Temple, head of U.S. equity strategy at Lazard Asset Management. “While job growth is slowing, the US economy remains far too hot for the Fed to achieve its inflation target,” Temple said in a Friday note. “The path to a soft landing keeps getting more challenging.” The Friday jobs report showed that employers added 263,000 jobs in September and that the unemployment rate fell to 3.5%. That’s a relatively strong labor market, even if job gains are slowing. It means the Fed will likely be aggressive with interest rate hikes going forward. “If there are any doves left on the FOMC, today’s report might have further thinned their ranks,” said Temple. —Carmen Reinicke ------------------------- 8 HOURS AGO Employment data unlikely to push Fed off course, economist says Friday’s employment data shows the job market is heading in the right direction, said Andrew Hunter, senior U.S. economist at Capital Economics. But he doesn’t see it as convincing to the Federal Reserve to change course from its strategy of raising rates as a means to fight inflation. “The 263,000 gain in non-farm payrolls in September is another signal that labor market conditions are cooling,” Hunter said. “But with the unemployment rate dropping back to 3.5% the report is unlikely to significantly alter the Fed’s view that the labor market is ‘out of balance.’” — Alex Harring ------------------------- 8 HOURS AGO Oil hits $90 per barrel, heating oil also jumps Oil prices are surging following OPEC+ major production cut announced Wednesday. West Texas Intermediate crude for November delivery hit $90 per barrel, the highest level since Sept. 14. The commodity is up almost 13% this week and is on track for its best week since March 4. Brent crude is also higher today, up 1.35% at $95.69 per barrel. Heating oil has also jumped, hitting 3.9478, its highest level since Aug. 30. Heating oil is up nearly 17% this week, on pace for the biggest weekly gain since April 29. Shares of major energy companies also gained with the price of oil. The Energy Select Sector SPDR Fund is up 15% this week, on pace for its best week since Nov. 13, 2020. Exxon is up 17.62% this week, its best weekly performance since 1972. Marathon Oil is up more than 26% this week, and Halliburton is up more than 22% in the same timeframe. It’s both company’s best week since June 5, 2020. —Carmen Reinicke, Gina Francolla ------------------------- 8 HOURS AGO U.S. jobs growth slows in September to 263,000 The U.S. economy added 263,000 jobs in September, slightly below a Dow Jones estimate of 275,000. The unemployment rate came in at 3.5%, down from 3.7% in the previous month. Click here to read more. — Jeff Cox ------------------------- 9 HOURS AGO BMO Capital Markets still sees an up year for the S&P 500 Stocks’ decline starting in mid-August has been “more severe and longer lasting” than analysts at BMO Capital Markets anticipated, but investors should keep calm and carry on, the firm said in a note Friday. “We advise investors to stay calm and disciplined and refrain from going into panic mode amid this selloff,” chief investment strategist Brian Belski siad. “Yes, the market has been volatile, and the path of least resistance has largely been to the downside in recent weeks, but we continue to firmly believe that the S&P 500 will finish the year higher than current levels with Q3 earnings results potentially being a catalyst for a more sustained market rebound.” Last week the S&P 500 capped the September trading month, ending lower by about 9% and finding a new bear market low in the midst of the losses. That drop marked the index’s biggest monthly loss since March 2020 and its worst September since 2002. — Tanaya Macheel ------------------------- 9 HOURS AGO Goldman Sachs shares rise on KBW upgrade Shares of Goldman Sachs rose slightly in Friday premarket trading after Keefe, Bruyette & Woods upgraded the stock to outperform from market perform. The firm said the Goldman Sachs’ valuation based on tangible book value (TBV) looks attractive. “We are upgrading Goldman Sachs to Outperform from Market Perform due to an attractive valuation of just under forward TBV, strong TBV growth, improved capital allocation and potential near-term benefits of strong FICC results over what could be a volatile next few quarters,” Konrad wrote. Read the full CNBC Pro story on the note here. — Sarah Min ------------------------- 9 HOURS AGO Credit Suisse climbs after announcing debt buyback The U.S. traded shares of Credit Suisse rose 6% in premarket trading after the investment bank offered to buy back roughly $3 billion of its debt. Credit Suisse is also selling the Savoy Hotel in Zurich. The bank’s share price and debt have fallen sharply in recent weeks amid concern about how fast rising interest rates around the world are hurting the European financial sector. Credit Suisse is expected to announce broader strategic plan later this month. — Jesse Pound, Elliot Smith ------------------------- 10 HOURS AGO DraftKings jumps on potential ESPN deal Shares of DraftKings jumped as much as 9% in premarket trading Friday on reports that ESPN is nearing a new partnership with the sports betting company. The potential deal would allow ESPN to capitalize on growing demand for sports betting. Disney, which owns ESPN, has been searching for a sports betting partnership for the network for about a year and has said it will spend as much as $3 billion in an extended deal. Shares of Disney were little changed Friday morning. —Carmen Reinicke ------------------------- 13 HOURS AGO European markets retreat slightly ahead of key U.S. jobs report European markets pulled back slightly on Friday to round out a volatile week, as global investors await a key monthly jobs report out of the United States. The pan-European Stoxx 600 index was down 0.2% in early trade, with tech stocks falling 1.6% while food and beverage stocks gained 0.4%. - Elliot Smith 16 HOURS AGO Inflation could resurge if the Fed pivots too early, former Fed president says The Fed has a very delicate and difficult period ahead, says former Kansas City Fed presidentWATCH NOW VIDEO02:58 Fed has a very delicate period ahead: Former Kansas City Fed president Former Kansas City Federal Reserve President Thomas Hoenig said the Fed could “reignite” inflation if it stops raising interest rates “too soon.” The Fed should not enter a rate-cutting cycle immediately after reaching the terminal rate, Hoenig told CNBC’s “Street Signs Asia.” Officials have signaled their intention to raise rates to 4.6% by 2023. Speaking of the Fed’s cycle of rate hikes, Hoenig said, “They need to stay there and not back off of that too soon to where they reignite inflation, say in the second quarter [of] 2023 or the third quarter.” “They have a very delicate and very difficult period ahead of them in terms of decision-making,” he said. — Jihye Lee 18 HOURS AGO CNBC Pro: Fund manager says oil is in a multi-year bull market – and names 3 stocks to cash in Oil is in a bull market that’s going to last for at least six years, according to fund manager Eric Nuttall. The partner and senior portfolio manager at Ninepoint Partners, which manages more than $8 billion in assets, named three stocks for investors to cash in. Pro subscribers can read more here. — Zavier Ong 20 HOURS AGO CNBC Pro: Tesla or Nvidia? One will dominate in A.I., analyst says, giving it 50% upside Tech’s next frontier — artificial intelligence — is still in its adolescence, but offers significant growth opportunities for suppliers and users alike, according to Truist Securities. Both Nvidia and Tesla offer ways to get exposure to AI, the analysts say, revealing their price targets on both stocks. CNBC Pro subscribers can read more here. — Weizhen Tan 22 HOURS AGO Levi Strauss slumps on revenue miss, outlook cut Shares of Levi Strauss shed 6.5% in extended trading Thursday despite an earnings beat. The company missed revenue estimates for the recent quarter and cut its guidance, dragged down by the U.S. dollar’s strength. Levi Strauss posted earnings of 40 cents a share on revenues of $1.52 billion. Analysts expected earnings of 37 cents a share on $1.60 billion in revenue. Data is unavailable Please contact cnbc support to provide details about what went wrong — Samantha Subin 22 HOURS AGO Exxon on pace for best week since October 1974 Exxon Mobil shares are on track to finish their best week since October 1974. The energy stock rose about 3% in regular trading Thursday as oil prices gained, putting Exxon on track to close out the week 17% higher. Energy was the only S&P 500 sector finishing in positive territory on Thursday, rising nearly 2%. It’s on track to finish the week about 15% higher and close out its best week since November 2020. As of Thursday’s close, energy was also the only sector positive for the year. Shares of Marathon, Halliburton and Devon Energy are on track to finish the week higher by roughly 20% or more. — Samantha Subin, Gina Francolla 23 HOURS AGO Advanced Micro Devices falls on disappointing preliminary third-quarter results Advanced Micro Devices ’ stock fell 3.9% in extended trading as the company preannounced results for the third quarter that came in below its previous guidance. The semiconductor company shared preliminary revenue of $5.6 billion for the period, down from the expected $6.7 billion. It blamed the cut on a weakening PC market and supply chain issues. AMD also said it expects a non-GAAP gross margin of roughly 50%, previously expecting gross margins would range closer to 54%. — Samantha Subin 23 HOURS AGO Stock futures open lower Stock futures opened lower in overnight trading Thursday. Futures tied to the Dow Jones Industrial Average shed 57 points, or 0.19%. S&P 500 futures dipped 0.36%, while futures tied to the Nasdaq 100 slipped 0.49%. — Samantha Subin TRENDING NOW As California stimulus checks of up to $1,050 start to go out, here’s what you need to know Director of National Institute of Allergy and Infectious Diseases Anthony Fauci testifies during a hearing before the Labor, Health and Human Services, Education, and Related Agencies of House Appropriations Committee at Rayburn House Office Building on Capitol Hill May 11, 2022 in Washington, DC. Dr. Fauci: A new, more dangerous Covid variant could emerge this winter A sale sign is seen at car dealer Serramonte Subaru in Colma, California. New cars are finally back in stock — but Americans might not be able to afford them Dow drops 600 points, Nasdaq closes 3% lower as rates pop after September jobs report Grant Sabatier and Guillermo and Dianne Rastelli 37-year-old millionaire reacts to couple who retired early with $2.2 million in Portugal by TaboolaSponsored LinksFROM THE WEB Two Lies That May Cost Investors Billions in 2023 Investing Outlook How Much Money Do You Really Get from a Reverse Mortgage? NewRetirement logo Subscribe to CNBC PRO Licensing & Reprints CNBC Councils Supply Chain Values CNBC on Peacock Join the CNBC Panel Digital Products News Releases Closed Captioning Corrections About CNBC Internships Site Map Podcasts Ad Choices Careers Help Contact News Tips Got a confidential news tip? We want to hear from you. GET IN TOUCH Advertise With Us PLEASE CONTACT US CNBC Newsletters Sign up for free newsletters and get more CNBC delivered to your inbox SIGN UP NOW Get this delivered to your inbox, and more info about our products and services. Privacy Policy | Do Not Sell My Personal Information | CA Notice | Terms of Service © 2022 CNBC LLC. All Rights Reserved. A Division of NBCUniversal Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market Data Terms of Use and Disclaimers Data also provided by Reuters

| The text being discussed is available at | https://www.cnbc.com/2022/10/06/stock-market-futures-open-to-close-news.html?__source=newsletter%7Cbreakingnews and |