OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

FINANCE

CENTRAL BANKS Reuters: Analysis: Decade of central bank largesse haunts taxpayers as losses loom

Signage is seen outside the European Central Bank (ECB) building, in Frankfurt, Germany, July 21, 2022. REUTERS/Wolfgang Rattay/File Photo Original article: https://www.reuters.com/business/finance/decade-central-bank-largesse-haunts-taxpayers-losses-loom-2022-10-25/? Peter Burgess COMMENTARY I am nervous ... very nervous. I have a fairly good understanding of macroeconomics and microeconomics as well as corporate management accounting, but the management and policy options of Central Banks seems to be in another world unconstrained by reality. At some level Central Banks are the 'lender of last resort' for commercial banks, but it is not at all clear to me that the modern Central Bank has the resources to actually do that without the support and backing of the 'Government'. In other words 'we the people' are really the lenders of last resort and the big institutions are more or less empty shells. Peter Burgess | ||

|

Analysis: Decade of central bank largesse haunts taxpayers as losses loom

Written by Francesco Canepa October 25, 2022 1:12 AM EDT Additional reporting by Toby Sterling, Balazs Koranyi, Marta Orosz and Jesus Aguado Graphics by Vincent Flasseur and Kripa Jayaram Editing by Tomasz Janowski Our Standards: The Thomson Reuters Trust Principles. Eurozone finance ministers meeting in Brussels

President of European Central Bank Christine Lagarde, Dutch Finance Minister Sigrid Kaag, Dutch Treasurer-General at the Ministry of Finance Christiaan Rebergen, and Luxembourg's Finance Minister Yuriko Backes attend the Eurozone finance ministers meeting in Brussels, Belgium, July 11, 2022. REUTERS/Yves Herman/File Photo Summary

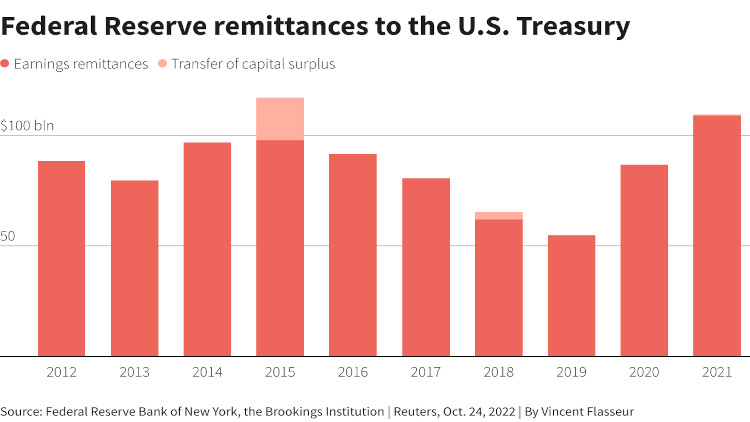

Having raised interest rates to fight runaway inflation, the Federal Reserve and its Europeanpeers must make huge interest payments to commercial banks on deposits the institutions themselves created via massive bond purchases and cheap loans. The optics of this are dire enough at a time when millions of citizens struggle with a cost-of-living crisis. Worse, it means they will have little or no money to pay into the governments' coffers and some central banks in Europe might even need taxpayer help. 'The central bank continues to send money to the banks, while we have to cut back on our expenditure,' Lex Hoogduin, an economics professor at the University of Groningen and a former board member at the Dutch central bank, said. 'So it's mostly a political issue.' Indeed, calls are growing to curb interest payments to banks, much to the dismay of a sector which sees itself as already having borne the brunt of a decade of low rates. Among those who want lenders to take the hit is Michiel Hoogeveen, a Dutch lawmaker on the European Parliament's economic committee, which oversees the ECB. 'If the taxpayer ends up paying the bill, that will be very unfair,' he told Reuters. The Bank of England's former deputy governor Paul Tucker also urged the BoE to cut the interest on part of those reserves and save 30-45 billion pounds ($84.93 billion) in each of the next two financial years. Morgan Stanley estimates that every percentage point increase in the BoE's rate lowers remittances to the Treasury by 10 billion pounds per year. The British government, which received 120 billion pounds in profits from the BoE since 2009, has already earmarked a transfer of 11 billion pounds for the central bank. The U.S. Treasury will not need to worry about bailing out the Fed, which can simply defer any loss. But it will be missing the $50-100 billion or so that it has been receiving from the central bank every year since the financial crisis. This meant Fed chair Jerome Powell was likely to face heat from lawmakers because funds will instead flow to banks, many of which are foreign. 'The Fed won’t be bankrupt financially but it could be politically,' said Derek Tang, an economist at LH Meyer, a research firm.

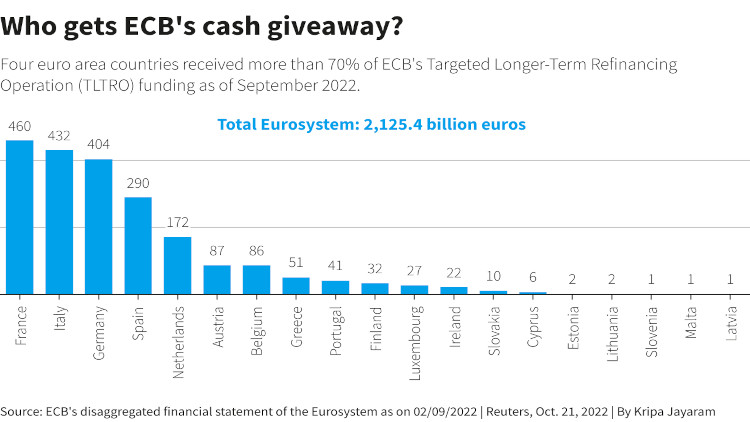

Reuters Graphics ROD FOR OWN BACK For none is the problem more acute than for the ECB, which this week will discuss options to cut its interest bill amid a web of political, legal and financial complications. The central bank of the 19 countries that share the euro has made a rod for its own back by lending money at negative rates to banks. These are now set to make a guaranteed profit by simply parking that cash back at their national central bank, earning a 0.75% annual interest rate that is likely to double this week and is seen rising to 3% next year. This arbitrage will net banks 31-34.9 billion euros if the rate on deposits peaks between 2.5% and 4.5%, according to Eric Dor, the director of economic studies at IESEG School of Management in Paris. It will contribute to losses of around 40 billion euros for euro zone central banks next year, according to Morgan Stanley. Ironically, the central banks of the most fiscally prudent countries - the Netherlands, Germany and, to a lesser extent, Belgium - will be the hardest-hit because they warehouse a larger share of bank deposits and the bonds they bought on the ECB's behalf yield zero or less. They have all warned of upcoming losses and the Dutch central bank openly said it risked needing a bailout, although finance minister Sigrid Kaag later cautioned this was 'not yet on the table'. By contrast, central banks with less cash and higher-yielding bonds in Italy, Spain and Greece were likely to fare better. 'It is clear that the Dutch and German citizens have never voted for such redistribution through the backdoor,' said ISEG's Dor. Johan Van Overtveldt, the Belgian chair of the EU Parliament's budget committee, said this may even make future decisions more difficult by fuelling the resentment of taxpayers in the north of the bloc towards their southern counterparts. On the other hand, the notion of cutting banks' remuneration was already drawing the ire of the industry. German banking lobby Deutsche Kreditwirtschaft said any 'change of the contractual conditions could impair the trust' in central banks and Spanish lender Bankinter said it was not a 'good idea'. Citi estimates that Italian and Spanish banks were benefiting the most from this so called 'carry trade' and would therefore be the biggest losers if it was removed. But the status quo may just be too economically and politically painful. An increase in the deposit rate to 3% will worsen the euro zone's fiscal balance by 1% of GDP in the first year, according to French insurer AXA. 'If taxpayers have to pay the bill this may result in political instability and changes of government in Europe,' Dorien Rookmaker, a Dutch member of the European Parliament's economic committee, said. 'It is a dangerous path.'

Reuters Graphics ($1 = 0.8831 pounds) Additional reporting by Toby Sterling, Balazs Koranyi, Marta Orosz and Jesus Aguado Graphics by Vincent Flasseur and Kripa Jayaram Editing by Tomasz Janowski Our Standards: The Thomson Reuters Trust Principles. Latest Updates

| The text being discussed is available at | https://www.reuters.com/business/finance/decade-central-bank-largesse-haunts-taxpayers-losses-loom-2022-10-25/? and |