OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

COMPANY ... BOEING

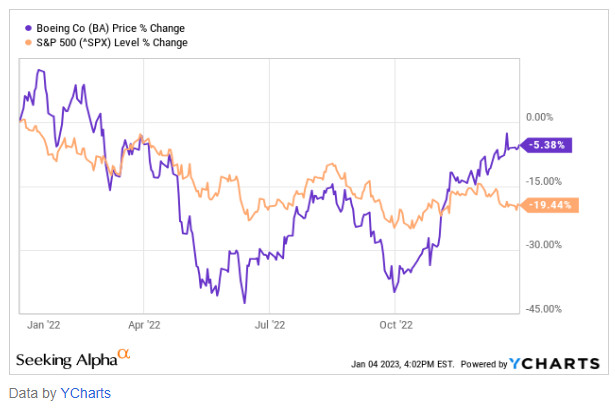

STOCK PERFORMANCE The Boeing Company (BA) ... Boeing Stock Explodes ... Analysis January 2023

Boeing 787 Dreamliner of Lot Polish Airlines taxing at Cracow Balice Airport ... Wirestock/iStock Editorial via Getty Images Original article: https://seekingalpha.com/article/4567886-boeing-stock-explodes Peter Burgess COMMENTARY Peter Burgess | ||

The Boeing Company (BA) ... Boeing Stock Explodes

Written by Dhierin Bechai ... Author of The Aerospace Forum. In-depth insights from an expert on the aerospace and airline industries

Jan. 04, 2023 6:22 PM ET

Summary

What marked a big reversal for Boeing was the fact that the company decided to remarket some aircraft initially built for China. Boeing has been waiting for years now to get those aircraft delivered to China, but geopolitical tensions and the COVID-19 situation in China delayed or even halted any significant progress to reintroduce the MAX in China. Boeing ultimately ran out of patience and started remarketing the jets, which sent a strong message to China. It also showed how strong the demand environment for jets actually is, which puts more confidence in Boeing’s ability to price the aircraft right. Who will eventually “win” this strongarming battle remains to be seen, but Boeing made a bold move to send a message to China which could count on support from investors.

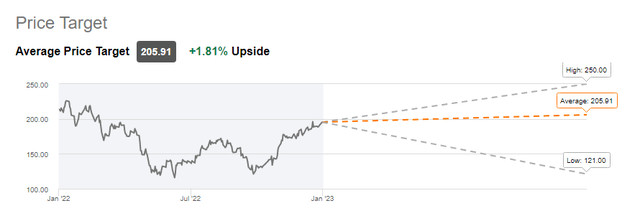

Wall Street price target Boeing (Seeking Alpa) Furthermore, the plan that Boeing presented during its Investor Day was promising and followed by a necessary reorganization of the Defense segment. For the full year 2022, Boeing expects to be cash flow positive, with up to $2 billion in cash generated and $3 billion to $5 billion in 2023 with projections of returning to $10 billion in free cash flow by 2025-2026. For me, that was reason enough to put a $240 price target on Boeing’s shares granted they are able to execute on their projections. With a share price projection of $240, my projection is significantly higher than what Wall Street analysts are expecting, but I also have to note that since I marked shares of Boeing a buy in May 2022, the stock has surged over 60%.

Boeing KPI Commercial Aircraft (The Aerospace Forum) So, we have most definitely seen some bad elements, primarily in Defense, wide body cost pressures, and a slow MAX recovery. However, the fact remains that with the MAX and Boeing 787 back in the game, things are developing in positive directions. We don’t have the data from Boeing yet for December, but looking at the January-November period we see that things have materially improved for Boeing. Gross orders are down 17% and with demand being higher than in the years before you could wonder why. The reason is that last year we saw a lot of cancellations, which were than offset by the same company placing a new order. So, it was really a zero-sum game that boosted gross orders. A better metric to look at is the net orders, which are up 43%. United Airlines’ agreement for up to 300 aircraft is not part of this overview, since the announcement occurred in December, but it is one of the orders that also showed the continued appetite for Boeing 737 MAX and Boeing 787 aircraft. This proved the doomsayers on Boeing’s key programs wrong. In line with net orders being up, the net order value is up 40% while deliveries are up 36%, while delivery value is up 27%. So, we most definitely are seeing what is supporting the major improvement in cash flows, and in 2023 we should see the full-year effect of that. Conclusion: Boeing Is A Buy Even Without It Firing On All Cylinders I continue to believe that The Boeing Company is a buy even if it is not firing on all cylinders. The recovery in MAX deliveries is rather slow, and Defense programs have provided a drag on earnings and cash flow, and that will be the case for 2023 as well. However, even with that in place, the improvement that we do see and should be seeing on an annualized scale this year should propel The Boeing Company stock price even higher, even after the big 60% surge we saw in late 2022. We're about to raise our subscription prices. If you want full access to all our reports, data and investing ideas at the reduced rate, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by Dhierin Bechai profile picture Dhierin Bechai 14.1K Followers Author of The Aerospace Forum In-depth insights from an expert on the aerospace and airline industries Dhierin is a leading contributor covering the aerospace industry on Seeking Alpha and the founder of The Aerospace Forum. With his Aerospace Engineering background he has a more indepth knowledge about aerospace products enabling him to cover a complex niche. Most of his reports will be about companies in the aerospace industry or airlines industry, comparing products and looking at market forecasts providing investors with unique and thorough insights. Dhierin has accumulated nearly 20 million views never failing to spark healthy and thoughtful discussions for investors and aerospace professionals. His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux. AeroAnalysis offers wide variety of services, ranging from providing data and cost models to consultancy possibilities. Check out our website for more information. Though we believe in the strong nature of our analysis, we are in no way giving buy or sell recommendations and advise everyone to do their own due diligence before making investment decisions. Show more Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Like (11) Save Share Print Comments (16)

| The text being discussed is available at | https://seekingalpha.com/article/4567886-boeing-stock-explodes and |