OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

TECHNOLOGY

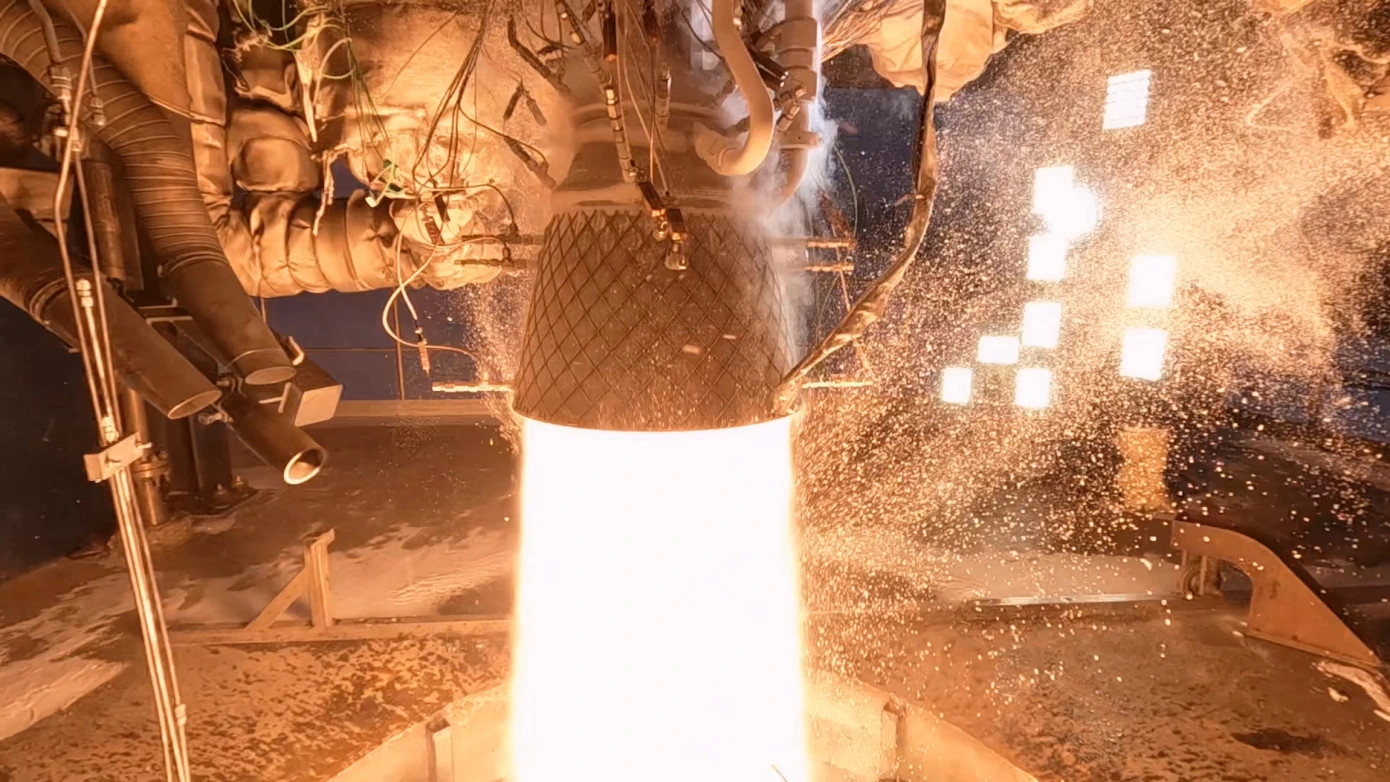

SPACE Isar Aerospace raises $165 million to bring more sovereign launch to Europe

E45F1423-2D1E-4223-B83B-2377DE7B6134 Image Credits: isar aerospace(opens in a new window) Original article: https://techcrunch.com/2023/03/28/isar-aerospace-raises-165-million-to-bring-more-sovereign-launch-to-europe/ Peter Burgess COMMENTARY Peter Burgess | ||

Space: Isar Aerospace raises $165 million to bring more sovereign launch to Europe

Written by Aria Alamalhodaei ... @breadfrom

March 28, 2023 ... 6:00 AM EDT

German launch startup Isar Aerospace has scored $165 million (€155 million) in new funding as it races toward the inaugural flight of its Spectrum small rocket later this year.

The company, founded in 2018, is one of a handful of European startups looking to fill the gap in the launch market on that continent. There are just two European rockets flying today: the heavy-lift Ariane 5, built by ArianeGroup, and Italian aerospace company Avio’s Vega launch vehicle.

But Isar CEO Daniel Metzler told TechCrunch that European governments are waking up to the geopolitical and economic upsides to sovereign launch capabilities.

“If you take a look at the European Union, even Germany itself, there’s a strong focus on the automotive industry. [The space industry] is a huge opportunity at the same time to build up another economical pillar that can be extremely profitable,” he said.

Isar’s funding history reflects this increasing overlap between public and private interest. This most recent Series C round was led by investors including 7-Industries Holding, Bayern Kapital, Earlybird Venture Capital, HV Capital, Lakestar, Lombard Odier Investment Managers, Porsche SE, UVC Partners and Vsquared Ventures. Part of these funds are backed by the EU and programs managed by the European Investment Fund; last year, Isar also won a $11.3 million (€10 million) prize from the European Commission.

Isar is taking a long-term approach, Metzler said. This thinking is built into the company’s decision to be fully vertically integrated, its automated, mass-manufacturing technique, and the design of the launch vehicles. The company is betting that some investments — in the vertical integration, for example — will eventually have a huge pay off, even if that pay-off is not realized for the first five or even ten vehicles.

“I believe that you can be much cheaper if you’re actually fully vertically integrated — if you know how to do it,” Metzler said. “I think one of the big drivers for us early on was scalability. We wanted to not just build one or two vehicles a year, but tens of vehicles per year. In that case, especially with more and more units per year, it really starts paying off if you actually do it yourself.”

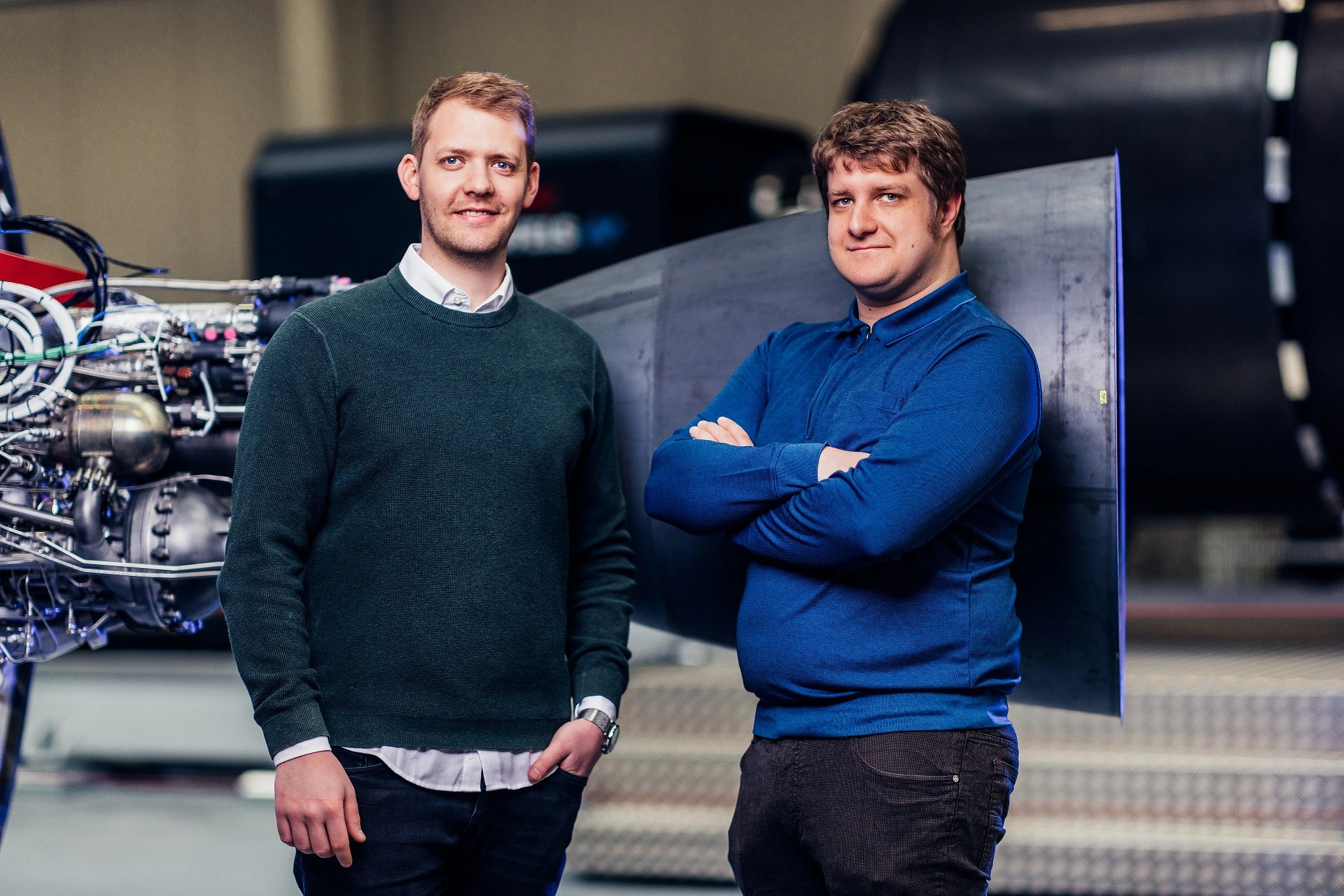

Isar Aerospace co-founders Daniel Metzler and Josef Fleischmann. Source: Isar Aerospace

| The text being discussed is available at | https://techcrunch.com/2023/03/28/isar-aerospace-raises-165-million-to-bring-more-sovereign-launch-to-europe/ and |