OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

BANKING CRISIS 2024

FIRST REPUBLIC BANK WSJ: First Republic Bank Founder Earned a Big Payday—as Did His Family Members

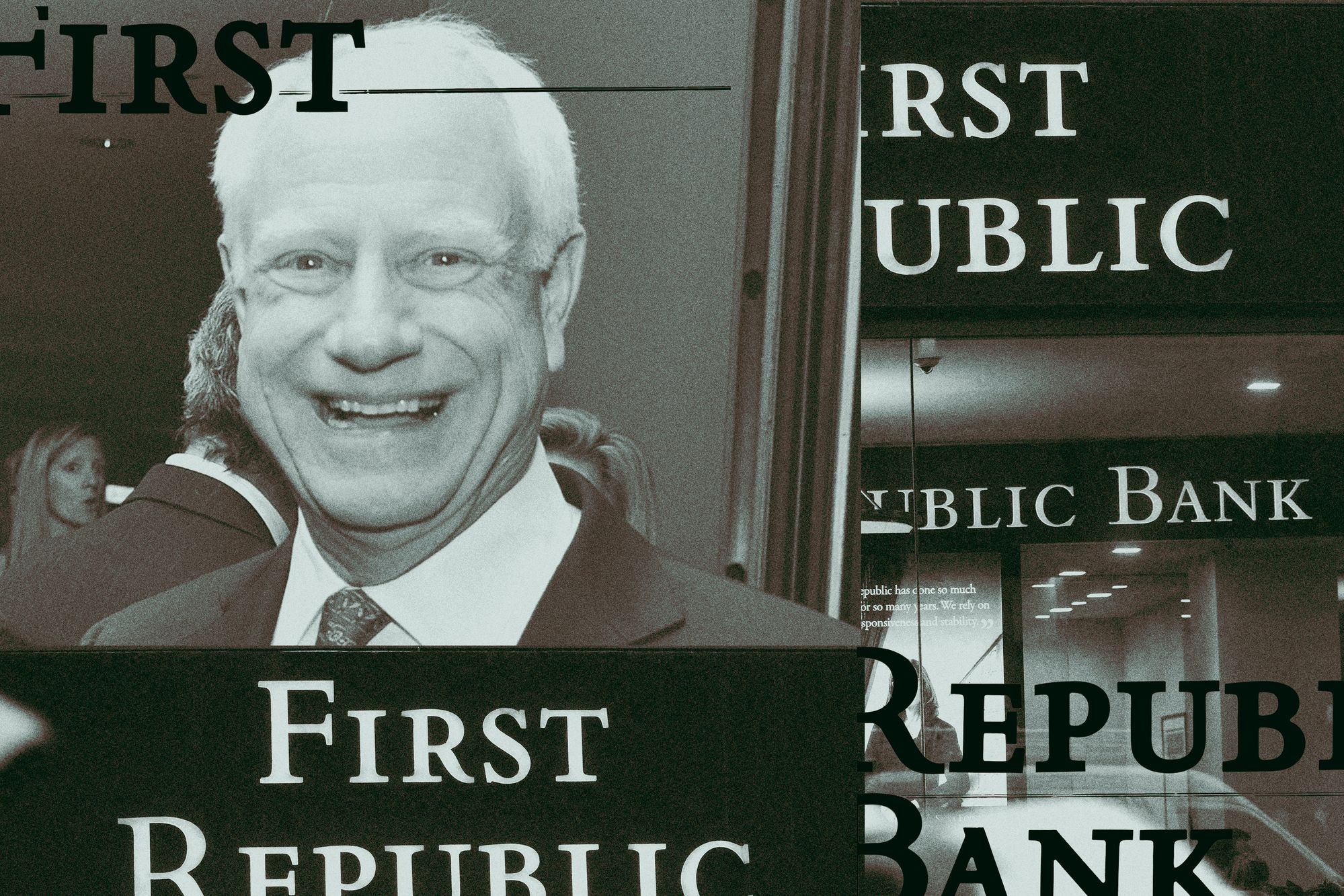

PHOTO-ILLUSTRATION BY THE WALL STREET JOURNAL; PHOTOS: AMANDA GORDON/BLOOMBERG NEWS, MIKE SEGAR/REUTERS Original article: https://www.wsj.com/articles/first-republic-bank-founder-earned-a-big-payas-did-his-family-members-33e395cd Peter Burgess COMMENTARY Peter Burgess | ||

|

WSJ: First Republic Bank Founder Earned a Big Payday—as Did His Family Members

Bank paid a consulting company owned by the founder’s brother-in-law and employed the founder’s son Written by Eliot Brown Updated March 24, 2023 2:20 pm ET First Republic Bank FRC 3.04%increase; green up pointing triangle paid family members of its founder, James Herbert, millions of dollars for work at the lender in recent years, including for consulting services related to interest rates and risk, according to public disclosures the bank made as part of annual filings. The bank paid Mr. Herbert, who was chief executive before stepping into the executive chairman role last year, $17.8 million in 2021, the bank’s disclosures for that year said. The compensation was more than CEOs at most similar-sized banks. A consulting company owned by Mr. Herbert’s brother-in-law earned $2.3 million for advisory work related to its “investment portfolio, risk management, interest rate and economic outlook and other financial matters” in 2021, it said in an annual proxy filing filed last spring. First Republic also paid Mr. Herbert’s son $3.5 million to oversee a lending unit at the bank, the disclosures said. The two family members were paid similar amounts in 2020. First Republic, which was the country’s 14th largest bank measured by assets at the end of 2022, has been at the center of contagion fears in the U.S. banking system, with its stock down over 90% in the past three weeks. Known for catering to wealthy individuals, the bank has raced to stem a rush of depositors pulling funds amid concerns that First Republic has some similarities to now-failed Silicon Valley Bank. Asked about the payments to Mr. Herbert’s son and brother-in-law, a spokesman said the bank has a policy for transactions with family members “and fully discloses such transactions each year.” He said executive compensation in 2021 reflects that the company “outperformed industry peers and the S&P 500 from 2016 to 2021, and delivered strong shareholder returns.” On Wednesday, the bank said that Mr. Herbert and some other top executives would take zero bonuses in 2023 as part of an effort to “signal commitment to the bank and all of its stakeholders.” It said Mr. Herbert also agreed to take no salary for the year, and would forgo some prior stock awards. The bank has been paying for advisory work from Mr. Herbert’s brother-in-law, James Healy, since 2010, when Mr. Healy started the firm Capra Ibex to advise First Republic. Since then, the company has grown to have numerous other clients, and advised JPMorgan Chase’s board on issues relating to the London Whale trade scandal, Capra Ibex says on its website. Mr. Healy was a senior executive at Credit Suisse until 2007, overseeing its fixed income business, which fared better than many other large banks in the 2008 financial crisis. Mr. Healy confirmed his arrangement with the bank but declined to answer further questions. Mr. Herbert’s son, who wasn’t named in the disclosures, is a senior vice president at the bank and previously worked at Colony Capital and Morgan Stanley and co-founded a mortgage lending startup. Mr. Herbert wasn’t involved in pay negotiations for either relative, the disclosures said. The deals with Mr. Herbert’s family members stand out among similar-sized banks. While numerous other midsize and large banks employ top executives’ family members, they are typically paid less, often under $250,000, disclosures show. Mr. Herbert and other executives have sold more than $11 million in stock so far this year, The Wall Street Journal previously reported, bringing attention to executive compensation at the bank. Mr. Herbert’s pay as chief executive was higher than for CEOs at institutions around the same size of First Republic, which had $212 billion in assets at the end of 2022. The CEO of Bank of New York Mellon, with $324 billion in assets, was paid $9.3 million in 2021, the latest year available for First Republic. The CEO of Silicon Valley Bank, with $209 billion in assets, was paid $9.9 million. Mr. Herbert’s pay was closer to that of the CEOs of many larger banks including U.S. Bancorp, whose CEO made $19.1 million in 2021, and Citigroup, whose CEO made $20.5 million, according to the banks’ annual proxy filings. Benjamin Bennett, a finance professor at Tulane University who studies executive compensation, said Mr. Herbert’s pay between 2019 and 2021 was sizable as a percent of the bank’s income, totaling nearly 1.5% of profits in that period. “At most banks, it is significantly less than 0.5%,” he said. Mr. Herbert’s pay in recent years has come largely in the form of a stock and cash bonus that was based mostly on his ability to meet “certain financial safety and soundness criteria” at the bank and regulatory criteria meant to have the bank operate in a “financially safe and sound manner,” bank disclosures say. He was awarded the full bonus for these categories in 2021 and 2020, some of which was in restricted stock. The bank’s profits, deposits and revenue all grew quickly in the period of low interest rates, boosting the bank’s stock price—another factor in his compensation. Mr. Herbert founded First Republic in 1985, and sold it to Merrill Lynch in 2007. After Merrill was taken over by Bank of America, First Republic was spun out as an independent bank again in 2010 through an initial public offering, with Mr. Herbert as CEO. Write to Eliot Brown at Eliot.Brown@wsj.com YOU MAY ALSO LIKE How the FDIC Protects Consumers When Banks Fail Play video: How the FDIC Protects Consumers When Banks Fail The Federal Deposit Insurance Corporation is doing what it was designed to do when banks like Silicon Valley and Signature Banks go under: cover insured deposits. Here’s how the FDIC works and why it was created. Photo illustration: Madeline Marshall A key area of focus has been the level of interest rate risk the bank took when rates were low. A large portfolio of mortgages has fallen in value by billions of dollars thanks to rising interest rates. Markets A.M. A pre-markets primer packed with news, trends and ideas. Plus, up-to-the-minute market data.

| The text being discussed is available at | https://www.wsj.com/articles/first-republic-bank-founder-earned-a-big-payas-did-his-family-members-33e395cd and |