Date: 2026-01-30 Page is: DBtxt003.php txt00016945

Banking and Finance

The 2008 Financial Crash

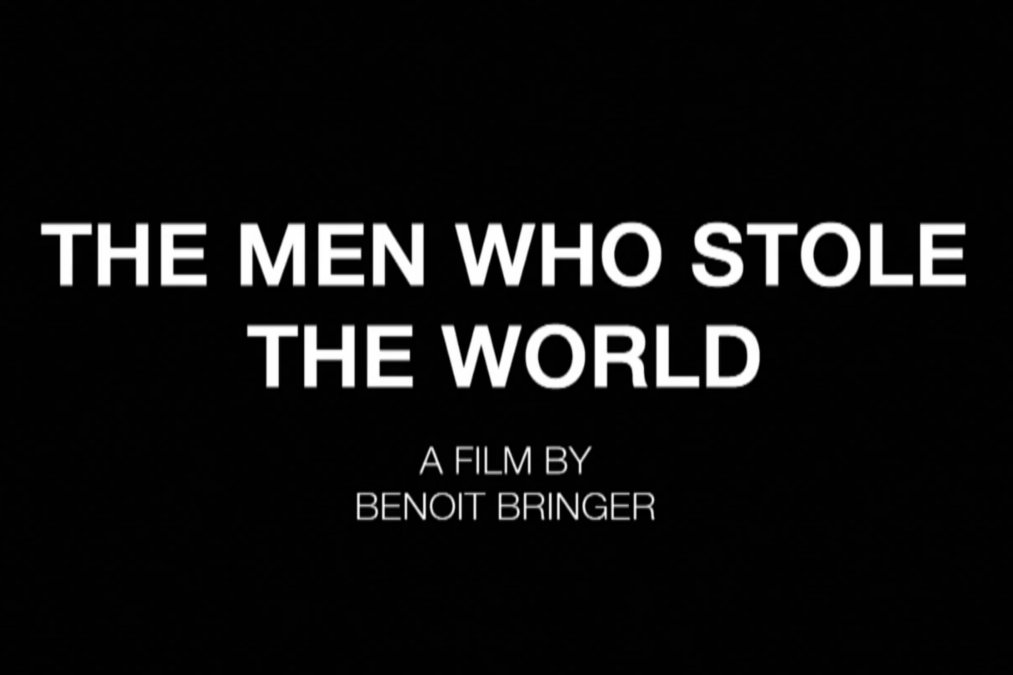

The Men Who Stole the World: Inside the 2008 Financial Crisis

A look at how top executives on Wall Street helped trigger

a global financial crisis - and how it may happen again.

The 2008 Financial Crash

The Men Who Stole the World: Inside the 2008 Financial Crisis

A look at how top executives on Wall Street helped trigger

a global financial crisis - and how it may happen again.

Richard S Fuld Jr leaves Capitol Hill after testifying on the collapse of Lehman Brothers in 2008 [AP Photo/Susan Walsh/FILE]

Original article: https://www.aljazeera.com/programmes/specialseries/2019/06/men-stole-world-2008-financial-crisis-190611124411311.html

Peter Burgess COMMENTARY

I have been disgusted by the manner in which the economy has been 'managed' since the global oil shock of the 1970s. It became very clear since that time that the majority of the emminent economists and powerful politicians had little or no idea of how the modern global system comprising society (people), environment and the material economy actually worked.

The modern high energy Western world floundered during the 1970s. In the early 1980s Margaret Thatcher in the UK and Ronald Reagan in the USA emerged as popular national leaders, and both took aggressive steps to address the prevailing economic malaise. Thatcher and Reagan were both 'conservatives' and both embraced the idea that a 'free market' would optimise economic performance as well as social performance.

I have more sympathy with Thatcher than Reagan. By the end of the 1970s the British worker had a very low productivity and it was high time something was done to address this problem. Prime Minister Margaret Thatcher earned the reputation as the 'Iron Lady' as she addressed this earning all sorts of commentary about he style of management. I like the reference to Margaret Thatcher being the only man in her Cabinet as she insisted on tough measures to address all sorts of big problems in the UK.

I don't have much time for Reagan and 'Reaganomics' and 'Trickle Down'. To me Reagan represents an era of economic thinking that went out of fashion before I was born! (I was born in 1940!). Among his achievements was to enable the economic growth of the industrial base of China at the expense of the industrial heartland of the United States. The financial performance of the economy of the United States improved during the Reagan administration by this massive outsourcing of production from the USA to low wage countries around the world as well as China. The social performance of the United States started a 40 year decline during the Reagan administration that is ongoing as I write this in August 2023. I call this 'financialization' ... and it has been good for financiers in both the UK and the USA for a long time now, and it has enabled the location of the center of economic gravity to move very much from the old industrial global 'West' to China and India and other low wage counries.

The financial folk in the 'West' have done well ... very well ... but everyone else has not.

What happened in the banking crash of 2008 is scandalous ... but the 'fat cats' got away with most all their accumulated wealth!

Disgusting !!!!!!!!!!!

Peter Burgess

A look at how top executives on Wall Street helped trigger a global financial crisis - and how it may happen again.

Produced by AlJazeera

24 Jun 2019 14:16 GMT

AlJazeera Editor’s note: This film is no longer available to view online.

More than a decade since the global economic meltdown of 2008 devastated lives across the world, no one who caused the crisis has been held responsible.

'The 2008 financial crisis displayed what the world now identifies as financial contagion,' says Philip J Baker, the former managing partner of a US-based hedge fund that collapsed during the financial crisis.

Despite this, 'zero Wall Street chief executives have been to prison, even though there is today absolutely no doubt that Wall Street executives and politicians were complicit in creating the crisis,' he says.

Baker was among the few relatively smaller players imprisoned for the part they played.

In July 2009, he was arrested in Germany and extradited to the United States where he faced federal court on charges of fraud and financial crimes.

He pled guilty and was sentenced to 20 years in prison for costing some 900 investors about $294mn worldwide. He served eight years in jail and is now on parole and advocates against financial crime.

'I've been asked why did I break the line,' says Baker.

'I wanted to protect what I had: money, family, power. Everybody does that, don't they? ... How many people say 'No, I don't want the power, I don't want the money' and walk away?'

Time and time again the people that they're going after are these little minnows. They're not going after the big fish, are not going after the bankers for the most part, they're certainly not going after the senior executives at the banks or other big financial institutions that were the decision-makers leading up to the financial crisis.

David Enrich, Finance editor for the New York Times

Baker's arrest came amid mounting pressure to prosecute the top executives that helped lay the groundwork for the 2008 collapse.

But the hand of the law has not extended to the very top of the pyramid.

Lehman Brothers, one of the biggest offenders, went bankrupt on 15 September 2008. As a result, the New York Stock Exchange had its biggest drop in a single day since 9/11.

'When you are talking about the Lehman bankruptcy, you are talking about the largest single bankruptcy in the history of financial institutions,' says Anton R Valukas, a former US attorney and Lehman Brothers bankruptcy examiner.

Many experts say cases like Baker's are just a distraction - his hedge fund is pennies compared with some multi-billion-dollar investment companies - while those truly responsible get away.

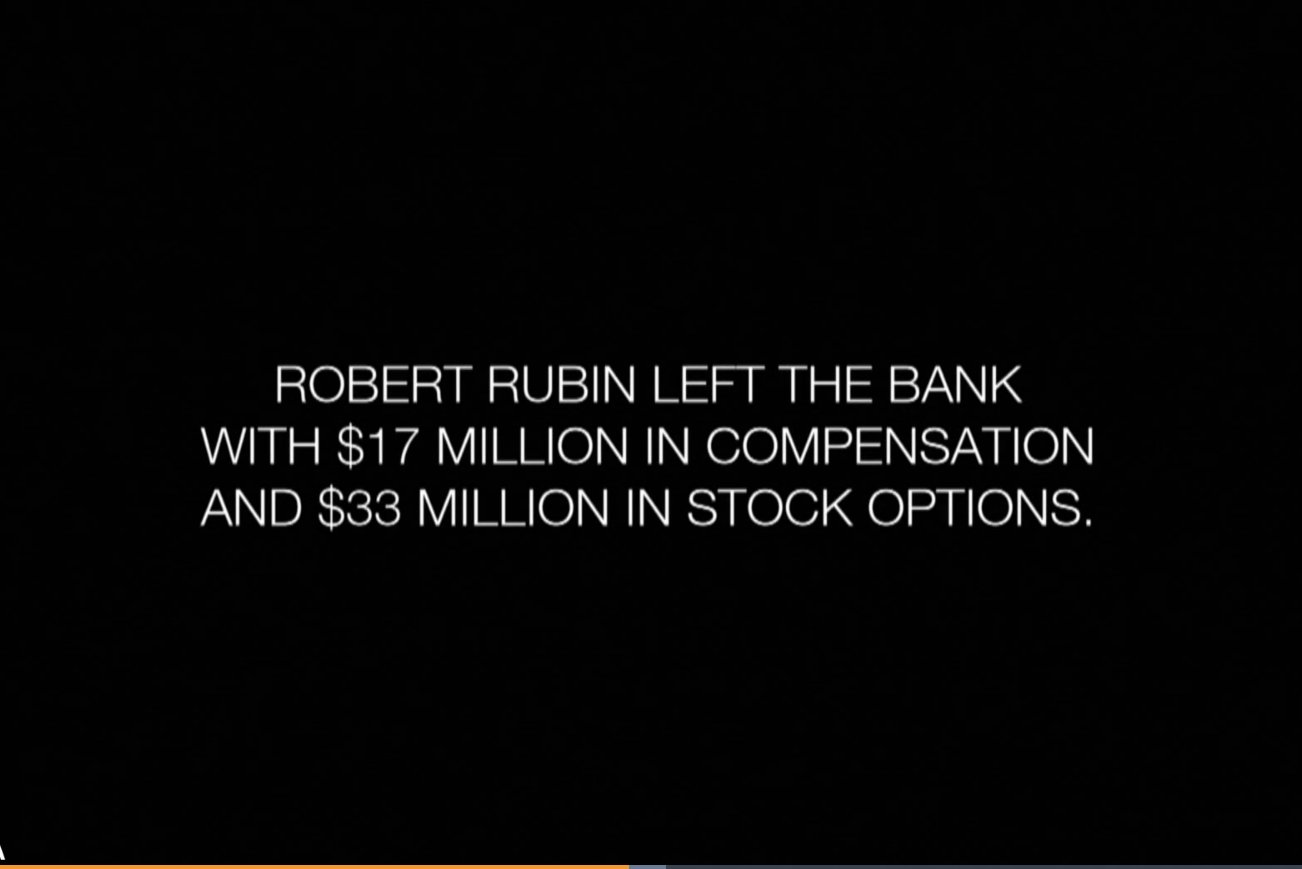

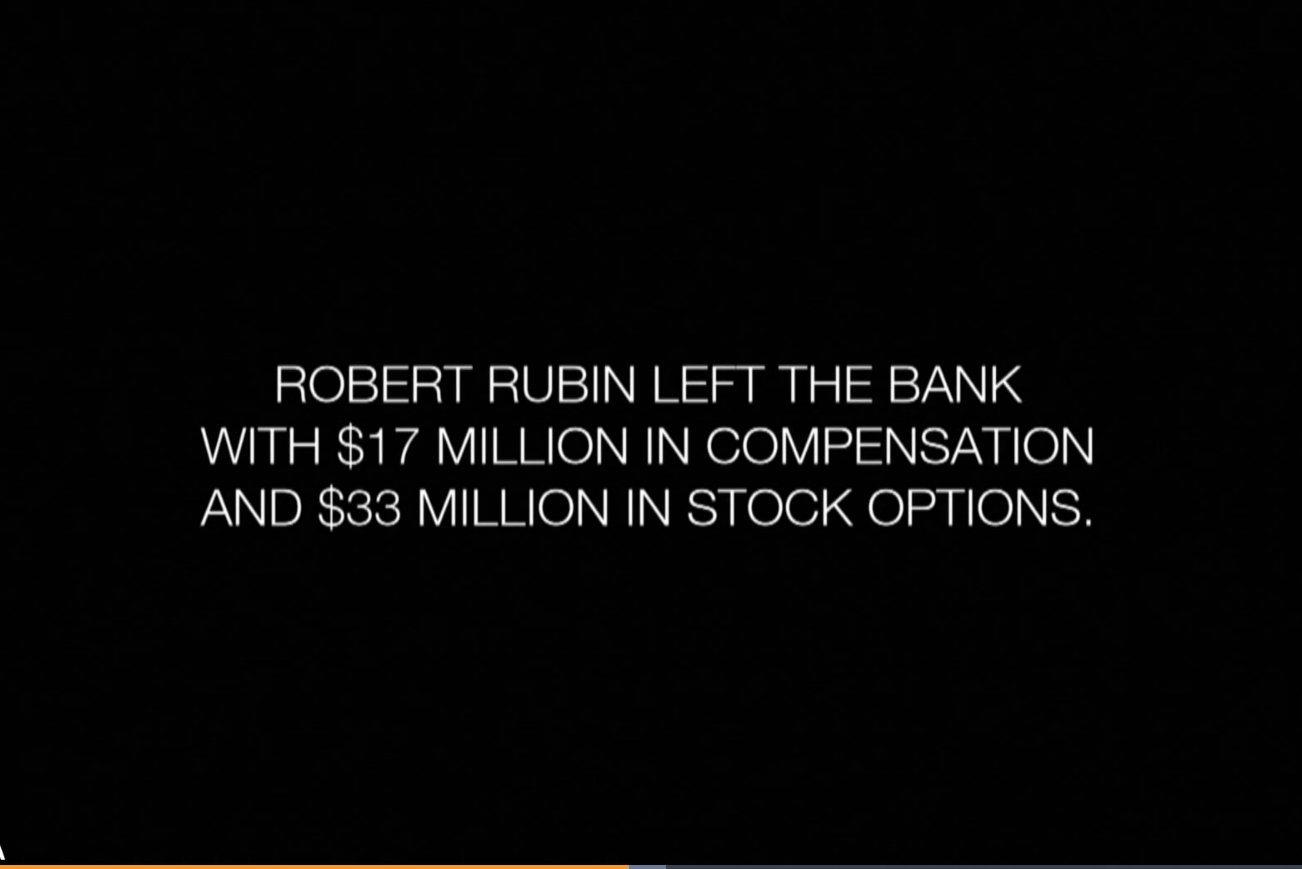

Lehman's former CEO, Dick Fuld, got to keep his money and continues working in the industry today.

'This is a classic example of where the Justice Department takes a shortcut. They want to generate publicity for themselves as going after financial crooks and everyone wants them to do that,' says David Enrich, finance editor for the New York Times.

'Time and time again the people that they're going after are these little minnows. They're not going after the big fish, are not going after the bankers for the most part, they're certainly not going after the senior executives at the banks or other big financial institutions that were the decision-makers leading up to the financial crisis.'

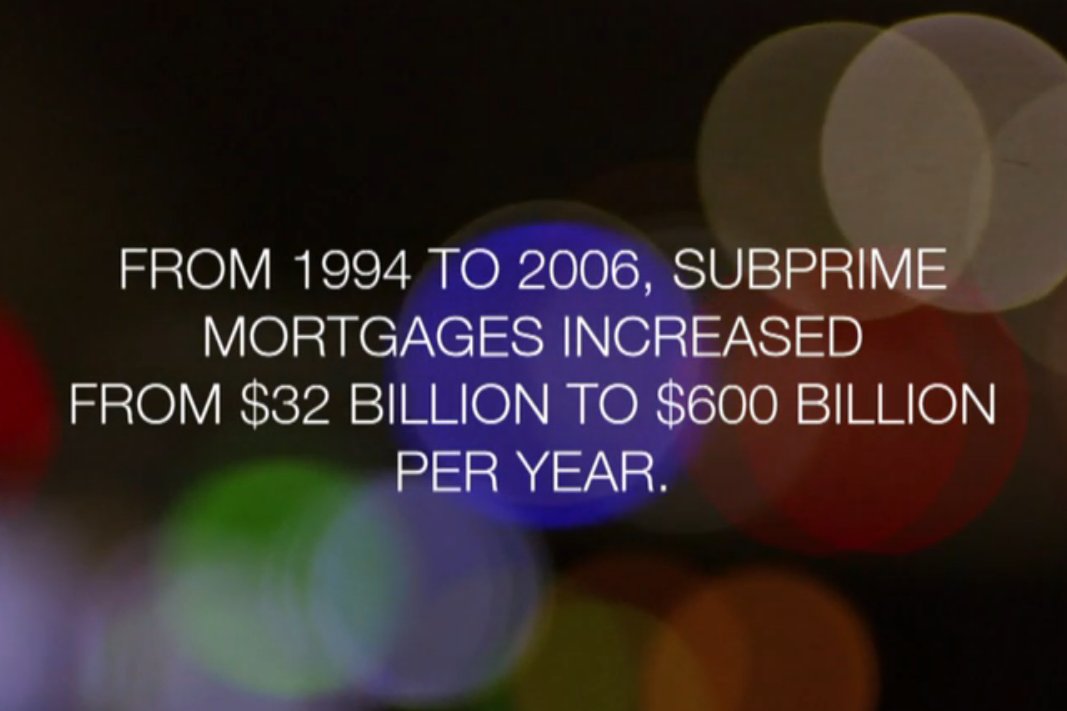

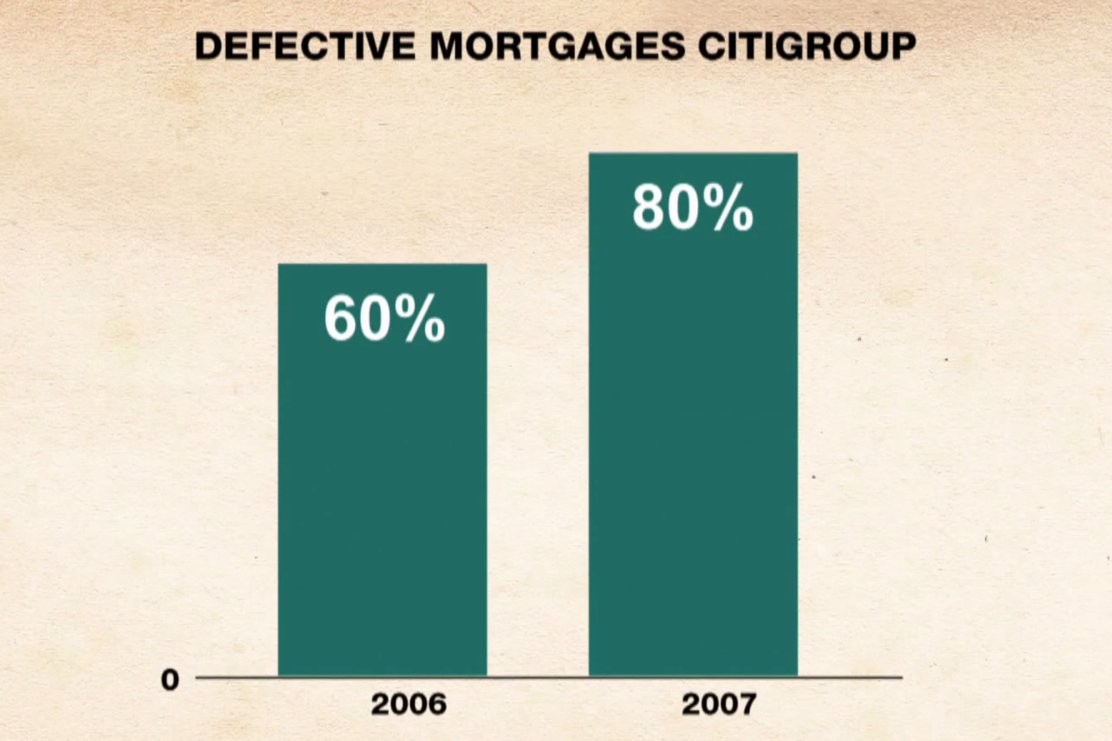

In the decades leading up to the crisis, US banks, enabled by government policies that sought to promote home ownership, gave loans to those who could not afford to pay them off, and these loans were then packaged into risky financial products that were sold worldwide. Between 1994 and 2006, the number of subprime mortgages - loans granted to people with low credit scores - increased from $35bn per year to $600bn per year.

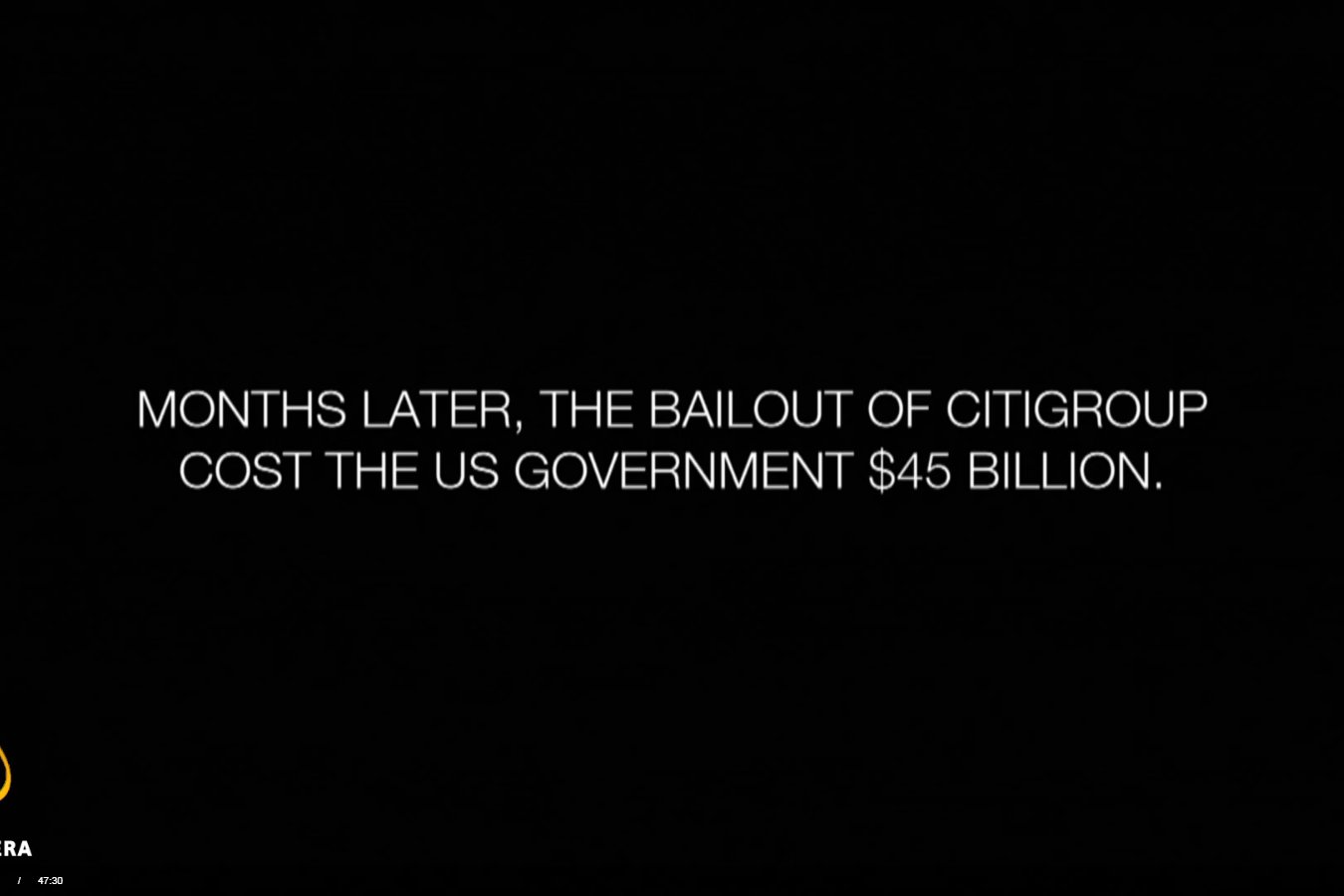

The economic crisis that eventually followed had a devastating impact. From 2008 to 2011, almost 30 million people around the world lost their jobs, according to the UN Department of Economic and Social Affairs. Officially, the US government also spent $700bn in bailouts for banks, although some experts argue the numbers are much higher, in the trillions.

'Without the crisis, Brexit would not have happened and Trump would not be the president of the United States,' says Martin Wolf, the chief economics commentator at the Financial Times.

'This is a major turning point; you never know what it will be, but the [economic collapse of the] '30s transformed the world. Of course it brought us the second world war, Hitler would certainly not have become chancellor of Germany without The Great Depression. So it changes everything.'

So who are the biggest culprits of the 2008 crash, what did they do, and how were they able to walk away?

Through the eyes of experts and former employees on Wall Street, The Men Who Stole the World examines how a group of powerful executives helped trigger one of the largest global financial crises ever, how they got away with it, and why another crisis may be under way.

Source: Al Jazeera

06-a

07-a

101-a

102-a

103-a

104-a

105-a

106-a

107-a

108-a

109-a

110-a

111-a

112-a

113-a

114-a

115-a

201-a

201-a