Date: 2025-04-03 Page is: DBtxt003.php txt00018291

Thoughts Leaders

Marjorie Kelly

New paradigm | New archetypes | Institutional design | Failure of imagination | Strategies and Models | Moving forward

Marjorie Kelly

New paradigm | New archetypes | Institutional design | Failure of imagination | Strategies and Models | Moving forward

https://longreads.tni.org/the-end-of-the-corporation/

Source: https://www.project-equity.org/wp-content/uploads/2018/07/Project-Equity-National-Small-Business-Closure-Crisis.pdf

Peter Burgess COMMENTARY

This essay is very thought provoking. I worked in the corporate sector for almost two decades and was very good at my job. Early on, I became a very young division CFO in a corporate organization that had experienced explosive growth and success in the 1960s. They were a pioneer in the aerosol industry and produced some 90% of the aerosols manufactured in the USA. When I joined the company, I was part of an attempt to bring some management discipline to a very entrepreneurial organization. I learned a lot about what an organization is and is not. Later I was recruited to help another company that had also been a pioneer in its industry in the 1960s, but was failing to stay competitive into the 1970s as technology changed. Some of the lessons learned from this period in my own career were incorporate in 'cases' used by the Harvard Business School many years ago. Management choices really matter ... and bad decisions have consequences.

Later I started to do consulting work internationally for the World Bank, the United Nations and others involved with economic development. I had been a critic of corporate management and their decision making, now I became a even more aggresive critic of the development community and government operatives in both under-developed countries and rich countries. I was appalled by the lack of 'management' throughout this segment of the global economy ... with not even a basic understanding of the role that 'better management' could deliver.

It is interesting to me that quite early in the industrial revolution there were many different threads to how society and the economy could progress including the idea of a 'social business' or a 'cooperative'. I did some work on cooperatives in development during my period as a development consultant, and to some extent the work that is ongoing with TrueValueMetrics embraces some of the importance of impact other than profit in determining performance of any entity.

The following is very interesting!

Peter Burgess

Written by Marjorie Kelly ... Marjorie Kelly is the Senior Fellow and Executive Vice President of The Democracy Collaborative (TDC)

January 18, 2020

Imagine your town is crisscrossed by giant trains that travel insanely fast, because the train owners pay their drivers based on speed. The town establishes speed limits, installs flashing lights, brings out police to keep pedestrians off the tracks. Inevitably, the trains continue to crash into people and cars, causing injury and death. How does the town council respond? By repairing crossings and fences.

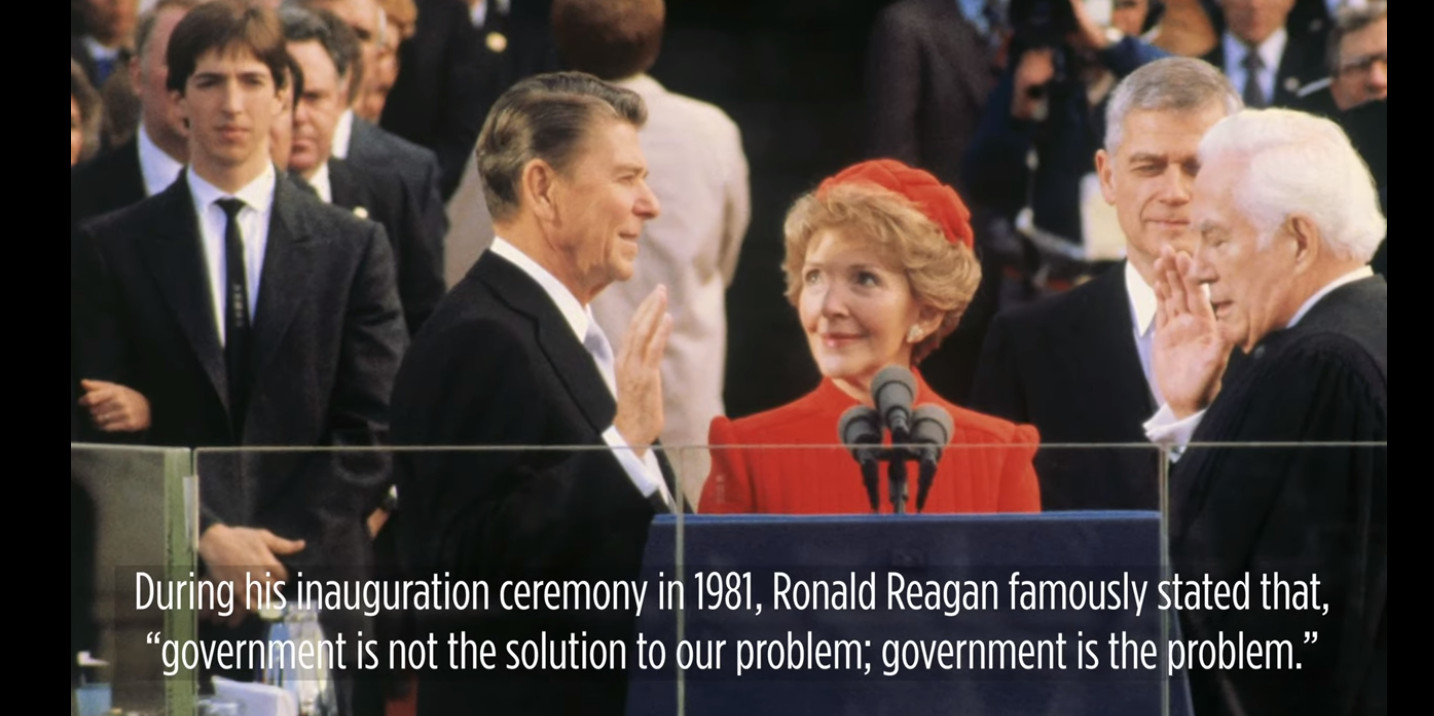

This is how society now attempts to regulate corporate behaviour. We wrap regulations around massive corporations, leaving their profit-maximising mandate in the driving seat. When corporations crash through intricately wrought regulations – think mega-banks in 2008 nearly crashing the entire global economy – our response is to repair the regulatory fences.

It’s time to make the profit-maximising, shareholder-controlled corporation obsolete. In the perilous moment we face, with the crises of the climate emergency and spiralling inequality, the time is up on corporations acting as though serving financial shareholders is their highest duty.

That much has been conceded, at least rhetorically, even by CEOs of the largest US corporations, in an August 2019 Business Roundtable statement. The membership group indicated it realised the need to serve a broader set of stakeholders as the new corporate purpose. Similarly, at the January 2019 gathering of the financial elite at the World Economic Forum in Davos, a key topic was loss of faith with the economic status quo. Axios called it ‘a reckoning for capitalism’.

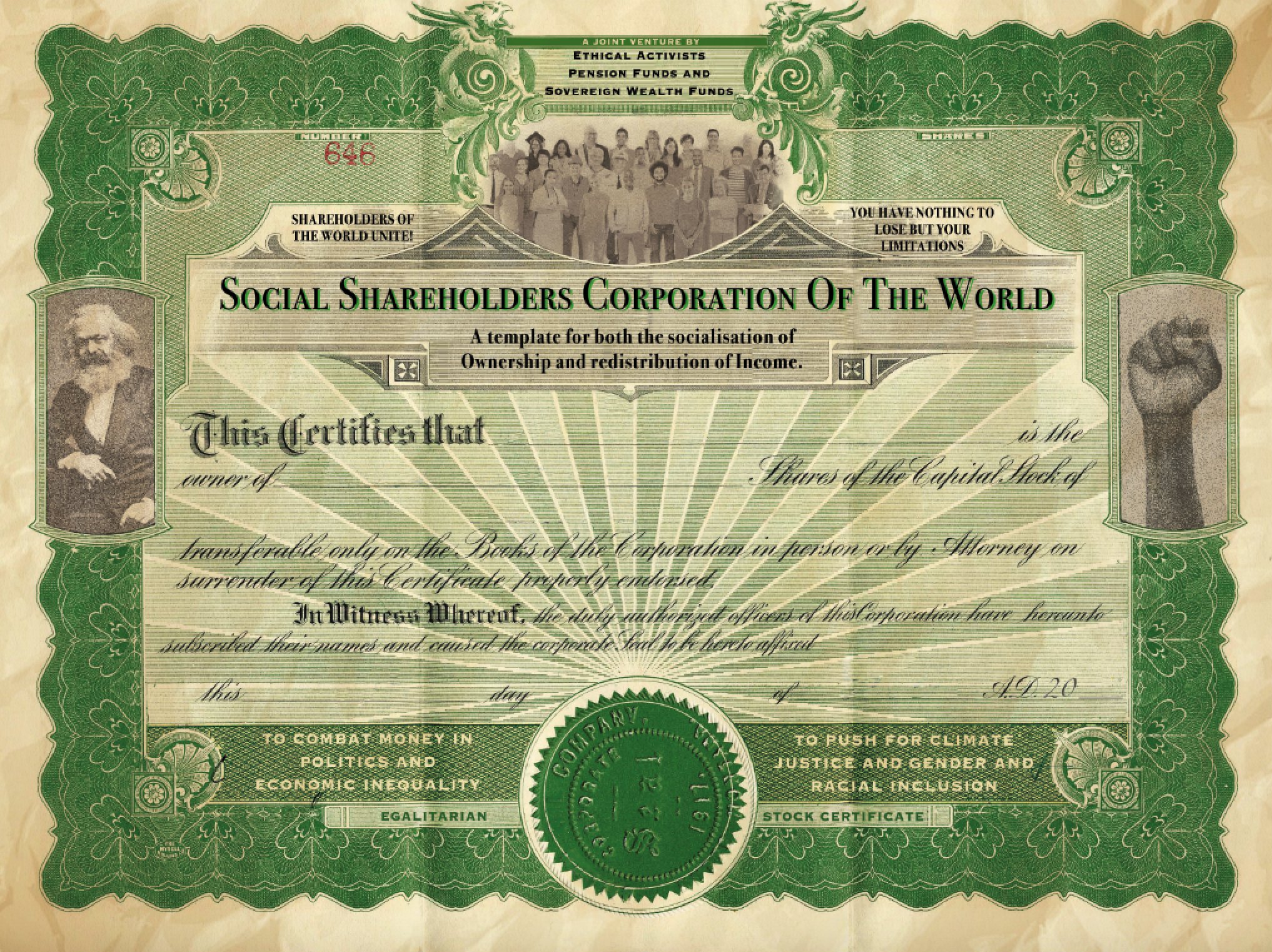

What must change is the structural design and ownership of the corporation itself.

Missing from these conversations, however, is the more threatening truth that what must shift is ownership. As long as the structural forces of current corporate ownership remain in place – where only shareholders vote for the board, where shareholders are predominantly the wealthy, where companies define success as a rising share price and pay executives handsomely for achieving it – there is no amount of rhetoric or external regulation that can turn companies away from their existing mandate: to create more wealth for the wealthy, with all possible speed.

What must change is the structural design and ownership of the corporation itself. We need to envisage and create an entirely new concept of the company – a just firm – designed from the inside out for a new mandate: to serve broad wellbeing and the public good. The just firm is the only kind that should ultimately be permitted to exist. The time is coming when society must end the corporation as we know it.

This task may seem today unimaginable. The top ten US corporations alone—including Apple, Exxon Mobil, General Motors and Walmart – have revenues of $2.18 trillion and employ 3.6 million people. By comparison, the US government’s total revenue in 2015 was just $3.1 trillion and total employment (excluding uniformed military) 2.7 million.

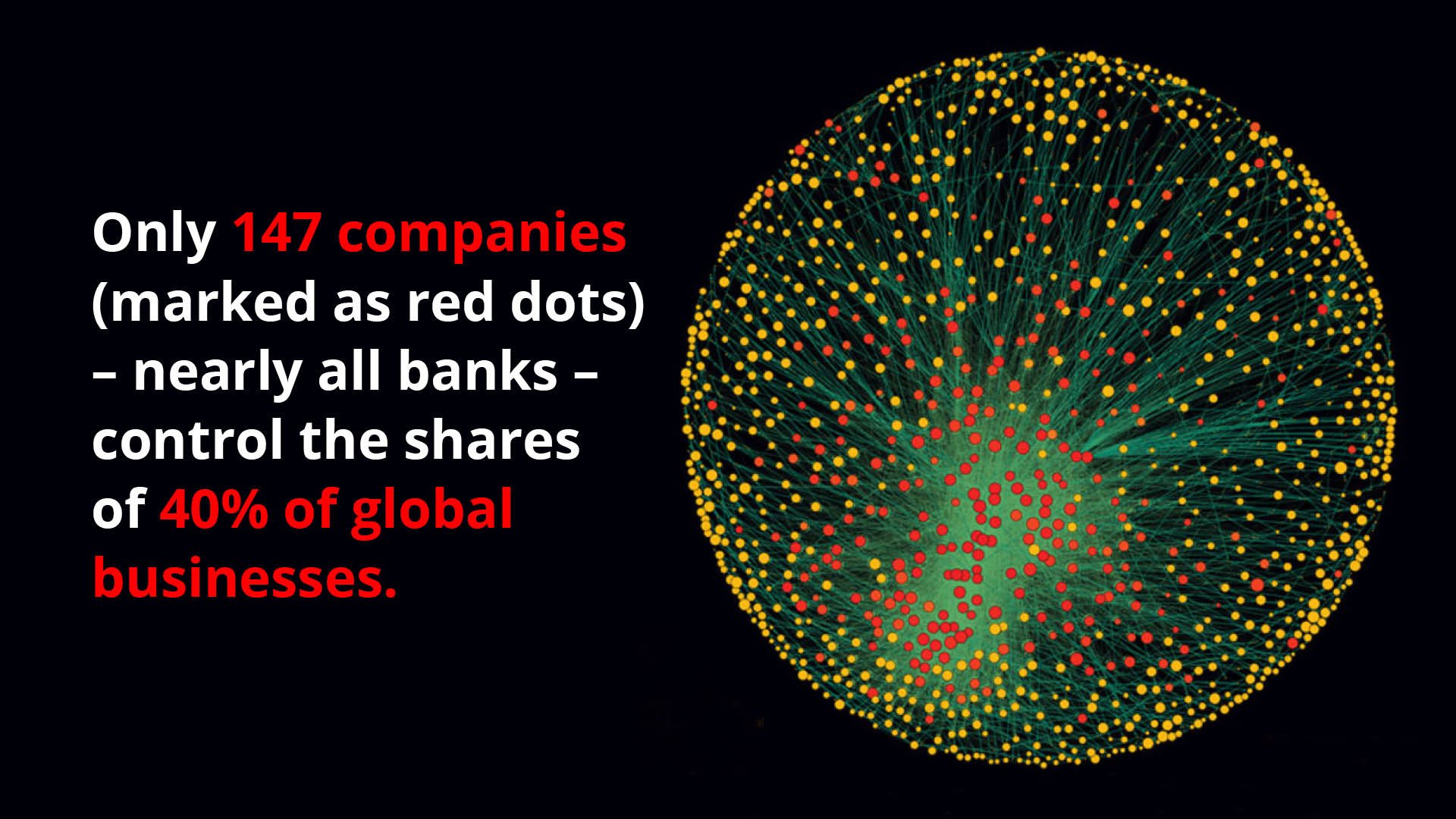

In other words, ten corporations combined are two-thirds as large as the world’s most powerful government. Globally, in 2011 the Swiss Federal Institute of Technology in Zurich found that just 1318 massive corporations control 80 per cent of business revenues.

The same Zurich study showed that 147 corporations control 40 per cent of the total wealth in the network. Source: Vitali et al (2011)

These corporations are, in turn, owned by the few – with the wealthiest 10 per cent in the US holding 84 per cent of shares in publicly traded companies. The elite’s concentrated ownership of assets keeps corporations in their current orbit, locking the broader system into the extractive practices that lead to increasing inequality and ecological destruction.

Lights out, lights on

By contrast, democratic and just forms of company ownership are by their nature more likely to provide broad public benefits. Consider, for example, the recent debacle with Pacific Gas & Electric in California (PG&E), the investor-owned company whose poorly maintained and outdated equipment ignited wildfires in 2017 and 2018, including the catastrophic Camp Fire that killed 85 people and destroyed the town of Paradise.

In the 2019 fire season, PG&E responded by shutting down power for weeks in fire-prone areas, leaving millions literally in the dark.

Camp fire seen by Satellite. Source: NASA (Joshua Stevens) [Public domain]

The lights stayed on, however, in regions served by the community-owned Sacramento Municipal Utility District: the inelegantly nicknamed SMUD. This utility – broadly in public ownership, with a mission to serve its customers, not extract maximum profits from them – is widely acknowledged to offer a cheaper, more reliable service than its corporate neighbour. Indeed, in recent years several neighbouring jurisdictions served by PG&E have attempted to join SMUD (moves often blocked by PG&E).

Some observers say it’s unfair to contrast SMUD and PG&E because the latter serves areas more prone to fire. Yet, SMUD also serves some fire-prone regions, where it has invested in transmission towers designed to withstand high winds, and these haven’t experienced problems. Moreover, according to the Sacramento Bee, many other smaller publicly and cooperatively owned utilities serving areas at high risk of fire maintained reliable service even as PG&E areas went dark.

The difference is ownership design. It is financially focused ownership and control that is behind PG&E’s negligent practices. PG&E went for a decade without inspecting the power line – close to 100 years old, running through a heavily wooded area – which broke and sparked the Camp Fire.

The difference is ownership design. PG&E was focused on maximising share price and SMUD has a primary mission to serve its customers

Why would such a massive firm, with 2018 revenues of $17 billion, neglect basic line maintenance? Because it was focused on something else. It was following the prime mandate: maximise share price. Instead of spending to keep communities safe, PG&E served shareholders by spending billions to buy back its own stock over a decade, to artificially inflate share price. That share price eventually evaporated, plummeting between 2017 and 2019 from a lofty $70 to below $10. What PG&E spent those billions on turned out to be thin air.

The connection between ownership design and corporate behaviour is often lost on the public. But it’s not lost on activists and progressive policymakers in Northern California. The City of San Francisco, California Governor Gavin Newsom, and a coalition of city and county officials, have been jostling to take over PG&E as the company is in bankruptcy.

The governor has threatened a public takeover, while 110 city and county officials jointly proposed turning the utility into a customer-owned cooperative. Representing that group, the Mayor of San José, Sam Liccardo, said the group’s framework would create a ‘viable customer-owned PG&E that will be transparent, accountable, and equitable’.

Their aim, in short, is to create a just firm.

A new paradigm

If our civilisation is to live safely within planetary boundaries, with an economy that allows us all to flourish, more democratic economic decision-making processes will be needed. At the epicentre of this shift are new kinds of company ownership.

Ownership is the original system condition of an economy. Every economy is defined by its dominant form of ownership – in the agrarian age, ownership of land by the monarchy and landed aristocracy; in the industrial age, ownership of railways and factories by the robber barons; in communism, ownership by the state; and in today’s financialised economy, asset ownership by the financial elite.

If we are to move successfully from a disaster-prone economic landscape to one of potentially broad wellbeing, creating a new dominant enterprise paradigm will be among the core shifts needed. Without changing how corporations are owned – by whom, and towards what ends – other forms of change may be impossible, and are unlikely to succeed.

A just firm can be defined simply. It is a firm where the public good is in the driving seat, where ownership has evolved to become broadly held, and where companies have matured beyond the primitive norm of maximum financial gain for the few to embody a new norm of service to the many.

Today’s dominant company ownership design – the investor-controlled, profit-maximising firm – represents a monoculture of design. Its flagship form is the publicly traded company. While there are fewer of these iconic firms – the number of US companies listed on stock exchanges dropped by half between 1996 and 2012 – the profit-maximising principle tends to remain the same with large private firms like Koch Industries and Cargill, or with companies like private equity firms. Public or private, the capital-controlled firm occupies the commanding heights of the capitalist economy.

Tokyo Stock Exchange. The publicly listed firm dominates the global economy. Source: Dick Thomas Johnson/Flickr/(CC BY 2.0)

Control by capital is what pulls companies away from the living mission for which they exist, as in the PG&E debacle. The purpose of economies is to meet human needs. When companies instead exist simply to spin off gains for capital, society is in peril. As John Maynard Keynes observed, ‘Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes a bubble on a whirlpool of speculation’. The entire society can become, in Keynes’ terms, ‘a by-product of the activities of a casino’. This is where we find ourselves today, in an economy of the 1 per cent, by the 1 per cent, for the 1 per cent.

An economy of, by, and for the people requires a new archetype of enterprise. In contrast to the monoculture of the capital-controlled firm, a new archetype can be glimpsed in a rich diversity of designs – including cooperatives, employee-owned companies, community banks, credit unions, social enterprises, state-owned banks, community- and state-owned companies, and other models. In these, ownership and control are not in the hands of the casino, but of people, with a natural interest in healthy communities and ecosystems.

Such enterprises are harbingers of an emerging archetypal model, which can become the North Star as we approach the day we can tackle the larger challenge of redesigning large corporations. Today’s diverse models show that the architecture of ownership defines business purpose and largely determines whether firms operate in ways conducive to the common good, or heedless of it.

As I wrote in Owning Our Future, there is a simple pattern language that describes different elements of ownership design, with five core elements: purpose, membership, internal governance, capital, and networks. Externally, over and around this is the firm’s relationship to government. Internally, enterprise design empowers ethical leadership, or extractive leadership intent on amassing untold individual wealth.

5 elements of ownership design

- Purpose

- Membership

- Internal governance

- Capital

- Networks.

The emerging generation of enterprises are designed to create the conditions for life to flourish. They feature membership in the living hands of employees, communities, and civic leaders connected to the real economy of jobs, homes, and families. Such companies are led by a social and ecological mission, embodied in internal governance where stakeholder voices are heeded.

These companies still require capital, but as their partner, not their master. Ethical networks support these companies, like the worldwide networks of cooperatives and impact investors. Most of these companies are profit making, but they’re not profit maximising. They seek to balance profit with mission. In relationship to government, they do not infringe on the right of natural persons to govern themselves, nor infringe on other universal human rights.

Variants of an emerging archetype

What this archetype looks like in the real world can be seen in existing global models. We see new company purpose, for example, in the B Corporation, where firms embrace a legal commitment to the public good. Across 60 nations, there are 2,655 B Corporations, certified by the non-profit B Lab. There are 5,400 similar benefit corporations embracing a public purpose through incorporation statutes across 34 US states, including firms like Kickstarter, Patagonia, and King Arthur Flour.

While the benefit/B corporation model has its flaws – it focuses on purpose but not ownership or governance, and also lacks robust enforcement mechanisms – it represents a significant step in cultural recognition that it is possible to run successful companies with public benefit as the core aim.

Some criticize B Corporations as wholly private, rather than governmental, but this is generally how powerful new social directions emerge, as with organic standards and LEED (Leadership in Energy and Environmental Design) green building standards, both of which began as private sector innovation before seeing policy uptake.

Also embodying clear public purpose are social enterprises, like those created to hire the hard-to-employ. Tech Dump in Minneapolis, for example, trains ex-prisoners in electronics recycling. Social enterprises, often owned by non-profits, use business methods to tackle social problems. The Social Enterprise Alliance has more than 900 members in 42 US states. Social entrepreneurship is taught at business schools including Oxford, Harvard, and Yale.

Tech Dump recycles e-waste and provides employment to formerly incarcerated workers. Source: Techdump

The social economy – a related but broader concept, including cooperatives – is substantial in Canada, particularly Quebec, which has more than 7,000 collective businesses with annual revenue of more than $40 billion.

The power of internal governance, combined with broad-based ownership, is at work at the John Lewis Partnership (JLP), which, despite recent financial difficulties related to economic conditions in the retail sector, remains the UK’s largest department store chain with sales of over £11.7bn and a workforce of 81,500.

This firm is wholly owned by its employees or, as JLP calls them, partners. The firm’s stated purpose is to serve the happiness of its partners, who exercise voice through a democratic governance structure of elected councils, committees and forums.

We might note the contrast here with capital-controlled firms, where only shareholders – capital owners – are considered members. Employees in traditional firms are not members. They are disfranchised and dispossessed, with no claim on profits they help create, and no voice in governance, gaining power only through union membership. But in an employee-owned firm like the JLP, employees are not conceptually outside the firm. They are the firm.

Employee ownership is today advancing in the US, the UK and elsewhere. Were it to grow substantially, workers would begin to occupy the commanding heights of the economy.

The oldest and largest body of alternative firms is the cooperative sector – businesses owned by the people they serve – which includes depositor-owned credit unions; agricultural cooperatives like Sunkist, Ocean Spray, and Land O’ Lakes; and consumer cooperatives like REI.

Worldwide, cooperatives have more than 1 billion members, and combined revenues of $3 trillion. The largest worker cooperative organization is the Mondragon Corporation of Spain, a worker-owned federation including 98 worker-owned cooperatives, 80,000 workers and €12 billion in revenue. It sells products worldwide and has its own bank, university, business incubators, and social welfare agency.

In the farmer-owned cooperative Organic Valley – a Wisconsin firm with a revenue of $1 billion – the owner-members are its 1,650 suppliers, the farmers who produce the organic milk, cheese, and eggs the company distributes. Organic Valley combines ownership in human hands with a living purpose: to save the family farm. Because this firm sells only organic products, restoring and protecting the ecosystem is also integral. As the company helps new farmer-members through the rigorous process of going organic, company growth translates into expanding restoration of watersheds and soils.

The vital model of public ownership has begun to re-emerge globally as a viable strategy after the 2008 financial crisis. Beginning in Latin America, there has been a global movement to reclaim community ownership of water systems after the disastrous failure of many investor-owned water ventures. This movement has reclaimed public ownership of water in at least 235 cases in 37 countries, benefitting 100 million people.

Our future as a species depends on our ability to restore our relationship to water, land, and other generative resources of nature. The architecture of ownership is key.

Equally vital to our future is who owns the banking system, which is a kind of utility providing a public good, hence often appropriate for public ownership.

State-owned banks play significant roles in China, Germany, India and several Latin American countries. The European Union (EU) has more than 200 public and semi-public banks, with another 80-plus funding agencies, comprising 20 per cent of all bank assets. Germany’s 413 publicly owned municipal savings banks, Sparkassen, hold more than €1.1 trillion in assets. As The Economist noted, these banks came through the global financial crisis ‘with barely a scratch’.

Their ownership design kept them in service to the public, free from the demands of speculators that pulled other banks into misbehaviour that nearly sank the global economy.

It adds up to a force bigger than almost anyone knows. Our society is at a point of breakdown, yet also in a time of deep innovation and redesign. These alterative ownership models have much to teach us about what might come next – how their design lessons can be applied to the larger challenge of the modern corporation.

Beyond regulation to institutional design

With the planet at the brink, millions living in economic anxiety, and the radical right everywhere on the rise, it’s apparent that old ways of regulating capitalism are no longer sufficient. The tools of the past are a start, but are inadequate to confront the problems of corporations today.

Take anti-trust. It’s a tool that can, potentially, address the critical issue of size (although in recent decades, anti-trust strategies have been defanged by corporate capture and lobbying), yet even at it best, anti-trust doesn’t address the key issue of purpose.

The common good must become part of the DNA of economic institutions and practices.

Can and should companies be permitted to pursue profit maximisation for shareholders as their prime purpose? This is a threatening aspect of their activity that breaking them apart or preventing mergers and acquisitions (M&A) fails to address.

Nor do other approaches, like minimum wage and maximum hours regulations, touch the core purpose, which leaves corporations to simply find ways around those rules – sending jobs overseas, for example, or turning full-time jobs into contract labour.

Many of the approaches used in regulation today – including minimum wages, unions, old-style securities regulation, and social safety nets – harken back to the 1930s. Of course, we still need these, and they must be strengthened. But in contemporary turbo-charged, globalised, financialised capitalism, deploying only these tools is like erecting a speed limit sign in front of a hurtling train.

The common good must become part of the DNA of economic institutions and practices. If we can achieve such a transformation, it will mean community and workers’ economic wellbeing will no longer be dependent on the legislative or presidential whims of a particular hour, but will be supported by an enduring shift in the underlying architecture of economic power – the design of ownership and control.

Systems science tells us that human social systems are not structured simply by rules and regulations but are self-organised around values, around what we instinctively care about. The core value of the current system can be distilled to the problem of capital bias: a favouritism towards finance and wealth-holders woven invisibly throughout the system, in values, culture, and institutions.

The central problem is profit maximisation through financial extraction

Capital interests are often advanced by policy – as with lower taxes on capital gains than on labour income, or bailouts for big banks but not for ordinary homeowners. Yet capital bias lies more deeply in basic economic architectures and norms, in institutions and capital ownership. The central problem is profit maximisation through financial extraction. This is what society has long attempted to dance around, through technical regulatory fixes.

Changing this core bias means going to the central question at the heart of political economy – the question of the ownership and control over productive capital. We need to move over time to a new kind of efficient, and politically and ecologically sustainable economic system – a moral and democratic political economy, designed for the wellbeing of us all.

Central to this evolution is bringing to an end the profit-maximising, investor-controlled corporation.

A failure of imagination

Even on its own terms, the contemporary capital-centric economy is beginning to show itself to be unsustainable. It’s a system programmed for its own implosion.

The International Monetary Fund (IMF) has warned of ‘storm clouds’ gathering for the next financial crisis; billionaire investor Paul Tudor Jones has highlighted a ‘global debt bubble’; and fund manager Jim Rogers has predicted a financial crash that will be the biggest in his 76 years.

The financial community is talking of the ‘everything bubble’ – the unsustainable runup in the value of stocks, real estate, and other assets – with the New York Times asking, ‘what might prove the pinprick?’ After the last crash, the Wall Street Journal declared, ‘the Wall Street we have known for decades has ceased to exist’. Next time, might this actually prove true?

A decade on, what’s different is that young people are rising up in ways not seen since the 1960s, and radical policy ideas are on the table as never before. We may be approaching tipping points where major historical change heaves into view.

It’s an apt time to be mindful of two key tools progressives possess: legitimacy and imagination. Once a system loses legitimacy, no matter how strong it seems, it will ultimately fall. Think of apartheid in South Africa. Think Harvey Weinstein and other powerful men versus the #MeToo movement. Think of the monarchies that dominated the globe for millennia, before the mischief of democracy.

The capitalist system has already lost vast legitimacy. This process can deepen, as we help others to see how and why the system is failing the vast majority. A key step is helping people understand a truth that cultural historian Edward Said articulated, that the fundamental tool of empire is turning natives into outsiders in their own land. What is lost, he continued, ‘is recoverable at first only through the imagination’.

What often holds a dying political-economic system in place is a failure of this kind of imagination. But today’s leading thinkers and activists are piercing the seeming invincibility with audacious proposals and approaches.

For example, the UK government still holds control of Royal Bank of Scotland (RBS), which taxpayers bailed out in 2008 to the tune of £45 billion. The New Economics Foundation (nef) in the UK has proposed bringing RBS entirely into public ownership, breaking it into a network of 130 local banks.

In the US, my colleague at The Democracy Collaborative, Thomas Hanna, has similarly proposed that in the next financial crisis, policy-makers consider converting failed banks to permanent public ownership. This is a way to de-financialise our economy, break up large concentrations of capital, and provide necessary funding for priorities such as green energy. If such ideas strike some as outlandish today, they can become eminently practical in a crisis.

Strategies and Models

The Green New Deal – which calls for a ten-year mobilisation to meet 100 per cent of power needs through clean, renewable, and zero-emission energy sources – is another avenue for moving next-generation enterprise models forward.

The Sunset Park Solar project in New York City is the kind of initiative a Green New Deal could finance across the US. Uprose, a Latinx organisation, partnered with the state agency NYC Economic Development Corporation and others to install community-owned solar power on the Brooklyn Army Terminal. It will provide 200 low-income residents with electricity that is less expensive and more resilient in the face of climate-related grid disruption.

Latino community organisation UPROSE pushed for a community solar project to respond to the climate crisis and create green jobs. Source: Groundswell

Community-run energy projects like this could be advanced by a new federal agency proposed by my colleagues Gar Alperovitz and Johanna Bozuwa. They have outlined a proposal for the creation of a Community Ownership of Power Administration (COPA), akin to President Franklin Roosevelt’s Rural Electrification Administration, which brought electric power to the 90 per cent of rural areas that previously lacked it. A new COPA at the national level could deploy financing and capacity-building to build community-run energy utilities.

In both the UK and the US, the commitment to a community-controlled and just renewable energy system is gaining momentum. Recent years have seen a surge of utility takeover campaigns – including the Switched On London campaign, and the #NationalizeGrid campaign against National Grid, a UK for-profit company operating in both New England and in the UK.

The UK Labour Party took this vision further with its proposed full takeover of the Big Six energy utilities. Though Labour failed disastrously in 2019 – in large part because of Brexit – the problem was not the unpopularity of other key economic policies like public ownership. For example, in a 2017 poll, the UK free-market think tank Legatum Institute found 83 per cent supported public ownership of water, and 77 per cent supported public ownership of gas and electricity.

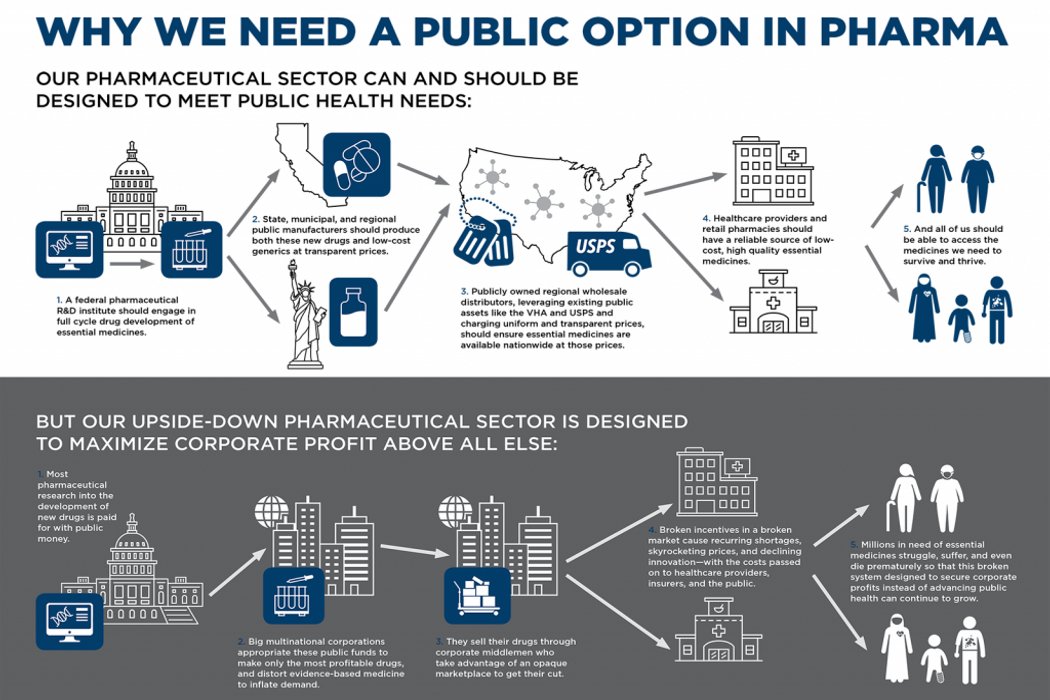

Another sector where next-generation enterprises are needed is health care – particularly the pharmaceutical sector, where skyrocketing prices, recurring shortages, post-market safety issues, and increasing financialisation are all natural outcomes of firms designed for maximising profit.

My colleague Dana Brown has proposed developing a public pharmaceutical sector for the US, as a systemic approach that supersedes the need for piecemeal reforms that could later be rescinded. Such a design would include a national public research and development (R&D) institute developing essential medicines; state and local public manufacturers; and regional public wholesale distributors. Profits would be returned to public balance sheets, and could be invested upstream in social determinants of health, such as local economic development.

The idea of a ‘public option’ in the pharmaceutical industry has been endorsed by Senators Elizabeth Warren and Bernie Sanders. And in the UK, the Labour Party ‘Medicines for the Many’ proposal called for overriding patents when necessary for the public health, and for publicly owned drug manufacturing at scale. (Admittedly, this is not a policy that will fly under Boris Johnson.)

In addition to sector strategies, next-generation enterprises can be advanced model by model – as with employee ownership, the one most ready for scale. In Italy, for example, workers whose workplaces are being closed have a first right of refusal to join co-workers and purchase the firm, under the country’s ‘Marcora’ legislation. A similar right has been proposed in the UK by the Labour Party, and in the US by Bernie Sanders. As the baby-boom generation reaches retirement age, 2.34 million businesses owned by boomer entrepreneurs will come on the U.S. market in the next ten years – an event being called the ‘silver tsunami’. If more of these firms can be sold to workers, it could bend the curve of history, helping to create a major democratic ownership revolution.

New kinds of models that don’t yet exist will also be needed – particularly in the technology sector. There is a movement for worker-owned platform cooperatives, as alternatives to billionaire-owned high-tech firms. A former Microsoft executive has suggested a model of ‘end user equity’, in which users get equity in firms like Facebook, since user data adds value. One start-up called Driver’s Seat supports ride-hail drivers in aggregating and capturing value from their data, rather than seeing that value extracted by firms like Uber.

A full-on approach to creating a new model of accountable enterprise has been proposed in Elizabeth Warren’s Accountable Capitalism Act, which would require US firms with revenue of more than $1 billion to obtain new federal charters (corporations are today chartered at the state level), with broader fiduciary duties, creating a new mandate to serve not just shareholders but also employees and the community; the legislation also proposes 40 per cent of board seats for employees.

In these many kinds of approaches, we can see how a new paradigm of the just firm could be advanced model by model, sector by sector, crisis by crisis. By helping firms be sold to employees, rather than absorbed by competitors, we can begin to stop the conveyor belt that feeds massive corporate size. Similarly, if companies are broken up by anti-trust, the new firms could be mandated to become worker owned.

We can act opportunistically, as with PG&E or bank bailouts, taking advantage of bankruptcies and crises to move firms into permanent public or community ownership. Sectors where the moral case for public ownership is strong – like health care or water – can be targeted for mobilisation. Banks can be reconceptualised powerfully as public utilities, as in the already growing movement in the US and UK for more city-owned, state-owned, and cooperative banks.

Ultimately, the day will come when all large corporations must be subject to redesign. We can lay the groundwork for that day through approaches that advance cultural acceptance – such as amplifying the voices of progressive business leaders at successful firms that have broad-based, mission-led ownership, making the business case for a new kind of moral and just firm.

Moving forward

In all of this, social and environmental movements have leading roles to play. Also vital are theorists and legal scholars, who are needed to advance academic theories of the just firm. The necessary kind of legal frameworks are suggested by an observation Franklin Roosevelt made – that private enterprise ‘has become a kind of private government, a power unto itself’.

Massive corporations are not in any real sense private, like a household or a family, nor are they democratic governments, like cities, states, and nations. They are a third entity, a governing power that has never been democratised, and still functions with the archaic, aristocratic worldview where the rights of wealth trump other human rights.

The word ‘corporation’ appears nowhere in the US Constitution. Corporations did not emerge in anything like today’s form until the industrial era. What concerned the founding fathers was protecting individuals against abuses of the king.

As Hofstra University law professor Daniel Greenwood observed, that mindset led to a great divide in the law between public and private: limitations on government on one side, protection of individual liberties on the other. When corporations later arose, they placed themselves on the private side of this divide, posing as private persons, possessing liberties that require protection from government over-reaching its proper scope.

When we recognise that massive corporations are private governments, it’s clear that the people and our elected bodies need protection from the over-reach of these anti-democratic entities, which must appropriately be reorganised in the public interest.

Reconceptualising the firm, redesigning it, displacing the corporation as we now know it – this is a task as massive as the elimination of carbon emissions. Both are equally necessary. The difference is that while the climate challenge is conceptually far more advanced and widely embraced as essential, the task of redesigning the corporation is barely recognised and remains vastly under-theorised.

If such a task seems impossible, we might remind ourselves that fundamental transformation is historically as common as grass. There is only one future scenario that’s utterly impossible – continuation of the status quo.

The work begins simply with seeing – recognising that ownership design matters, that it lies at the root of today’s crises. We don’t yet possess a shared clarity that deepening problems are not accidental or the result of policy but are the predictable outcomes of the basic organisation of the extractive economy.

Still less do progressives share a positive alternative economic vision of what might replace capitalism. Instead, our minds fixate on dystopia. Indeed, it is true that lights out in California is the smallest taste of what is to come, if we go through the coming devastation with giant corporations in control, intent solely on short-term earnings. It’s time to begin together imagining a next generation of enterprise design.

-------------------------------------------------

ABOUT THE AUTHOR

Marjorie Kelly is the Senior Fellow and Executive Vice President of The Democracy Collaborative (TDC) and a leading theorist in “next-generation enterprise design.” At Tellus Institute, Kelly cofounded Corporation 20/20 to envision and advocate enterprise designs that integrate social, environmental, and financial aims. Kelly is coauthor of The Making of a Democratic Economy (2019, Berrett-Koehler Publishers), author of Owning Our Future: The Emerging Ownership Revolution (2012) and The Divine Right of Capital, which was named one of Library Journal’s 10 Best Business Books of 2001.