Date: 2024-08-16 Page is: DBtxt003.php txt00019321

THE TRUMP SAGA

Washington Post: Trump's coronavirus crisis response undermines his image as billionaire populist

Washington Post: Trump's coronavirus crisis response undermines his image as billionaire populist

Original article:

Peter Burgess COMMENTARY

Peter Burgess

The Washington Post ... The Finance 202 ... Your economic policy briefing

Written by Tory Newmyer with Brent D. Griffiths

August 3rd 2020

President Trump blasted income inequality for growing out of control during the pandemic, pointing to a report noting billionaires have seen their wealth boom as up to 30 million Americans collect unemployment. “Changes must be made, and soon!” Trump tweeted Saturday.

But his response to the economic crisis has dealt a major blow to his image as a populist billionaire fighting for workers where Democratic elites had not – a sentiment that helped carry Trump to victory in 2016.

Consider the optics: Just hours before Trump's tweet, his top emissaries were on Capitol Hill pushing against a full and lengthy extension of $600 in enhanced federal benefits to jobless Americans that expired last week. And on Sunday — as the talks dragged on, with millions of people in limbo — Trump made the 284th visit of his presidency to one of his own golf courses.

Now polls indicate voters now think Trump is the one who has lost touch. Just 37 percent in a recent Quinnipiac University survey say he cares about average Americans, while 61 percent say he doesn’t. That represents a low for him on the matter — and a sharp drop from the 51 percent of Americans who gave him favorable marks on the question in late November 2016. Voters give former vice president Joe Biden a markedly better score, with 59 percent telling Quinnipiac in its most recent survey he cares about average Americans while a third of them say he does not.

The president’s most outspoken priorities for the next round of emergency economic relief, meanwhile, haven’t centered on the jobless Americans closest to the brink. Instead, he continues to push for a payroll tax cut that even those in his own party have rejected as providing help to the wrong people — those who already have jobs — while doing little to encourage hiring. And his team has insisted on providing $1.75 billion for a new FBI headquarters in downtown Washington, an initiative with no discernible relevance to the economic crisis. The president’s push has drawn criticism from Democrats that Trump is moving to stifle competition for the Trump International Hotel, a block away.

Trump’s properties continue to do hundreds of millions of dollars in business.

Trump himself has only known life on the rarefied end of the income divide, a fact underscored by the latest financial disclosures from his business empire: The Trump Organization reported $446 million in revenue in 2019, up about 2 percent from the previous year, according to disclosures the White House released on Friday. “The documents do not give details about 2020, when Trump’s company has been slammed by the coronavirus pandemic,” David Fahrenthold and Joshua Partlow note. “Some Trump properties were closed for weeks at a time, and others saw their occupancy rates nosedive, as the broader travel industry declined.”

Eric Trump, the president’s second son and an executive at the company, put a bullish spin on the report: “Our businesses thrived with strong revenues while remaining underleveraged and maintaining very low levels of debt,” his statement said.

Trump’s golf courses proved a strength, with several reporting double-digit revenue gains, per the New York Times.

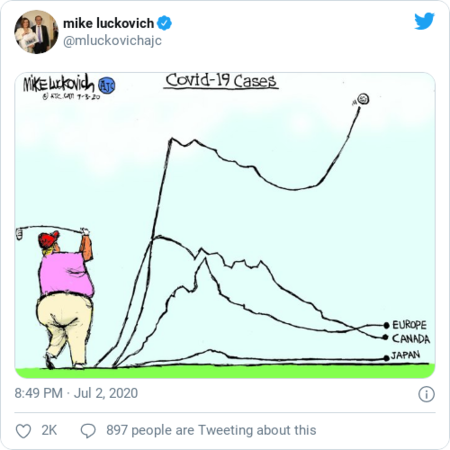

Trump has received some heat for the amount of time he has managed to spend golfing, especially in light of the criticism he heaped on then-President Barack Obama for the same activity. But the visual carries the potential to do more damage to Trump amid public health and economic crises, conveying a sense Trump is taking his leisure while the country suffers. From Atlanta Journal-Constitution cartoonist Mike Luckovich last month:

The other Trumps in the White House have also been faring well financially.

Ivanka Trump and Jared Kushner, meanwhile, earned at least $36.2 million while they served in the White House last year, according to disclosures the president’s daughter and her husband filed Friday. The average American household pulled in about $63,000 last year — or roughly what Ivanka and Jared earned in 15 hours from their outside companies and investments.

Trump’s daughter took heat last month for urging out-of-work Americans to “find something new,” as part of a White House effort to promote skills-based jobs that don’t require a college degree. It landed with a thud. Critics noted the multimillionaire daughter of a billionaire for whom she now works in the White House is not the most credible messenger to the millions seeking work amid an economic collapse, when job seekers outnumber open positions by more than three-to-one.

Treasury Secretary Steven Mnuchin brings his own issues to the role of administration frontman in this crisis.

Mnuchin argued on Sunday the $600 federal payments to the unemployed are too generous. Republicans are proposing instead to cut the payment to $200 or use a formula that would peg it to two-thirds of their wages before they lost their jobs. “In some cases, people are overpaid, and we want to make sure there are the right incentives,” he said on ABC’s “This Week.'

“But some preliminary studies on the issue have not found the temporary bump is a disincentive for a noticeable number of workers,” Erica Werner and Eli Rosenberg report. “A recent study by three Yale economists found workers receiving the extra benefits returned to work at roughly the same rate as others, finding ‘no evidence that more generous benefits disincentivized work.’”

The extra payments have helped people meet basic needs, including making rent and mortgage payments. But the benefit expired last week, along with a moratorium on evictions from federally-backed housing, putting more than 12 million renters at risk of losing their homes.

Mnuchin, the Goldman Sachs veteran now helping lead the administration’s response to this crisis, found opportunity to profit in the last one. He led a group of investors that put up $1.6 billion to buy the failed IndyMac Bank from the FDIC in 2009 as the great financial crisis hit full tilt. They completed a $3.4 billion merger with CIT Group in 2015, and Mnuchin walked away with a $10.9 million severance, on top of what he earned from stock options and a multimillion-dollar salary running the bank.

Mnuchin contended in his Senate confirmation hearings that his group stepped in to salvage a failed institution no others would touch. “OneWest inherited some 178,000 foreclosures already in the pipeline,” Politico reported. 'As house prices fell and job losses mounted, more home seizures were inevitable.” Mnuchin emphasized the bank under his leadership made more than 100,000 modification offers to borrowers.

But the bank also foreclosed on some 36,000 homes, by one estimate, and its federal regulator detailed cases of bank employees falsely claiming to review individual foreclosure filings. In 2011, the Treasury Department that Mnuchin would later lead forced his bank into an agreement to monitor the conduct of its employees.