Date: 2024-11-22 Page is: DBtxt003.php txt00022658

STOCKMARKETS

FIRST HALF 2022

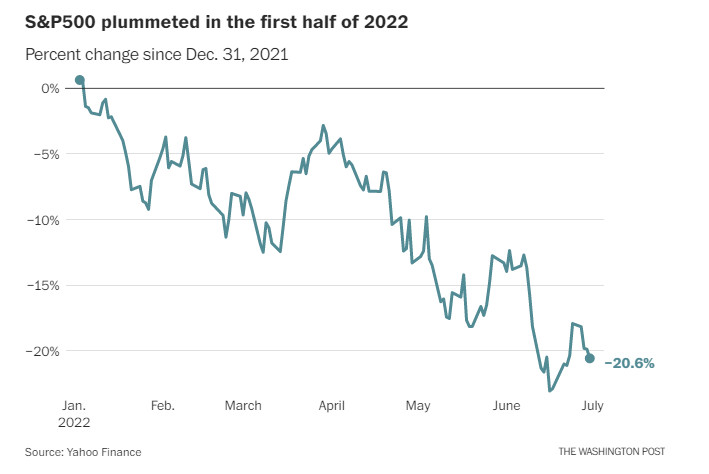

S&P 500 posts worst first half since 1970, Nasdaq falls more than 1% to end the quarter ... Inflation should start to moderate by end of 2022

FIRST HALF 2022

S&P 500 posts worst first half since 1970, Nasdaq falls more than 1% to end the quarter ... Inflation should start to moderate by end of 2022

Original article: https://www.cnbc.com/2022/06/29/stock-market-futures-open-to-close-news.html

Peter Burgess COMMENTARY

The New York stock markets have declined substantially ... around 20% ... in the first half of 2022, and investors are unhappy. Commentators are asking when the markets will go up again, but don 't seem to understand that the markets are still way over-priced for a sustainable system.

There is something wrong with a 'system' that is only stable when it is growing. Some economists seem to think that growth of 2% is an optimum growth rate for economic stability, but I have never understood exactly how they came to this conclusion. I believe it is something to do with the fact that a zero growth economy cannot justify in any way, the stock market valuations that prevail in the modern capital markets.

So the question that needs to get asked is not so much when will the stock markets return to the December 2021 levels, but what is a justified level for the market in a stable socio-enviro-economic situation, and what behavior changes are needed to get the best possible results.

There have been substantial behavior changes over the past 50 years in order to achieve sustainable profit growth for the business sector and the maintenance of wealth by 'owners'. President Ronald Reagan and a Republican administration gets credit for accomplishing this after the broad economic malaise of the 1970s. So what happened in the 1980s that made things better for Americans than the 1970s? First of all, things became better for some Americans in the 1980s but a lot worse for others. The investment community started to recover from the stagflation of the 1970s with th support of very aggressive pro-business policy choices from Washington that substantially reduced the power of labor unions and enabled expansion of production out-sourcing to low labor low regulation locations around the world ... mainly in Asia. If the singular goal of policy was to maximise the profit for business owners and investors, this policy framework was justified, but in the real world of a complex inter-connected socio-envir-economic system the benefit that was realized by business owners and investors was coupled with social degradation for a lot of people as well as significant environmental degradation.

Not to anyone's surprise, the media was happy to report GDP growth as a policy success without spending too much time explaining that the gain for owners and investors was offset by significant losses for workers and retired workers. It was in the 1980s that I started to talk about the 'financialization' of the modern world and its many issues. Forty years later, it should have become clear that a world where financialization is the dominant policy direction is catastrophically unsustainable and will support a decent quality of life for fewer and fewer people over time.

The bad news is that financialization has been 'taught' in prestigeous academic establishments ... like the Harvard Business School, Wharton at the University of Pennslvania, Tuck at Dartmouth and so on ... but the fact that students have learnt it does not mean they understand it, nor that it is actually a sustainable practical policy framework.

I trained at Cambridge in the UK as an engineer (Mechanical Sciences Tripos) before completing my academic studies with economics. Later I qualified as a Chartered Accountant with Coopers in London.

During my study of engineering, I learned a lot about the technologies that were the 'cutting edge' for the late 1950s and it was very impressive compared with what had been possible say in the 1930s. For example. we had a jet engine in the engineering lab that was cutting edge technology for its time. I think it was the same sort of engine that powered the Gloster Meteor jet fighter. We also had examples of aircraft engines that had powered the Spitfire and other WWII aircraft. We learned about radio telescopes (Jodrell Bank) and space travel (Sputnik) as they were in 1960. I learned about materials ... and electronic circuits and electonic components as they were in the 1950s.

I got to study economics because I could not decide what area of engineering to specialize in ... so punted and went into something quite different that did not require me to choose a specialization. Rather, it served to broaden my understanding rather than deepen it. I was exposed to classical economics and to Keynes. I was struck by the way Keynes applied what he knew to the problems at hand. He was a young 'expert' at the Treaty of Versailles after WWI, but resigned because he thought the outcomes were so wrong that they would precipitate a new war. Later he was a strong advocate of government intervention to address the issues of the Great Depression in the 1930s. In 1944 he was a leading participant at the Bretton Woods conference which established the World Bank and the IMF and the general post-war international economic architecture. What I have tried to learn from Keynes is that a solution must be designed to address the problem as it exists in reality, and not a simplified theoretical construct of the problem.

In 1960, there were no business schools in the UK. In my first job after graduating from Cambridge it became very clear to me that there was a huge deficit in effective communication. As a 21 year old management trainee I was being given an opportunity to work in every different department of the company, and on construction sites where are equipment was being installed ... but none of the real managers were getting out of their offices, and a flow of critical management information simply did not exist.

I was struck by the huge disconnect between the engineering progress of the company's products that was being made and the archaic routines of the commercial departments of the company. The engieers were doing cutting edge (for 1961) control engineering, but the cost of this work was not being reflected in the pricing of the projects and the contracts being written. This was an absolute nonsense but I was in no position to change it ... though I did try. As a result of this advocacy I got to be friendly with a Board Member and the Chief Financial Officer of the company, who suggested that I might want toe become a Chartered Accountant rather than continuing with my engieering focused management training. Three months later I was in London at Cooper as an Articled C lerk on my way to becoming a Chartered Accountant.

Fast forward about 60 years, and I see the modern world rather the same way I saw that company in my youth. Bits of the company were the best in the world and at the cutting edge of critical progress, and other bits of the company were stuck in doing things the old way that might have been good for 30 years before, but no longer good for now. Not suprisingly, the company failed not many years later. The question today is whether the world will fail in the next few years. Bits of the modern world are amazing and have the potential to be the basis for sustainable prosperity for all ... but these bits are submerged by a whole range of practices that have become entrenched and are very difficult to change.

Change is not easy ... but without change the world and the society it needs to support will go the way of the first company I worked for after I graduated from University. For some reason ... I am reminded of the dinosaurs !!!!!!!!!!

More than anything, what needs to happen is for competent policy analysts to try to work through what needs to be done in order for all the actors in the modern socio-enviro-economic system to be progressing year over year at a 'decent' pace. It is my view that the 'productivity' of the modern world is good enough for every human being to have a 'decent' quality of life ... one that is modestly improving year over year. It is economic productivity that delivers 'value add', but there is a substantial amount of economic activity that results in 'value destruction' ... notably the military industry complex talked about by President Eisenhower many decades ago. I bring this up, because the economics of international affairs and national security are complicated, and I do not want to be naive ... but I also do not want to encourage stupidity. My preference is that the military should be super-strong, but almost never used and a diplomatic corps should be super-good and always in play everywhere and driving progress in ways that benefit everyone.

Fortunately the engineering and scientific community ... inlcuding myself ... did not stop learning in 1960, but have been accumulating knowledge at an accelerating pace and in greater quantify all the time for the past 60 years. Sadly, most of the people with a lot of power in the modern world seem to belong more to medievial times than the modern world ... and this is very dangerous. This must change. It is time for some new thinking that balances social, environmental and economic benefits in an equitable manner.

Peter Burgess

Inflation should start to moderate by end of 2022

PUBLISHED WED, JUN 29 2022 6:03 PM EDT

Written by Tanaya Macheel @TANAYAMAC and Pippa Stevens @PIPPASTEVENS13

Stocks fell on Thursday, as the S&P 500 capped its worst first half in more than 50 years.

The Dow Jones Industrial Average shed 253.88 points, or 0.8%, to 30,775.43. The S&P 500 slid nearly 0.9% to 3,785.38, and the Nasdaq Composite pulled back by 1.3% to 11,028.74.

Thursday marked the final day of the second quarter. The Dow and S&P 500 posted their worst quarter since the first quarter of 2020 when Covid lockdowns sent stocks tumbling. The tech-heavy Nasdaq Composite is down 22.4% for the second quarter, its worst stretch since 2008.

The S&P 500 posted its worst first half of the year since 1970, hurt by worries about surging inflation and Federal Reserve rate hikes, as well as Russia’s ongoing war on Ukraine and Covid-19 lockdowns in China.

“We had the unprecedented pandemic that shut the world down and the unprecedented response, both fiscal and monetary,” Stephanie Lang, chief investment officer at Homrich Berg, told CNBC. “It created the perfect storm with regard to surging demand and supply chain disruptions, and now there’s inflation that we haven’t seen in decades and a Fed that was caught off guard.”

“Now the market is forced to adjust to this new reality where the Fed is trying to play catch up and slow growth,” she added.

The major U.S. indexes are down significantly since the start of 2022

The Dow is down more than 15%, the S&P 500 is down more than 20% and the Nasdaq is down almost 30%.

Note: Closing price for each day. Y-axes are unique to each chart. Chart: Gabriel Cortes / CNBC Source: FactSet

A surge in bond yields earlier in the year and historically pricey equity valuations sent tech stocks tumbling first, as investors rotated out of growth-oriented areas of the market. Rising rates make future profits, like those promised by growth companies, less attractive.

The tech-heavy Nasdaq has been hit especially hard this year. The index is now more than 31% below its Nov. 22 all-time high. Some of the largest technology companies have registered sizeable declines this year, with Netflix down 71%. Apple and Alphabet have lost roughly 23% and 24.8%, respectively, while Facebook-parent Meta has slid 52%.

On Thursday, Universal Health Services fell 6.1% and helped lead the market lower after it issued second-quarter earnings and revenue guidance below expectations, citing lower patient volumes. Shares of HCA Healthcare lost 4.3%. Abiomed and Viatris were lower by more than 3%.

Pharmacy stock Walgreens Boots Alliance was the biggest decliner in the Dow, down 7.2% after the company reiterated its full-year forecast of adjusted per-share earnings growth in the low single digits.

Cruise stocks continued to drag, after Morgan Stanley cut its price target on Carnival roughly in half Wednesday and said it could potentially go to zero. Carnival shares were down more than 2% Thursday. Royal Caribbean and Norwegian Cruise Line each fell more than 3%.

Home retail stocks were down, too. High-end furniture chain RH saw shares drop about 10.6% after it issued a profit warning for the full year. Wayfair and Williams-Sonoma fell roughly 9.6% and 4.4%, respectively.

Inflation and the economy

The core personal consumption expenditures price index, the Fed’s preferred inflation measure, rose 4.7% in May, the Commerce Department reported Thursday. That’s 0.2 percentage points less than the month before, but still around levels last seen in the 1980s. The index was expected to show a year-over-year increase of 4.8% for May, according to Dow Jones.

The Chicago PMI, which tracks business activity in the region, came in at 56 in June, slightly below a StreetAccount estimate of 58.3.

The Federal Reserve has taken aggressive action to try and bring down rampant inflation, which has surged to a 40-year high.

Federal Reserve Bank of Cleveland President Loretta Mester told CNBC Wednesday that she supports a 75 basis point hike at the central bank’s upcoming July meeting if current economic conditions persist. Earlier in June, the Fed raised its benchmark interest rate by three-quarters of a percentage point, the largest increase since 1994.

Stock picks and investing trends from CNBC Pro:

- Is the bear market coming to an end? Here’s one indicator pros say to watch closely

- Goldman says investors may be missing ‘rapid’ growth in chip stocks — and gives 2 over 70% upside

- Recession stars: The best stocks in every industry during economic downturns

- Cathie Wood explains her bear market strategy, slashes portfolio to just 34 holdings

- Some Wall Street watchers are worried that too-aggressive action will tip the economy into a recession.

- “We do not believe the stock market has bottomed yet and we see further downside ahead. Investors should be holding elevated levels of cash right now,” said George Ball, chairman of Sanders Morris Harris. “We see the S&P 500 bottoming at around 3,100, as the Federal Reserve’s aggressive, but necessary inflation-fighting measures are likely to depress corporate earnings and push stocks lower.”

“The markets are going to price in the recession before the recession actually happens and that’s what you need to focus on as an investor,” she told CNBC’s “Power Lunch” Thursday. “When you have a period like now where the markets are down more than 15% in the first half of the year, which has happened a couple times in history, they tend to have a really good second half of the year by an average of about 24%.”

However, Lang said that in this current downturn, the Fed is less likely to step in with easy policy to help limit big losses in equities — which has been known since the days of former Fed Chair Alan Greenspan as “the Fed put” — than it has been in the past.

“Inflation is going to persist for a while, so it’s our expectation that the Fed will stay full steam ahead and you won’t have that Fed put that we’ve seen in every other big sell-off in the last decade plus,” she said.