Date: 2024-11-22 Page is: DBtxt003.php txt00022748

US CONVENTIONAL ECONOMIC METRICS

FAST / INCOMPLETE

CNBC ... Dow falls 142 points as Wall Street weighs more aggressive Fed, disappointing bank earnings

FAST / INCOMPLETE

CNBC ... Dow falls 142 points as Wall Street weighs more aggressive Fed, disappointing bank earnings

Original article: https://www.cnbc.com/2022/07/13/stock-futures-slip-after-wednesdays-session-as-wall-street-awaits-bank-earnings.html

Peter Burgess COMMENTARY

The media has a huge role in setting the tone of any country, and indeed, the world dialog. Of course, the media is segmented and specialized in order to appeal to its 'customers' who consume its products and the 'owners' who want to maximise revenues from engagement.

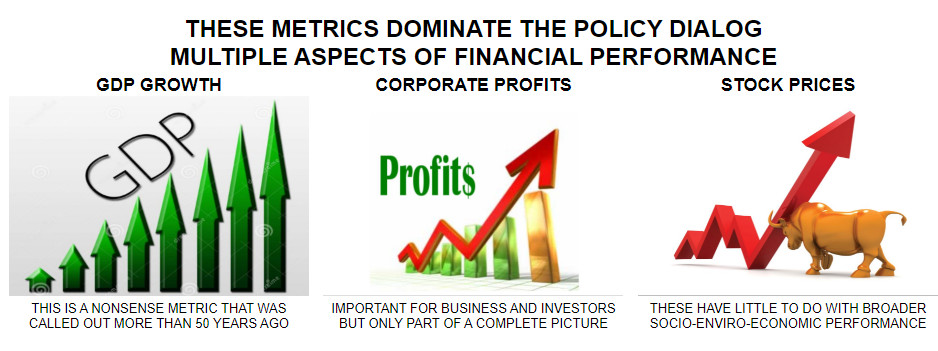

Investors, and those interested in business and economic performance get a very limited news flow from mainstream media. It annoys me that aggregate economic performance is still measured using GDP as the primary metric when it was already considered an unsatisfactory metric when I was an economics student more than 60 years ago. I am of the view that this is intentional, and serves to confuse the public and politicians who then become more emenable to business friendly policy choices.

The role of profits as a business performance metric has a long history, and certainly should be one of the key metrics for business performance. It is amazing that about 150 years after profit performance became subject to government oversight and regulation as to how it should be accounted for and reported that there is nothing like it for social performance and environmental performance, both of which have immense impact of quality of life and sustainability in the broadest sense. Again this in intentional. Those with a vested interest ... that is investment ... in the profit performance of business know that if social impact and environmental impact are taken into consideration in business decision making that profit performance will decline together with stock price valuation.

I have called what has been going on in the modern socio-enviro-economic system for the last 40 years as 'financialization' where decision making is being 'gamed' in order to maximize investment performance for the owners of investment. A certain amount of optimization for financial performance is perfectly reasonable, but what exists today in most large companies ... and many not-so-large companies is profit maximization at any cost. That means that there is little or no consideration of social or environmental impact, not indeed, much consideration of the impact of the company's actions on issues of national interest, especially by very large multi-national companies which optimize for owners and no longer give much consideration to any interest related to their national origin or to geopolitical security matters.

I have argued since the 1980s that companies have been ignoring a lot of consequential long term risks in structuring companies for maximum (short term) profit. My view is that many companies and nations are going to be faced with costs that will change valuations in ways that have not been seen since the 1930s about a hundred years ago. The sort of 'shake-up' that I am expecting will do a lot of damage to 'investment portfolios' but can have a major benefit for most everyone else as long as those with control of the levers of power understand the positive potential of how the modern socio-enviro-economic system actually works.

Peter Burgess

Written by Samantha Subin @SAMANTHA_SUBIN and Carmen Reinicke @CSREINICKE

PUBLISHED WED, JUL 13 2022 6:04 PM EDT ... UPDATED THU, JUL 14 2022 5:58 PM EDT

Stocks slipped Thursday as big bank earnings kicked off with disappointing results and traders assessed the possibility of even tighter U.S. monetary policy from the Federal Reserve as recessionary fears lingered.

The Dow Jones Industrial Average shed 0.46%, or 142.62 points, to 30,630.17, while the S&P 500 dipped 0.3% to 3,790.38. The Nasdaq Composite inched 0.03% higher to finish at 11,251.19.

Stocks closed in negative territory but well off their lows. At one point, the Dow plummeted as much as 628 points while the Nasdaq and S&P 500 fell more than 2% each. Equities were on track to close out the week in negative territory.

“If the banks are a barometer of the whole economy as well as what we’re likely to get from other earnings reports going forward, it’s going to be an ugly quarter,” said Sam Stovall, chief investment strategist at CFRA.

Earnings results from major banks on Thursday offered further clues into the health of the U.S. economy fears of a recession loom.

JPMorgan Chase shares sank 3.5% after the bank added to reserves for bad loans and halted its share buybacks, signaling a more cautious economic outlook. As profits dipped, CEO Jamie Dimon warned that the economy could take a hit from surging inflation, geopolitical tensions and dwindling consumer confidence “sometime down the road.”

Continuing the trend, Morgan Stanley shares slipped about 0.4% on the back of a sharp decline in investment banking revenue, while Goldman Sachs, which is set to report earnings Monday, fell nearly 3%. Earnings from big banks continue on Friday with results from Wells Fargo and Citigroup, which dropped 0.8% and about 3%, respectively, during Thursday’s session.

The results from banks raised further concerns that earnings estimates have perhaps risen too much in recent months. How much those numbers decline depends on the state of the economy and how hard a recession hits when and if it strikes, said Bob Doll, chief investment officer at Crossmark Global Investments.

“The market is finally concerned about the fact that estimates, having gone up almost nonstop during the first half of this year, are going to be under some pressure, and of course today’s culprit is JPMorgan,” he said. “How can corporate America, in the wake of a slowing economy and cost pressures have the earnings that have been expected by the consensus. Those numbers have to come down.”

Declines from JPMorgan, Goldman Sachs and American Express led the Dow’s losses on Thursday, while energy, materials and financials were among the S&P 500′s worst-performing sectors. Mosaic shares tumbled 5.7%, while energy companies Halliburton, Diamondback Energy and EOG Resources fell more than 3% each.

Big tech stocks were mixed on Thursday, with information technology up nearly 1%. Shares of Apple added 2%, and Nvidia gained more than 1%. Meta Platforms and Salesforce slipped.

“We think more equity downside is likely, primarily because earnings expectations are too high,” wrote Citi’s Jamie Fahy.

Thursday’s market moves come after the consumer price index for June came in hot at 9.1% and opened the door for a big Federal Reserve rate increase later this month, spurring speculation of a Fed rate hike of as much as 100 basis points.

Comments from Federal Reserve Governor Christopher Waller on Thursday alleviated some of those fears as he said he’s prepared to consider a bigger hike, but the market “is kind of getting ahead of itself.”

“The takeaway for investors is that Fed policy remains data-dependent and the central bank will continue on an aggressive tightening path until inflationary pressures peak decisively,” strategists at BCA Research wrote in a note. “Persistent price pressures call for another jumbo hike at the July 26-27 FOMC, but there is still room for the data to improve before the September meeting, 8 weeks later.”

Volatile oil prices also dropped on Thursday, with West Texas Intermediate crude hitting its lowest level since February.

Meanwhile, June’s producer price index report, which measures prices paid to producers of goods and services, showed wholesale prices rise 11.3% versus a year ago last month as energy prices jumped and offered further insights into the pressure from inflation.

Lea la cobertura del mercado de hoy en español aquí.

TRENDING NOW

Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., June 30, 2022.

Dow futures jump 300 points after better-than-expected retail sales, Citigroup pops following earnings

93% of employers want to see soft skills on your resume—here are 8 of the most in-demand ones

Jamie Dimon, chief executive officer of JPMorgan Chase & Co. JPMorgan CEO Dimon sums up U.S. economy in one paragraph — and it sounds bad