Date: 2024-07-17 Page is: DBtxt003.php txt00023850

ACCOUNTANCY

DUE DILIGENCE

Reuters: U.S. securities regulator probes FTX investors' due diligence sources

DUE DILIGENCE

Reuters: U.S. securities regulator probes FTX investors' due diligence sources

Illustration shows FTX logo and representation of cryptocurrencies ... [1/2] An FTX logo and a representation of cryptocurrencies are seen through broken glass in this illustration taken December 13, 2022. REUTERS/Dado Ruvic/Illustration/File Photo

Original article: https://www.reuters.com/technology/us-securities-regulator-probes-ftx-investors-due-diligence-sources-2023-01-05/

Peter Burgess COMMENTARY

This article got my attention. As soon as FTX got into the general news it struck me that a lot of well known investment funds had put money into FTX. As an old guy who trained in accountancy ... Chartered Accountancy ... in London in the early 1960s, it seemed to me to be a 'no-brainer' that these organizations had done little or no 'due diligence' regarding the outfit they were investing in.

My issues with the financial community are deep and many ... not least of which is the number of 'traders' whose education seems to be unbelievably superficial. Certainly there are a some traders and investors who understand markets and serve a very important purpose in the financial markets, but many are simply gamblers. As far as I am concerned, the big financial companies like Black Rock and others that have invested in FTX don't seem to have done any meaningful due diligence and their feet should be held to the fire.

Early in career as an independent consultant in the early 1980s I participated in some of the work that was needed to be done for a company to 'go public'. I applied what I had learned a couple of decades before in London in connection with the due diligence work required for a listing on the London Stock Exchange. My work was not appreciated ... the other members of the consulting team did in one minute what should more reasonably have taken an hour ... they simply filled in the boxes and that was the beginning and end of the dilligence. FTX should be a wake up call for the accountancy profession that seems to have lowered its standards so much that standards have become meaningless.

Peter Burgess

U.S. securities regulator probes FTX investors' due diligence sources

By Chris Prentice

January 6, 2023 12:59 AM EST

NEW YORK, Jan 5 (Reuters) - The U.S. Securities and Exchange Commission (SEC) is seeking details about FTX investors' due diligence, according to two sources familiar with the inquiry, as fallout from the crypto firm's collapse spreads.

The SEC has so far brought charges against three of FTX's top executives, accusing them defrauding investors in the crypto trading platform that has since filed for bankruptcy.

The SEC is now asking financial firms what diligence policies and procedures they have in place, if any, and whether they followed them when choosing to invest in FTX, the sources said.

Reuters was not able to determine how many firms were fielding such queries from the regulator. The SEC has alleged the Bahamas-based crypto exchange raised more than $1.8 billion from equity investors, including 90 U.S.-based investors, since May 2019.

The SEC inquiries do not indicate wrongdoing and Reuters could not ascertain if the firms are targets of the probe. But the sources said the SEC inquiries may mean the venture capital firms and investment funds that invested in FTX could face regulatory scrutiny even if they are considered victims of Bankman-Fried's alleged scheme. At issue would be whether the firms met their fiduciary duties to their own investors, they said.

Reuters and others previously reported that U.S. authorities sent document requests to investors and potential investors in FTX, seeking details on their communications with FTX officials.

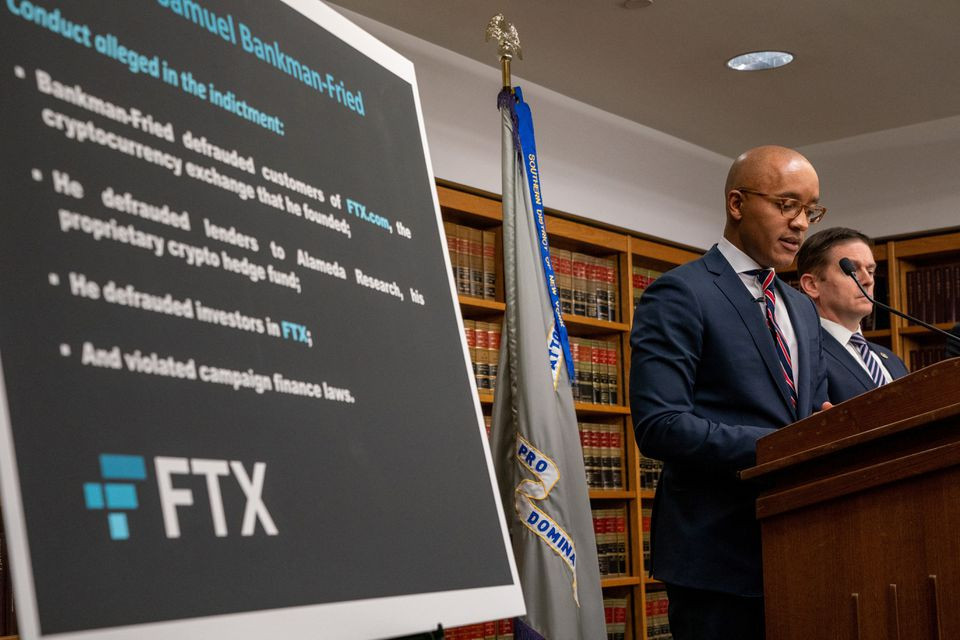

U.S. attorney Damian Williams speaks to the media regarding the indictment of Samuel Bankman-Fried the founder of failed crypto exchange FTX in New York City, U.S., December 13, 2022. REUTERS/David 'Dee' Delgado/File Photo

Those inquiries predated last month's SEC charges against FTX founder Sam Bankman-Fried for allegedly defrauding such investors. The SEC's inquiries to investors have continued after SEC filed those charges, and the agency has now shifted its focus to the firms' diligence, the sources said.

A spokesperson for the SEC declined to comment.

FTX, once deemed a white knight for the crypto industry, crumbled in less than a fortnight due to a liquidity crunch. FTX filed for bankruptcy in November amid what its new CEO later described as a 'complete failure of corporate controls'.

The SEC as well as the Justice Department and Commodity Futures Trading Commission have filed fraud charges against FTX founder and former CEO Sam Bankman-Fried. On Tuesday, he pleaded not guilty to criminal charges including wire fraud and money laundering on Tuesday.

Two former top associates, former Alameda chief executive Caroline Ellison and former FTX chief technology officer Gary Wang, have both pleaded guilty.

Reporting by Chris Prentice and Krystal Hu; editing by Megan Davies and Anna Driver

Latest Updates

- Samsung's quarterly profit plunges to 8-year low on demand slump

- Qualcomm, Iridium partner to bring satellite-based messaging to Android phones

- Google Cloud to support Kuwait's digitisation drive

- Carmaker Stellantis creates new data services business

- South Korea's SK On plans a new, lower cost EV battery by 2025