Date: 2025-04-05 Page is: DBtxt003.php txt00025620

US ELECTION

FROM THE UK TELEGRAPH NEWSPAPER

The bond markets will doom Biden to defeat ... America is heading

into a recession – voters rarely reward leaders for negative growth

FROM THE UK TELEGRAPH NEWSPAPER

The bond markets will doom Biden to defeat ... America is heading

into a recession – voters rarely reward leaders for negative growth

President Biden inherited an economy that was recovering but has since

embarked on a massive spending spree leading to colossal deficits

CREDIT: Kevin Dietsch/Getty Images North America

Original article: https://www.telegraph.co.uk/business/2023/10/07/bond-markets-doom-joe-biden-us-presidential-elections/

Peter Burgess COMMENTARY

I have read this article with considerable interest but vehemently disagree with the writer's conclusions.

When looked at through a financial sector perspective some of the Trump era policies were favorable but were associated with multiple bad policies that did serious damage to both the economy and US relations with the world.

The Biden administration has done a spectacular job of getting the USA back on track after four years of the worst American President ever ... and vindictive man who is still at large and likely to be even worse if he gets into office again!

The Biden administration has made significant progress in the longer term upgrade of the American economy including long overdue investment in the country's infrastructure and reinvigorating the country's industrial base ... programs that are more consequential than what was done in the Eisenhower, Kennedy and Johnson administrations.

The writer of this article clearly has concern that there will be some financial stress in the United States as the USA and the world has to address the financial implications of a more realistic interest rate regime than the one that has been used for a long time in recent years. There may be some stress in the financial sector in the near terim future, but the broader economy is likely to be much stronger.

I would love to know more about the author of this article ... especially where he learned his economics and any finance education that he has had!

Peter Burgess

America is heading into a recession – voters rarely reward leaders for negative growth

Written by Matthew Lynn

7 October 2023 • 6:00am

President Joe Biden inherited an economy that was recovering but has since embarked on a massive spending spree leading to colossal deficits

He is too old. Inflation has been too high. And his party has drifted too far left. There are lots of reasons why President Joe Biden’s bid for re-election next year is already in trouble.

But the real problem is this, even though it is not yet being widely discussed: the bond market.

The huge spike in yields witnessed over the last few weeks means the market is now predicting a recession next year. And no sitting President has been voted back into office while the economy is shrinking since 1900 with one exception.

It may not matter whether he begins delivering great speeches, or faces a weak Republican candidate – the bond markets have already killed Biden’s chances of a second term.

With a year to go before the election, it might seem premature to speculate on who will win the White House in 2024. The polls are not clear cut and we don’t yet know who will be the Republican nominee, even if momentum does appear to be firmly behind Donald Trump.

There are too many unanswered questions to make any predictions.

But we can perhaps predict this: after the turbulence in the financial markets of the last couple of weeks the United States could be heading into a recession.

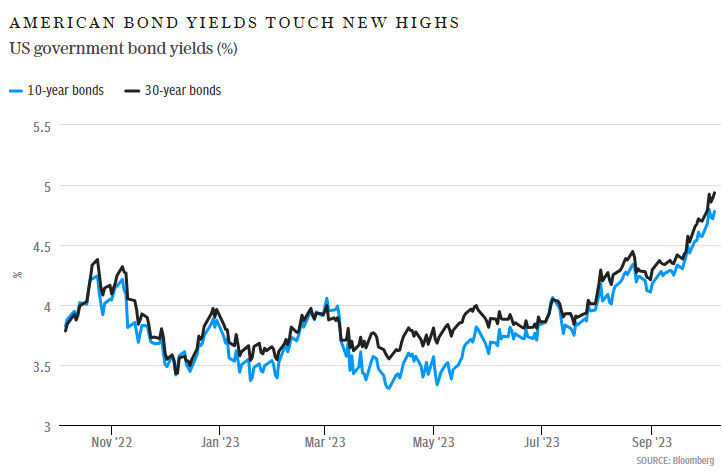

Last week, the yield on 10-year US government bonds hit 4.88pc, the highest level since before the 2008/2009 financial crisis. The “yield curve” has inverted, meaning that shorter dated bonds yield less than longer ones, a shift that on Wall Street is seen as the surest possible indicator that a recession is looming.

American bond yields touch new highs

The Bloomberg model predicts that the chances of a recession in the US next year are now more than 50pc, while 48pc of Wall Street economists, who as a general rule are far too optimistic, have a downturn in American GDP as their central forecast for the next twelve months.

Nothing is ever completely guaranteed. But a recession now looks more likely than not.

There is no great mystery about why that is happening.

Since the US inflation rate spiked at 9.1pc, the Fed chairperson Jerome Powell has shown his determination to raise interest rates to whatever level is necessary to bring that back under control, and to hold rates for “higher and longer” until prices moderate again.

Higher interest rates create a recession and that brings prices down again. Even if the Fed pauses on rate hikes now, the rise in bond yields will take six months to feed through into demand. By next spring, output will be falling. It could be a shallow recession or a deep one. We may find out soon enough.

It is the impact on the Presidential campaign next year that will surely be worrying Biden’s strategists. Voters rarely reward leaders who deliver negative growth.

The last President to win reelection after a recession in the final two years of their first term was William McKinley back in 1900 (he was assassinated the following year). In the years since then, William Taft was defeated in 1912, Herbert Hoover in 1930, Jimmy Carter in 1980, and George HW Bush in 1992.

There are Presidents who have been elected during an economic crisis, such as Barack Obama, and won reelection. And there are Presidents, such as Donald Trump, who have been defeated even when the economy is doing fine. But there are very few who inherit a growing economy, and are voted back into office when it is shrinking.

How much blame can be laid at Biden’s door? He took over an economy that was recovering at a respectable rate from the Covid pandemic.

Whatever his other faults, Trump’s deregulation, investment zones and significant cuts in corporate taxes had boosted American competitiveness. It was a strong economic legacy.

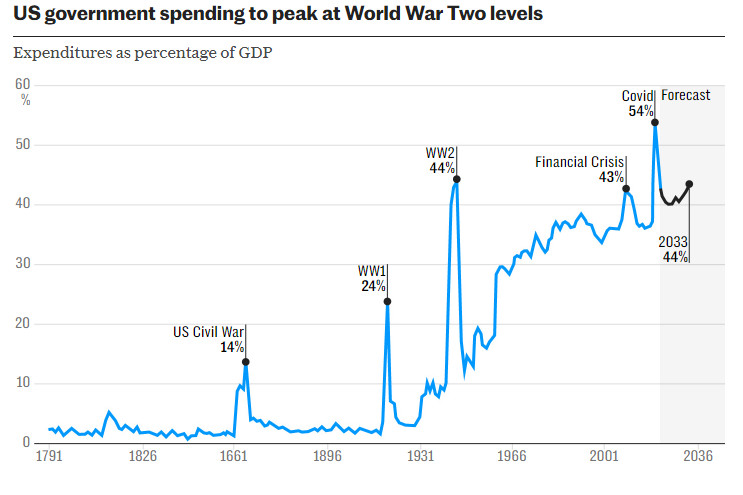

Yet, rather than preserve a steady recovery, Biden embarked on the biggest experiment in state-led capitalism since the 1930s, spending what might turn out to be more than $1 trillion on a “green industrial strategy” and running colossal deficits.

The result? A rise in inflation and a Fed left pushing interest rates much higher. It was curious, too, that Biden and his team did not kick some spending plans into the second half of his term or even later, so that rates would only rise after he was re-elected.

With a year to go, and against a likely candidate who was defeated last time around, President Biden is already trailing in some polls. And that is now, with an economy that is still growing and wages rising.

The outlook could be much gloomier a few months from now. Politicians rarely learn from history, but in this case, it indicates Biden won’t be re-elected – and he may have few people to blame.