Date: 2025-01-15 Page is: DBtxt003.php txt00026464

BOEING

SPECULATION ABOUT A NEW CEO

NYT: Two Boeing CEOs are better than one ... Written by Brooke Sutherland

SPECULATION ABOUT A NEW CEO

NYT: Two Boeing CEOs are better than one ... Written by Brooke Sutherland

Original article: https://www.bloomberg.com/news/newsletters/2024-03-27/boeing-ba-ceo-change-amid-737-max-crisis-opens-door-to-two-successors

Peter Burgess COMMENTARY

Peter Burgess

Written by Brooke Sutherland

March 27th 2024 ... 10:31 AM

Hello! I know I said no newsletter this week but Boeing had other plans. Please enjoy this special edition of Industrial Strength. I’ll be back with your regularly scheduled programming on Friday, April 5. Have thoughts or feedback? Anything I missed this week?

There aren’t many obvious candidates that have both the gravitas and manufacturing expertise necessary to lead Boeing Co. through its current crisis. It might be a two-person job.

The planemaker on Monday announced a sweeping leadership overhaul that includes the departure of Chief Executive Officer Dave Calhoun by the end of this year. It’s a long overdue but necessary acknowledgement that the midair 737 Max blowout on a January Alaska Airlines flight wasn’t a one-off glitch but a symptom of broader cultural challenges. Boeing needs a deep-rooted overhaul, and that wasn’t likely to happen under a CEO who had repeatedly pushed back against the “premise” of questions about the startling persistence of its quality-control failures. There’s a time lag to this accountability moment, however. It’s only March after all, and the end of the year is a long way away.

There’s only so much management change a company can pack into one go without creating chaos. Chairman Larry Kellner won’t stand for re-election at Boeing’s annual meeting, which typically happens in April, and Stan Deal, the head of Boeing’s commercial airplanes division, has retired, effective immediately. He will be replaced by Chief Operating Officer Stephanie Pope, a long-time Boeing executive who previously served as chief financial officer for the commercial airplanes division. But there’s also a practical reason to keep Calhoun around awhile longer: The company doesn’t yet have someone lined up to replace him.

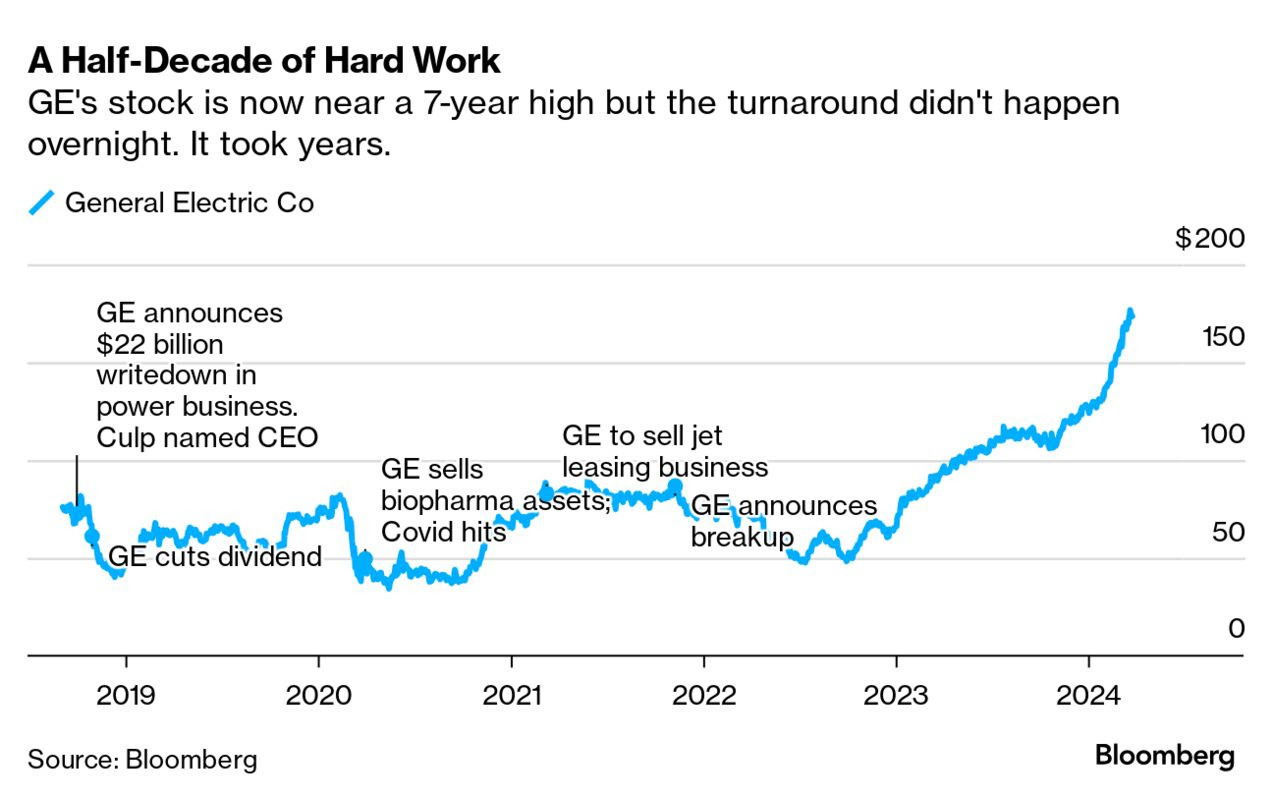

If Boeing is looking for one person to fill Calhoun's shoes, the most obvious choice would be General Electric Co. CEO Larry Culp. When Culp took on the top job in 2018, GE was arguably in even worse shape than Boeing because of a gargantuan debt load that well surpassed the company’s ability to wring out cash from its operations. Culp paid down the debt — more than $100 billion of it — through a series of well-timed divestitures. But more importantly, he systematically improved GE’s manufacturing operations, process by process and detail by detail, and replaced the company’s infamous arrogance with a culture of humility and transparency. His name means something to investors: “In industrial land, there aren’t too many people that really have the ability to take a business that’s operating subpar and improve the margins without structurally impairing the business,” David Giroux, a portfolio manager and chief investment officer of T. Rowe Price Investment Management, said in a February interview.

There’s a lot of shared management and history between the old GE and Boeing. Calhoun himself spent several decades there in the Jack Welch and Jeff Immelt eras and practically embodies the GE mentality that its top managers can run any business, with stints overseeing the transportation, lighting, jet engine, reinsurance and broader infrastructure operations, among others. If Culp can fix GE’s culture problems, he can fix Boeing’s — and would likely be handsomely compensated for his efforts. But Culp is already on track to pocket a one-time equity award worth about $350 million on today’s prices for his work at GE, according to the company’s proxy filing. Having orchestrated one major turnaround of an American industrial icon, it’s not clear he’s in the market for another fixer-upper. When asked in a February interview about the Boeing CEO role, Culp said he was “looking forward to serving Boeing as their most important partner and supplier.” GE had no additional comment Monday.

Next week, GE will complete the final piece of its slow-moving breakup when it spins off the GE Vernova energy assets, leaving Culp in charge of a business that essentially just makes jet engines. That kind of operational focus is itself a new challenge for Culp, who previously ran Danaher Corp., back when it was still a sprawling industrial giant in its own right. Culp turned down the GE job twice before agreeing to do it. He says he joined the GE board in 2018 “because I thought I could actually be helpful to John Flannery” — his predecessor as CEO who was ousted later that same year — and because the company had recently moved its headquarters to Boston. Culp was already in the area, working as a senior lecturer at Harvard Business School. “I thought I could maintain my Boston life,” Culp said. “I really wasn’t looking for a job.” GE Aerospace will be based in Cincinnati after the breakup.

Never say never, but if Culp isn’t interested, the list of comparable successors to Calhoun at Boeing is remarkably short. Dave Gitlin is on Boeing’s board and previously oversaw the commercial aerospace operations of RTX Corp. before becoming CEO of that company’s Carrier Global Corp. climate-control spinoff, but he doesn’t have quite the wow factor that a Culp hire would. The same goes for other Boeing board members with aerospace manufacturing qualifications, including Akhil Johri, the former United Technologies chief financial officer, and David Joyce, who oversaw GE’s aerospace business for more than a decade, mostly under former CEO Immelt.

Pope, the new head of Boeing’s commercial aerospace division, remains in the running for the top job, Bloomberg News reported, citing a person familiar with the matter. But her almost three-decade long career at the planemaker may make her too much of an insider for shareholders’ liking. Darius Adamczyk, the recently retired CEO and current chairman of avionics and auxiliary power unit manufacturer Honeywell International Inc., has the right industrial expertise and engineering background and is only 58, but an analyst once described him as “an informed, dispassionate, cerebral technocrat.” It was meant as a compliment but that’s perhaps not the right personality to soothe the flying public and smooth over relations with Boeing’s frustrated regulators and customers. Through a Honeywell spokesperson, Adamczyk declined to comment on the Boeing CEO job.

One alternative would be to pair up a charismatic aerospace heavyweight, say United Airlines Holdings Inc. CEO Scott Kirby, with a top-notch manufacturing operator. That would allow Boeing to look further afield from its immediate aerospace backyard to other well-respected industrial leaders — such as Fortive Corp.’s Jim Lico or Ingersoll Rand Inc.’s Vicente Reynal. Both are Danaher alumni and are just as steeped as Culp in lean manufacturing principles, including the pursuit of continuous improvement and a fundamental aversion to inefficiencies and defects. Lico declined to comment. Reynal, in an interview, said there’s “plenty of work to be done” at Ingersoll Rand, even after an almost 400% rally in the company’s stock price since the 2017 IPO of predecessor Gardner Denver. Reynal is also on the board of American Airlines Group Inc. United had no comment.

Dual CEOs are rare. A Harvard Business Review analysis found that fewer than 100 companies among the 2,200 listed on the S&P 1200 and the Russell 1000 from 1996 to 2020 were led by co-chief executives. There’s a perception that two heads can actually be worse than one in the C-Suite because there are competing priorities and egos. But the HBR analysis, published in 2022, found that companies led by dual CEOs generated higher average annual shareholder returns than the relevant comparable index.

Among the benefits of dual CEOs is the ability to merge two different skillsets and the option to have a leader in two places at once — say, Seattle, where Boeing’s 737 operations are still based, and the Washington, DC, home of its regulator and top defense customer. The model works particularly well for technology transformations, according to the HBR study. That may be an overly generous description of the reboot that’s needed at Boeing but this is, at heart, a company that makes incredible technology, even if it hasn’t been able to do that reliably of late.

“This may be the first real chance, in a long time, Boeing has had to clean house and reset their own narrative,” Bank of America Corp. analyst Ron Epstein wrote in a note this week. A true reset requires the right leader, and in Boeing’s case, the right leader may be two CEOs.

Bonus Reading

- Baltimore bridge collapse tests supply chains anew

- US regulators mull drastic curbs on United Airlines after safety incidents

- Cocoa price surge risks chaotic markets, trouble for trading firms

- Biden’s $6 billion plan to decarbonize heavy manufacturing will pay off

- US cotton demand is on an unrelenting — and accelerating — decline