Date: 2025-01-06 Page is: DBtxt003.php txt00027728

GLOBAL ECONOMY

BLOOMBERG INFORMATION ... NOVEMBER 27TH 2024

More turmoil than clarity in economic

reporting by Bloomberg and everyone else!

BLOOMBERG INFORMATION ... NOVEMBER 27TH 2024

More turmoil than clarity in economic

reporting by Bloomberg and everyone else!

Original article: https://mail.google.com/mail/u/0/#search/SAW/FMfcgzQXKNKwJRxWrpJClGqPzTbwDxnM

Peter Burgess COMMENTARY

I lived in Manhattan a few blocks away from the Bloomberg headquarters on the Upper East Side. In fact, for several months my little business was housed in a suite that was part of their headquarters complex. Fof some reason, they ... I cannot remember actually 'who' ... took a liking to what I was doing and provided some material help!. This was probably some time during the 1990s when I was accelerating my work towards 'better metrics' and seeking corporate collaboration that I was never able to mobilize!

Over the years I have attended a lot of 'events' hosted in the Bloomberg headquarters building. Many of these were 'worth-while' initiatives, others more self-serving! My big disappointment with the Bloomberg media empire is that its focus seems to have bcome more 'narrow' over time rather than becoming more complete. In other words, its central focus has become more and more about corporate 'success' ... that is profit performance and investor success ... and less about a more balanced approach along the lines of TVM which embraces, people (society / social), environment (nature) and economy (money / investment / technology / business).

I don't know Mike Bloomberg personally, but he seems to be a very decent human being and highly competent in a variety if fields ... both business and political, and a variety of sectors. My impression is that he made a big positive contribution to governance as Mayor of the City of New York. I think Johns Hopkins University is lucky to have Mike Bloomberg as a benefactor!

Imagine how much better it would be if Mike Bloomberg was the President-Elect and not Donald Trump

Presently, I don't get much of my 'news' directly from the Bloomberg media ecosystem ... much of which is behind a variety of 'paywalls' ... and the focus is more about corporate profit than I consider 'healthy' ... but I still think that the Bloomberg organization is among the best there is in the media space at the present time!

Peter Burgess

I’m Chris Anstey, an economics editor in Boston, and today we’re looking at the intentions behind the president-elect’s tariff threat. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics.

Top Stories

- President-elect Donald Trump named Kevin Hassett to direct the National Economic Council and Jamieson Greer as the US Trade Representative.

- A senior European Central Bank official said colleagues should be wary of cutting interest rates too far, as they’re already near a level that no longer restrains growth.

- Federal Reserve officials indicated broad support for a careful approach to future easing, minutes from their latest policy meeting showed.

With Donald Trump leading in the polls ahead of the election, policymakers in Seoul were coming up with a game-plan. If Trump wins and threatens tariffs, then South Korea — which has the seventh-largest trade surplus with the US — could ramp up imports of American energy.

It would be a win-win: Korea could avoid tariffs, the trade imbalance might come down. European Commission President Ursula von der Leyen similarly pitched to Trump directly, after his victory, buying more US liquefied natural gas. In Mexico City, officials have been working to curb some Chinese imports to avert criticism that their nation was serving as a conduit for China goods to enter the American market.

One thing in common with all those approaches: they speak to economics. And, thinking back to Trump’s first term, that might have made sense. His escalatory rounds of tariffs on China came in the run-up to a Phase One trade agreement. He slapped levies on washing machines to aid US manufacturers.

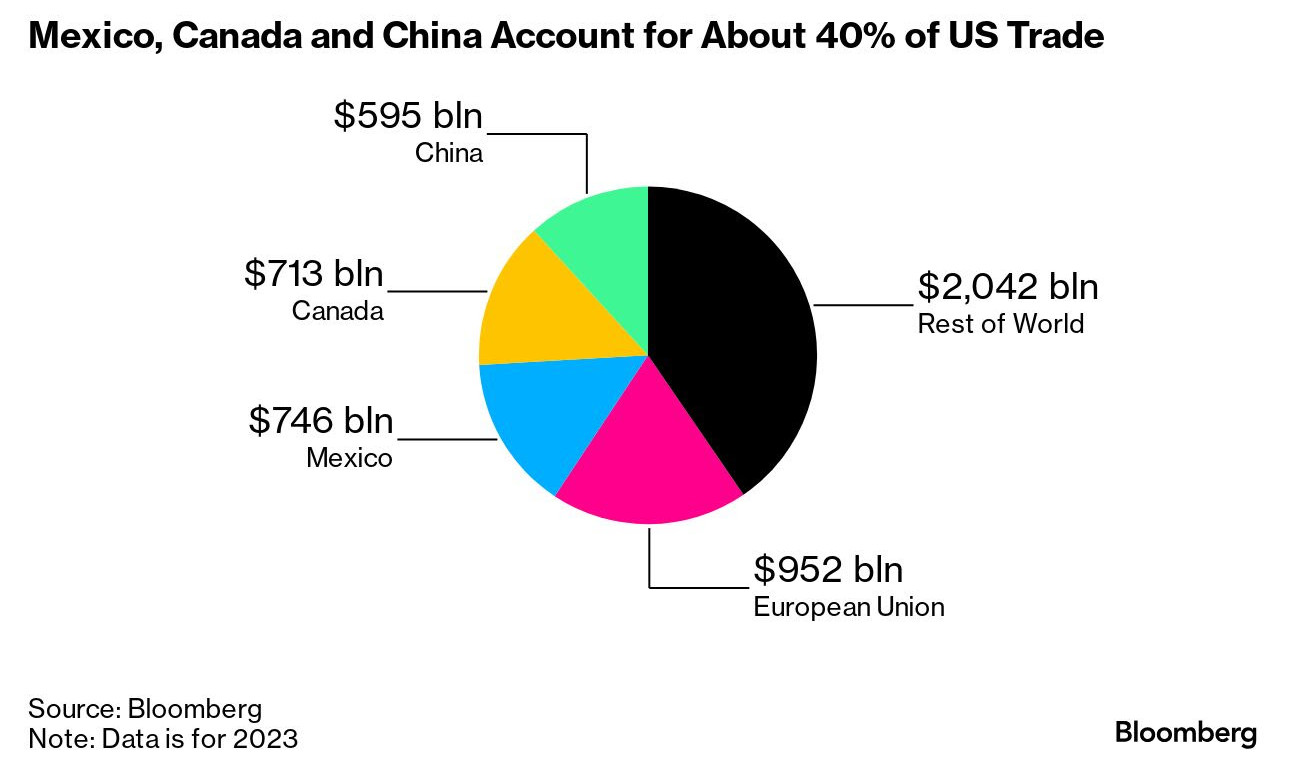

Trouble is, Trump’s Monday evening bombshell announcement of tariffs on the top three sources of US imports — Mexico, China and Canada — were tied to nothing economic. The measures, to be set in an executive order when Trump takes office Jan. 20, were cast as necessary to clamp down on migrants and illegal drugs flowing across borders.

The 25% tariff hike on the two North American trade partners, and 10% bump for China wasn’t tied to economic competition. So, “tariffs are no longer just a trade issue; it is a security and health issue,” Stephen Jen, chief executive at Eurizon SLJ Capital, wrote in a note.

That shouldn’t come entirely as a surprise: after all, as president Trump in 2019 unveiled border-related tariff-hike threats on Mexico, though they didn’t get imposed.

But it may suggest that US trading partners need to look well beyond simple purchases of American resources or limits on Chinese companies in international supply chains.

Trump’s pick for Treasury secretary, Scott Bessent — viewed by many market participants as a likely voice of caution on tariffs — has embraced linking trade with foreign policy. In a column in the Economist last month, Bessent argued for nothing less than a remaking of the international trading system.

He envisioned a core of nations that get US security assurances — presumably including western Europe, Japan and Korea — being given access to American markets in return for spending more on “our collective security” and structuring their economies “in ways that reduce imbalances over time.” He argued countries like Germany need to boost their demand.

“Countries could move closer to or further from the center of this system of relationships based on their revealed preferences,” Bessent said.

As for Jamieson Greer, who’s been nominated as the US Trade Representative, he sees China as a “generational challenge” to the US and has advocated for a strategic decoupling from the country.

“There is no silver bullet, and in some cases the effort to pursue strategic decoupling from China will cause short-term pain,” he said in May testimony before the US-China Economic and Security Review Commission, “However, the cost of doing nothing or underestimating the threat posed by China is far greater.”

Which all speaks to going way beyond an extra order of LNG or agricultural products to placate Trump and his incoming tariff hawks this time around.

Read about Canada and Mexico’s response to the opening tariff salvo here and China’s options here.

The Best of Bloomberg Economics

- America’s inflation-battered consumers are going to extreme lengths to nab holiday deals, from buying less to gifting secondhand items.

- New Zealand’s central bank chief said a third large rate cut could arrive in early 2025 if the economy evolves as expected, after easing policy today.

- A measure of French bond risk rose to levels last seen during the euro-area debt crisis as a political standoff over the budget threatens the government.

- China’s industrial firms saw profits decline for the third straight month amid worsening producer price deflation and sluggish factory output.

- Australia’s core inflation remained elevated. Meanwhile Goldman Sachs is making a contrarian case for a steep slowdown in South African consumer price growth.

- Bank of England Deputy Governor Clare Lombardelli said she needs to see more evidence of cooling price pressures before she backs another rate cut.

Immigration may stoke only slightly less ire than inflation among a segment of electorates across the developed world, but Germany’s economy needs more of it nonetheless if it wants to sustain its labor force.

That’s according to Bertelsmann Stiftung. The independent research group estimated in a report this week that Germany needs an annual influx of 288,000 workers — and that’s in a scenario assuming an increase in existing female and older-generation residents’ labor force participation rate.

If those assumptions don’t materialize, as many as 368,000 migrants may be needed to keep the labor force from shrinking substantially and crippling German growth, the group said. Over the decade through 2023, which included immigration spikes due to wars in Syria and Ukraine, net migration averaged about 600,000. The prior decade saw an average influx of about 136,000.

Plus, here are some newsletters we think you might like

- Supply Lines for daily insights into supply chains and global trade

- Balance of Power for the latest in politics from around the globe

- CityLab Daily for the latest on America’s municipalities and more

731 Lexington Avenue, New York, NY 10022