Date: 2025-04-03 Page is: DBtxt003.php L0700-MR-GDP

MANAGEMENT REPORTING

GDP

Gross Domestic Product

Talked about all the time, but not well understood, even by the experts!

GDP

Gross Domestic Product

Talked about all the time, but not well understood, even by the experts!

| HOME | SiteNav | Alpha | Chrono | Briefs | SEES | capitals | activities | actors | place | products | SI | SS | metrics | TPB |

| . |

|

|

Peter Burgess COMMENTARY Why is it that GDP is still one of the dominant metrics in modern economics? The fundamental flaws in GDP as a meaningful measure for economic performance were recognised many decades ago. Kuznets who developed the measure in the United States and Keynes understood the limitations before the Second World War! Kuznets and Robert Kennedy both spoke out about the flaws in the GDP metric in the 1960s. Sowhy did nothing get changed. My experience as a corporate CFO may be helpful. It was so much easier to increase profts for stockholders in an environment of economic growth ... that is GDP growth ... than in one where the economy was stagnant ... that is no growth! In the late 1960s there was a lot of growth, but in the early 1970s the bubble burst and then worse, the OPEC oil shock that resulted in massive increase in energy costs for US companies that had become incredibly sloppy with their use of really cheap energy. Many companies got into serious financial difficulties and the Nixon / Ford / Carter series of administations in Washington were unable to make much difference. It is my view that corporate thought leaders have had some role in promulgating the myth that economic growth is essential for profit growth. This has been copied by economists and political leaders who then conflate GDP growth with the potential for job growth. Peter Burgess |

|

GDP -v- GPI

Gross Domestic Products -v- Genuine Progress Indicator | GO TOP |

| |

UNITED STATES OF AMERICA

| |

|

US GDP is going up while GPI stays the same or declines

Until the late 1960s there was some correletion between per capita Gross Domestic Product (GDP) and the Genuine Progress Indicator (GPI), but this ended with the economic downturn of the early 1970s, the subsequent oil shock of 1973 and the associated stagflation and cost push inflation. After 1980, there was a new political imperative where deregulation and profit became the dominant policy rather than a more balanced set of socio-economic goals. The cost push inflation of the 1970s was ended in large part by the expansion of offshore manufacturing espcecially in China and reduction of high wage US manufacturing. TPB note: It is worth remembering that every $ of US money that is domiciled in China got there because the US private sector sent it there in order to bring low price (and even lower cost) Chinese products back to the USA so that they could sell them for a big profit in the United States. TPB Note: Worse, when wages in the USA stagnated and aggregated demand stalled, the banking sector came to the rescue and enabled consumer finance so that the buying could continue, even though this would ruin the balance sheet of almost every family in the country! |

PEOPLE'S REPUBLIC OF CHINA

|

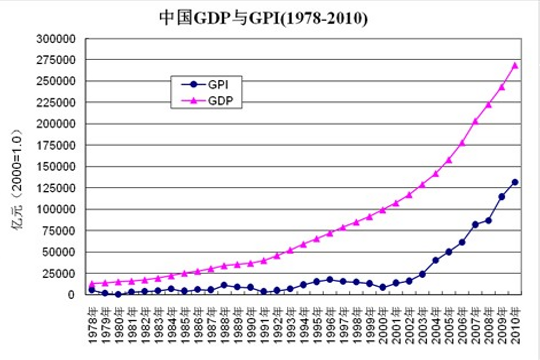

Chinese GDP is going up and GPI is going up as well

The difference between the US economic experience and the Chinese economic experience is clear. The second round study on China’s Genuine Progress Indicator was completed by Beijing Academy of Soft Technology & Center For Technology Innovation and Strategy Studies of CASS, and released on Sept. 12, 2012 in Beijing. |

| . |

|

ABOUT GDP

TPB note: These words are from around 2000 Gross Domestic Product (GDP) is a dangerously flawed metric. The way the GDP is compiled makes very little sense ... like most indexes the GDP is a measure, but what is being measured is far from clear. Cost is NOT a Product There needs to be clarity about the critical difference between product and cost. Much of the confusion in economic analysis and policy formulation would be avoided if there was a clear distinction about what is a product and what is a cost. What belongs in the Gross Domestic Product? Gross domestic product should be the output of the economy ... what the economy produces ... the product. Over time, more and more of the product is expressed as the cost of the product at the transaction level and over time the measure has become more and more inflated so as to become meaningless. Rather, it is much worse ... it has resulted in the wrong signals being sent about the prosperity of the nation! Producers, consumers and prosumers It is widely recognised that affluent consumers have been part of the success of the US economy ... good wages were part of this. The Keynesian Dynamic Keynes was also very clear about the way wages fed into the success of the economy by expanding aggregate demand. Keynes was clear about the dynamic of economic activity in a society ... but the Keysian clarity seems to be submerged in most modern economic analysts and policy dialog by ideas that are ideological more than anything else. Though there are powerful analytical tools available to process data ... most of the data are studied with a severe lack of transparency.What is GDP used for? GDP is one of those macro-economic indicators that has leverage over the economy because of its role in moving the capital markets ... but has little to no use as a tool to understand socio-economic performance. In TrueValueMetrics (TVM) it is clear that quality of health is a valid product of the health sector, and the cost of this health care should appear in something that might be called the Gross National Cost. At the moment this does not exist as a national macro-economic indicator ... but it does feature as an element of the TVM system. |

| . |

|

Economic Metrics ... If the GDP is Up, Why is America Down? This Monthly Atlantic Magazine essay written in 1995 by Clifford Cobb, Ted Halstead, and Jonathan Rowe explains how the GDP metric measures the wrong things. TPB Commentary: This essay written in 1995 and published in The Atlantic Monthly explains in some detail the many flaws in Gross Domestic Product (GDP) as a key economic metric. The authors explain some of the economic hostory that gave rise to GDP as a key metric in the 1930s and remained important during the 1940s and beyond. It is a long time now that the GDP has been questioned as the dominant metric about economic performance, but it has proved difficult to change. Better measures are also more subjective and more difficult to quantify, and it then becomes easier and safer to revert to GDP. More than 15 years after this article was penned, the issues remain important, and the TrueValueMetrics (TVM) initiative is a similar reform effort. | Open file 0452 |

|

Metrics ... Gross Domestic Product (GDP)

David Pilling ... Has GDP outgrown its use? A good summary of the weaknesses of GDP and how it is used to distort the understanding of economic performance. | Open file 8006 |

|

Interesting Facts about GDP

This 2 page PDF sets out many of the high profile criticisms of GDP going back decades. These include remarks by Simon Kuznets (1934 and 1962) Robert MacNamara (1973) Joseph Stiglitz (2003) Lord Layard (2004), WWF/Global Footprint Network (2007) # 'http://truevaluemetrics.org/DBpdfs/Metrics/BeyondGDP/InterestingFacts.pdf' | Open PDF ... InterestingFacts |

| . |

|

Metrics ... GDP ... A dysfunctional metric

Edoardo Campanella ... Is It Time to Abandon GDP? ... Economist Edoardo Campanella examines the conceptual and technical flaws of the world’s most important metric, and asks whether and how it could be reformed. | Open file 12167 | |

|

US senator Robert F Kennedy pointed out 50 years ago that GDP traditionally measures everything except those things that make life worthwhile.

| ||

|

Gabriel Makhlouf: Natural capital and national wellbeing

According to Gabriel Makhlouf, traditional economic measures, such as gross domestic product (GDP), productivity and economic growth remain fundamentally important, he says, but they’re not the whole picture. | Open file 14939 | |

|

GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319.pdf' | Open PDF ... GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319 | |

|

GDP/UK-SNA-dcp171766_365274

This is part of a series of articles describing changes to national accounts, detailing the improvements to National Accounts which will be made in September 2014 to ensure that the UK National Accounts continue to provide the best possible framework for analysing the UK economy and comparing it with those of other countries. 'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-dcp171766_365274.pdf' | Open PDF ... GDP/UK-SNA-dcp171766_365274 | |

|

Eric Zencey NYT GDP RIP

IF there’s a silver lining to our current economic downturn, it’s this: With it comes what the economist Joseph Schumpeter called “creative destruction,” the failure of outmoded economic structures and their replacement by new, more suitable structures. Downturns have often given a last, fatality-inducing nudge to dying industries and technologies. Very few buggy manufacturers made it through the Great Depression. 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/EricZenceyNYT_GDP_RIP.pdf' | Open PDF ... Eric-Zencey-NYT-GDP-RIP |

|

Metrics ... GDP ... A dysfunctional metric

Edoardo Campanella ... Is It Time to Abandon GDP? ... Economist Edoardo Campanella examines the conceptual and technical flaws of the world’s most important metric, and asks whether and how it could be reformed.

TPB note 161108: I enjoyed reading this article, but it reminded me of the amazing dysfunction of leadership over the past 50 years or so of my adult life. I read engineering and economics at Cambridge in the late 50s and one takeaway was the growing dangerous use of statistics for decision making in economics and the emerging power of data to improve technology and make it very powerful. Simon Kuznits, Robert Kennedy and others in the 1960s spoke eloquently about the need to do better than GDP when thinking about economic performance ... yet more than 50 years later it is still one of the dominant economic metrics. I was a corporate CFO for a number of years and in this role it was obvious that it was easier to improve profit performance in an economy that was 'growing' ... in other words GDP getting bigger ... but that was somewhat simplistic. Subsequently I have become convinced that technology driven productivity improvement and consumption based GDP growth will result in the dual existential crises of accelerated climate change and uncontrollable social unrest. A better outcome is possible, but this absolutely requires better metrics that embraces the people profit and planet of the socio-enviro-economic system from every possible perspective ... organization, place, product, people, processes. This is the 21st century, not the 19th! | Open file 12167 | ||

|

Eric Zencey NYT ... GDP RIP ... 2009

IF there’s a silver lining to our current economic downturn, it’s this: With it comes what the economist Joseph Schumpeter called “creative destruction,” the failure of outmoded economic structures and their replacement by new, more suitable structures. 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/EricZenceyNYT_GDP_RIP.pdf' | Open PDF ... Eric-Zencey-NYT-GDP-RIP |

|

GDP-Bradford-De-Long-Estimates-1998-Paper

Estimates of World GDP, One Million Years B.C. to Present ... constructing estimates of world GDP over the very long run by combining estimates of total human populations with estimates of levels of real GDP per capita. TPB Note: This is interesting ... maybe ... but does little to help with our understanding of what is going on in the global and local economy at this point in history! 'http://truevaluemetrics.org/DBpdfs/Economics/GDP-Bradford-De-Long-Estimates-1998-Paper.pdf' | Open PDF ... GDP-Bradford-De-Long-Estimates-1998-Paper |

| . |

|

Dysfunctional Metrics

Economics ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 ... Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/Our-Phony-Economy-HarpersMagazine-2008-06-0082042.pdf' | Open file 10909 |

| Open PDF ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 | |

| US senator Robert F Kennedy pointed out 50 years ago that GDP traditionally measures everything except those things that make life worthwhile. | |

|

| |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

R&D Recognized as Investment in U.S. GDP Statistics: GDP Increase Slightly Lowers R&DtoGDP Ratio 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US | |

|

Kitov-and-Kitov-on-GDP.pdf

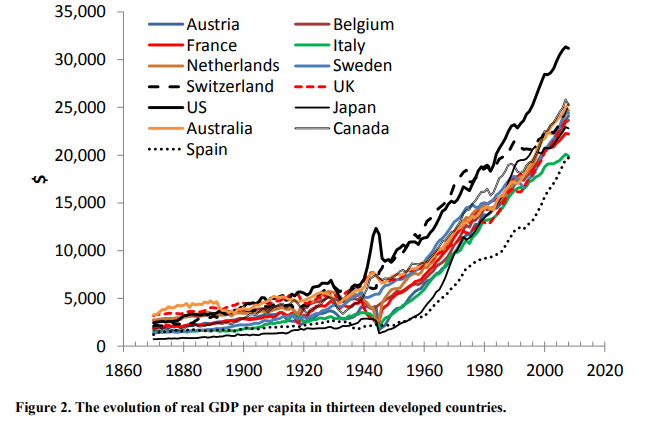

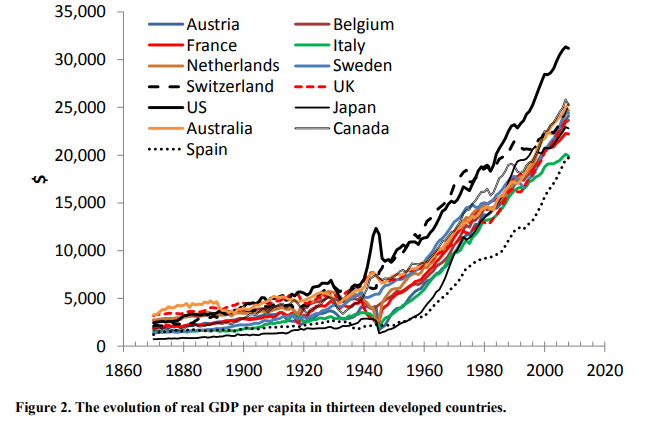

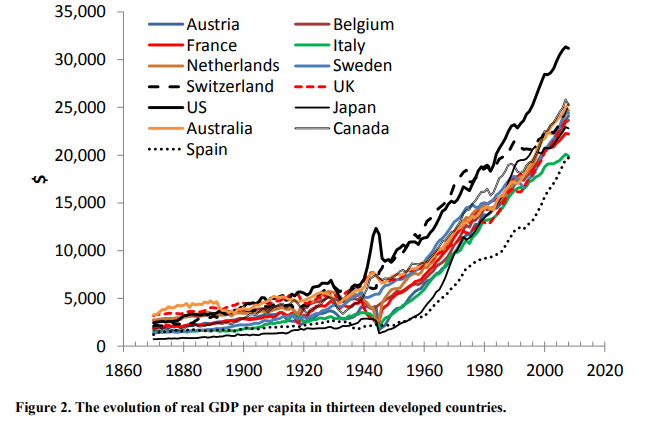

The linearity of long term growth is a significant result which is accompanied by a severe break in all time series between 1940 and 1950: the slopes and mean increments differ by an order of magnitude, although their standard deviations are close. The nature of this break should be considered in more detail, but the estimates before 1940 and after 1950 were made by different rules and using quite different methodologies: there was no working notation of GDP before 1940 and thus there was no relevant data collected systematically. 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/Kitov-and-Kitov-on-GDP.pdf' | Open PDF ... Kitov-and-Kitov-on-GDP.pdf |

|

Over time, in every country, human capital increased, and in most countries, produced capital increased as well. However, in Colombia, Nigeria, South Africa, Russia, Saudi Arabia, and Venezuela the natural capital depletion was not offset by increases in human capital and natural capital. This indicates that their economic growth is not sustainable.

By taking into account the capital formations which determine future growth, countries can better prepare themselves for the future. The U.N. report suggests that countries should target monetary and economic policy to IWI to ensure sustainable, rather than short-term growth. Such a shift was recently suggested by Jeffrey Sachs in a recent Huffington Post op-ed: | |

|

|

Beyond GDP

What comes next? How to get to beter metrics? |

|

Stiglitz-Sen-Fitoussi-Report-Reflections

'http://truevaluemetrics.org/DBpdfs/Metrics/BeyondGDP/Stiglitz-Sen-Fitoussi-Report-Reflections.pdf' | Open PDF ... Stiglitz-Sen-Fitoussi-Report-Reflections | ||

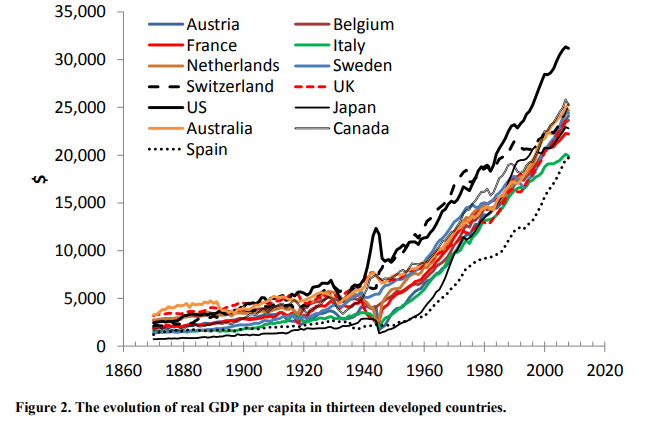

Kitov-and-Kitov-on-GDP

Per-capita-GDP-for-13-countries-1870-2010.png Real GDP per capita since 1870 / Ivan Kitov, Institute for the Geospheres’ Dynamics, RAS / Oleg Kitov, University of Oxford .... The most important [finding] is that all slopes (except that for Australia after 1950) of the regression lines obtained for the annual increments of real GDP per capita are small and statistically insignificant, i.e. one cannot reject the null hypothesis of a zero slope and thus constant increment. Hence the growth in real GDP per capita is a linear one since 1870 with a break in slope between 1940 and 1950. 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/Kitov-and-Kitov-on-GDP.pdf' | Open PDF ... Kitov-and-Kitov-on-GDP.pdf | ||

|

Sean McElwee ...Moving Beyond GDP

The Inclusive Wealth Index (IWX) is a unique measure of economic progress that examines all of a country’s capital sources, including manufactured capital, human capital and natural capital. It measures the key inputs to a country’s productive capacity include natural capital, human capital and manufactured capital. Hopefully in the future it will also include a measure of social capital. By examining progress towards a “Green Economy,” reporting of the Inclusive Wealth Index is a first step away from GDP and toward a more comprehensive metric of human progress. | Open file 9232 |

| moving-beyond-gdp_b_4311982.html | Open external link | ||

Using the IWX measure, 14 of the 20 countries surveyed were growing sustainably, including the United States. However, the growth was not as dynamic as GDP growth. The United States provides an example. While GDP (the red line) increased by 37%, Inclusive Wealth Index (the dark green line) increased by only 13% because of a steep decline in natural capital (the light green line). Human capital (yellow line) increased by 8% and produced capital (grey line) increased by 68%.

| |||

|

Sean McElwee ...Moving Beyond GDP

The Inclusive Wealth Index (IWX) is a unique measure of economic progress that examines all of a country’s capital sources, including manufactured capital, human capital and natural capital. It measures the key inputs to a country’s productive capacity include natural capital, human capital and manufactured capital. Hopefully in the future it will also include a measure of social capital. By examining progress towards a “Green Economy,” reporting of the Inclusive Wealth Index is a first step away from GDP and toward a more comprehensive metric of human progress. | Open file 9232 | Open external link | |

Using the IWX measure, 14 of the 20 countries surveyed were growing sustainably, including the United States. However, the growth was not as dynamic as GDP growth. The United States provides an example. While GDP (the red line) increased by 37%, Inclusive Wealth Index (the dark green line) increased by only 13% because of a steep decline in natural capital (the light green line). Human capital (yellow line) increased by 8% and produced capital (grey line) increased by 68%.

| |||

Over time, in every country, human capital increased, and in most countries, produced capital increased as well. However, in Colombia, Nigeria, South Africa, Russia, Saudi Arabia, and Venezuela the natural capital depletion was not offset by increases in human capital and natural capital. This indicates that their economic growth is not sustainable.

By taking into account the capital formations which determine future growth, countries can better prepare themselves for the future. The U.N. report suggests that countries should target monetary and economic policy to IWI to ensure sustainable, rather than short-term growth. Such a shift was recently suggested by Jeffrey Sachs in a recent Huffington Post op-ed: | |||

|

Demos-Beyond-GDP-2012

January 26, 2012 ... Lew Daly, Stephen Posner 'http://truevaluemetrics.org/DBpdfs/Initiatives/Demos/Demos-Beyond-GDP-2012.pdf' | Open PDF ... Demos-Beyond-GDP-2012 | ||

|

Economic Metrics ... If the GDP is Up, Why is America Down?

This Monthly Atlantic Magazine essay written in 1995 by Clifford Cobb, Ted Halstead, and Jonathan Rowe explains how the GDP metric measures the wrong things | Open file 0452 | ||

|

Economic Metrics ... more about GDP

A most dysfunctional metric | Open L0700-MT-GDP |

|

Economics ... Dysfunctional Metrics

Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy | Open file 10909 | Open PDF |

| THE UK ECONOMY AND GDP | |||

|

GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319.pdf' | Open PDF ... GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319 | ||

|

GDP/UK-SNA-dcp171766_365274

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-dcp171766_365274.pdf' 'http://www.ons.gov.uk/ons/dcp171766_365274.pdf' | Open PDF ... GDP/UK-SNA-dcp171766_365274 | Open external link | |

|

UK National Accounts

Impact of ESA95 Changes on Current Price GDP Estimates 'http://www.ons.gov.uk/ons/dcp171766_365274.pdf' | Open external link |

|

Estimates of World GDP, One Million B.C. – Present

J. Bradford De Long ... Department of Economics, U.C. Berkeley Massive change in the last 800 years ... and especially in the last 200 'http://truevaluemetrics.org/DBpdfs/Economics/GDP-Bradford-De-Long-Estimates-1998-Paper.pdf' | Open PDF ... GDP-Bradford-De-Long-Estimates-1998-Paper | |

|

Our-Phony-Economy-HarpersMagazine-2008-06-0082042

OUR PHONY ECONOMY By Jonathan Rowe, from testimony delivered March 12 before the Senate Committee on Commerce, Science, and Transportation, Subcommittee on Interstate Commerce. Rowe is codirector of West Marin Commons,a community-organizing group, in California. 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/Our-Phony-Economy-HarpersMagazine-2008-06-0082042.pdf' | Open PDF ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 | |

Kitov-and-Kitov-on-GDP

Per-capita-GDP-for-13-countries-1870-2010.png Real GDP per capita since 1870 / Ivan Kitov, Institute for the Geospheres’ Dynamics, RAS / Oleg Kitov, University of Oxford .... The most important [finding] is that all slopes (except that for Australia after 1950) of the regression lines obtained for the annual increments of real GDP per capita are small and statistically insignificant, i.e. one cannot reject the null hypothesis of a zero slope and thus constant increment. Hence the growth in real GDP per capita is a linear one since 1870 with a break in slope between 1940 and 1950. 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/Kitov-and-Kitov-on-GDP.pdf' | Open PDF ... Kitov-and-Kitov-on-GDP.pdf | |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

Expenditures for research and development are now capitalized—incorporated as investment—in the U.S. gross domestic product (GDP) and other national income and product accounts (NIPAs) produced and published by the Bureau of Economic Analysis (BEA). 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US |

| Measure State and you Measure Progress | ||

|

|

|

|

TPB Observation

Why is it that GDP is still one of the dominant metrics in modern economics? The fundamental flaws in GDP as a meaningful measure for economic performance were recognised many decades ago. Kuznets who developed the measure in the United States and Keynes understood the limitations before the Second World War! Kuznets and Robert Kennedy both spoke out about the flaws in the GDP metric in the 1960s. Sowhy did nothing get changed. My experience as a corporate CFO may be helpful. It was so much easier to increase profts for stockholders in an environment of economic growth ... that is GDP growth ... than in one where the economy was stagnant ... that is no growth! In the late 1960s there was a lot of growth, but in the early 1970s the bubble burst and then worse, the OPEC oil shock that resulted in massive increase in energy costs for US companies that had become incredibly sloppy with their use of really cheap energy. Many companies got into serious financial difficulties and the Nixon / Ford / Carter series of administations in Washington were unable to make much difference. It is my view that corporate thought leaders have had some role in promulgating the myth that economic growth is essential for profit growth. This has been copied by economists and political leaders who then conflate GDP growth with the potential for job growth. |

|

Economic Metrics ... If the GDP is Up, Why is America Down?

This Monthly Atlantic Magazine essay written in 1995 explains how the GDP metric measures the wrong things | Open file 0452 |

|

Economics ... Dysfunctional Metrics

Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy | Open file 10909 |

|

Metrics ... GDP ... A dysfunctional metric

Edoardo Campanella ... Is It Time to Abandon GDP? ... Economist Edoardo Campanella examines the conceptual and technical flaws of the world’s most important metric, and asks whether and how it could be reformed. | Open file 12167 |

|

ons/dcp171766_365274

'http://www.ons.gov.uk/ons/dcp171766_365274.pdf' | Open PDF ... ons/dcp171766_365274 |

|

GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319.pdf' | Open PDF ... GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319 |

|

GDP/UK-SNA-dcp171766_365274

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-dcp171766_365274.pdf' | Open PDF ... GDP/UK-SNA-dcp171766_365274 |

|

GDP/EricZenceyNYT_GDP_RIP

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/EricZenceyNYT_GDP_RIP.pdf' | Open PDF ... GDP-Eric-Zencey-NYT-GDP-RIP |

| GDP-Bradford-De-Long-Estimates-1998-Paper 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/GDP-Bradford-De-Long-Estimates-1998-Paper.pdf' | Open PDF ... GDP-Bradford-De-Long-Estimates-1998-Paper |

| Our-Phony-Economy-HarpersMagazine-2008-06-0082042 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/Our-Phony-Economy-HarpersMagazine-2008-06-0082042.pdf' | Open PDF ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 |

|

Economics ... Dysfunctional Metrics

Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy | Open file 10909 |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US |

|

Kitov-and-Kitov-on-GDP.pdf

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/Kitov-and-Kitov-on-GDP.pdf' | Open PDF ... Kitov-and-Kitov-on-GDP.pdf |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US |

|

Eric Zencey NYT GDP RIP

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/EricZenceyNYT_GDP_RIP.pdf' | Open PDF ... Eric-Zencey-NYT-GDP-RIP |

| Metrics ... BeyondGDP |

|

Interesting Facts

'http://truevaluemetrics.org/DBpdfs/Metrics/BeyondGDP/InterestingFacts.pdf' | Open PDF ... InterestingFacts |

|

Stiglitz-Sen-Fitoussi-Report-Reflections

'http://truevaluemetrics.org/DBpdfs/Metrics/BeyondGDP/Stiglitz-Sen-Fitoussi-Report-Reflections.pdf' | Open PDF ... Stiglitz-Sen-Fitoussi-Report-Reflections |

|

US Economy ... Boondoggle

What role government? Delaware’s very own Solyndra Will Delaware and US citizens get stuck with a Bloom Energy fuel cell boondoggle? | Open file 616 |

|

Ideas ... Metrics

Sean McElwee ...Moving Beyond GDP | Open file 9232 |

|

Demos-Beyond-GDP-2012

January 26, 2012 ... Lew Daly, Stephen Posner 'http://truevaluemetrics.org/DBpdfs/Initiatives/Demos/Demos-Beyond-GDP-2012.pdf' | Open PDF ... Demos-Beyond-GDP-2012 |

|

TPB note: These words were penned around 2000

Gross Domestic Product (GDP) is a dangerously flawed metric. The way the GDP is compiled makes very little sense ... like most indexes the GDP is a measure, but what is being measured is far from clear. Cost is NOT a Product There needs to be clarity about the critical difference between product and cost. Much of the confusion in economic analysis and policy formulation would be avoided if there was a clear distinction about what is a product and what is a cost. What belongs in the Gross Domestic Product? Gross domestic product should be the output of the economy ... what the economy produces ... the product. Over time, more and more of the product is expressed as the cost of the product at the transaction level and over time the measure has become more and more inflated so as to become meaningless. Rather, it is much worse ... it has resulted in the wrong signals being sent about the prosperity of the nation! Producers, consumers and prosumers It is widely recognised that affluent consumers have been part of the success of the US economy ... good wages were part of this. Henry Ford is meant to have realized that a prosperous working class would eventually be the consumers of the automobiles that his company was manufacturing ... those that were producing were the same as those that were consuming. I associate Henry Ford's insight as being something of the origin of the idea of a prosumer. The Keynesian Dynamic Keynes was also very clear about the way wages fed into the success of the economy by expanding aggregate demand. Keynes was clear about the dynamic of economic activity in a society ... but the Keysian clarity seems to be submerged in most modern economic analysts and policy dialog by ideas that are ideological more than anything else. Though there are powerful analytical tools available to process data ... most of the data are studied with a severe lack of transparency. What is GDP used for? GDP is one of those macro-economic indicators that has leverage over the economy because of its role in moving the capital markets ... but has little to no use as a tool to understand socio-economic performance. 16% of US economy is healthcare! The statement is made over and over again that healthcare makes up 16% of the US Gross Domestic Product (GDP). At the same time the observation is made that the proportion is the highest among the top developed countries and the health state of the US population is lowest of the group. Clearly one metric is insufficient to describe the economic characteristic of the health sector. In TrueValueMetrics (TVM) it is clear that quality of health is a valid product of the health sector, and the cost of this health care should appear in something that might be called the Gross National Cost. At the moment this does not exist as a national macro-economic indicator ... but it does feature as an element of the TVM system. | ||

|

Issue

GDP |

|

Basic observation

Gross Domestic Product is a commonly used macro-economic indicator that measures the size of an economy |

|

Prevailing response

It is a useful measure, but not very powerful for the analysis of complex relationships in the economy and the complex interactions that make up both the local situation and the world situation. |

|

A better response

In addition to macro economic measures, there needs to be a lot of management metrics so that the how and why can be answered. GDP is just one measure or hundreds that are possible, and most more specifically useful for analysis. |

| Gross Domestic Product (GDP) |

|

TPB Observation

Why is it that GDP is still one of the dominant metrics in modern economics? The fundamental flaws in GDP as a meaningful measure for economic performance were recognised many decades ago. Kuznets who developed the measure in the United States and Keynes understood the limitations before the Second World War! Kuznets and Robert Kennedy both spoke out about the flaws in the GDP metric in the 1960s. Sowhy did nothing get changed. My experience as a corporate CFO may be helpful. It was so much easier to increase profts for stockholders in an environment of economic growth ... that is GDP growth ... than in one where the economy was stagnant ... that is no growth! In the late 1960s there was a lot of growth, but in the early 1970s the bubble burst and then worse, the OPEC oil shock that resulted in massive increase in energy costs for US companies that had become incredibly sloppy with their use of really cheap energy. Many companies got into serious financial difficulties and the Nixon / Ford / Carter series of administations in Washington were unable to make much difference. It is my view that corporate thought leaders have had some role in promulgating the myth that economic growth is essential for profit growth. This has been copied by economists and political leaders who then conflate GDP growth with the potential for job growth. |

|

Economic Metrics ... If the GDP is Up, Why is America Down?

This Monthly Atlantic Magazine essay written in 1995 explains how the GDP metric measures the wrong things | Open file 0452 |

|

Economics ... Dysfunctional Metrics

Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy | Open file 10909 |

|

Metrics ... GDP ... A dysfunctional metric

Edoardo Campanella ... Is It Time to Abandon GDP? ... Economist Edoardo Campanella examines the conceptual and technical flaws of the world’s most important metric, and asks whether and how it could be reformed. | Open file 12167 |

|

ons/dcp171766_365274

'http://www.ons.gov.uk/ons/dcp171766_365274.pdf' | Open PDF ... ons/dcp171766_365274 |

|

GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319.pdf' | Open PDF ... GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319 |

|

GDP/UK-SNA-dcp171766_365274

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-dcp171766_365274.pdf' | Open PDF ... GDP/UK-SNA-dcp171766_365274 |

|

GDP/EricZenceyNYT_GDP_RIP

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/EricZenceyNYT_GDP_RIP.pdf' | Open PDF ... GDP-Eric-Zencey-NYT-GDP-RIP |

| GDP-Bradford-De-Long-Estimates-1998-Paper 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/GDP-Bradford-De-Long-Estimates-1998-Paper.pdf' | Open PDF ... GDP-Bradford-De-Long-Estimates-1998-Paper |

| Our-Phony-Economy-HarpersMagazine-2008-06-0082042 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/Our-Phony-Economy-HarpersMagazine-2008-06-0082042.pdf' | Open PDF ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 |

|

Economics ... Dysfunctional Metrics

Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy | Open file 10909 |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US |

|

Kitov-and-Kitov-on-GDP.pdf

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/Kitov-and-Kitov-on-GDP.pdf' | Open PDF ... Kitov-and-Kitov-on-GDP.pdf |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US |

|

Eric Zencey NYT GDP RIP

'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/EricZenceyNYT_GDP_RIP.pdf' | Open PDF ... Eric-Zencey-NYT-GDP-RIP |

| Metrics ... BeyondGDP |

|

Interesting Facts

'http://truevaluemetrics.org/DBpdfs/Metrics/BeyondGDP/InterestingFacts.pdf' | Open PDF ... InterestingFacts |

|

Stiglitz-Sen-Fitoussi-Report-Reflections

'http://truevaluemetrics.org/DBpdfs/Metrics/BeyondGDP/Stiglitz-Sen-Fitoussi-Report-Reflections.pdf' | Open PDF ... Stiglitz-Sen-Fitoussi-Report-Reflections |

|

US Economy ... Boondoggle

What role government? Delaware’s very own Solyndra Will Delaware and US citizens get stuck with a Bloom Energy fuel cell boondoggle? | Open file 616 |

|

Ideas ... Metrics

Sean McElwee ...Moving Beyond GDP | Open file 9232 |

|

Demos-Beyond-GDP-2012

January 26, 2012 ... Lew Daly, Stephen Posner 'http://truevaluemetrics.org/DBpdfs/Initiatives/Demos/Demos-Beyond-GDP-2012.pdf' | Open PDF ... Demos-Beyond-GDP-2012 |

|

TPB note: These words were penned around 2000

Gross Domestic Product (GDP) is a dangerously flawed metric. The way the GDP is compiled makes very little sense ... like most indexes the GDP is a measure, but what is being measured is far from clear. Cost is NOT a Product There needs to be clarity about the critical difference between product and cost. Much of the confusion in economic analysis and policy formulation would be avoided if there was a clear distinction about what is a product and what is a cost. What belongs in the Gross Domestic Product? Gross domestic product should be the output of the economy ... what the economy produces ... the product. Over time, more and more of the product is expressed as the cost of the product at the transaction level and over time the measure has become more and more inflated so as to become meaningless. Rather, it is much worse ... it has resulted in the wrong signals being sent about the prosperity of the nation! Producers, consumers and prosumers It is widely recognised that affluent consumers have been part of the success of the US economy ... good wages were part of this. Henry Ford Henry Ford is meant to have realized that a prosperous working class would eventually be the consumers of the automobiles that his company was manufacturing ... those that were producing were the same as those that were consuming. I associate Henry Ford's insight as being something of the origin of the idea of a prosumer. The Keynesian Dynamic Keynes was also very clear about the way wages fed into the success of the economy by expanding aggregate demand. Keynes was clear about the dynamic of economic activity in a society ... but the Keysian clarity seems to be submerged in most modern economic analysts and policy dialog by ideas that are ideological more than anything else. Though there are powerful analytical tools available to process data ... most of the data are studied with a severe lack of transparency. What is GDP used for? GDP is one of those macro-economic indicators that has leverage over the economy because of its role in moving the capital markets ... but has little to no use as a tool to understand socio-economic performance. 16% of US economy is healthcare! The statement is made over and over again that healthcare makes up 16% of the US Gross Domestic Product (GDP). At the same time the observation is made that the proportion is the highest among the top developed countries and the health state of the US population is lowest of the group. Clearly one metric is insufficient to describe the economic characteristic of the health sector. In TrueValueMetrics (TVM) it is clear that quality of health is a valid product of the health sector, and the cost of this health care should appear in something that might be called the Gross National Cost. At the moment this does not exist as a national macro-economic indicator ... but it does feature as an element of the TVM system. |

| GDP ... A DYSFUNCTIONAL METRIC |

|

Economic Metrics ... If the GDP is Up, Why is America Down?

This Monthly Atlantic Magazine essay written in 1995 by Clifford Cobb, Ted Halstead, and Jonathan Rowe explains how the GDP metric measures the wrong things | Open file 0452 |

|

Economics ... Dysfunctional Metrics

Harpers ... READINGS — From the June 2008 issue ... Our Phony Economy | Open file 10909 |

| http://ruevaluemetrics.org/DBpdfs/Economics/Jonathan-Rowe-Our-Phony-Economy-Harpers-Magazine-2008-10908.pdf | Open PDF ... Jonathan-Rowe-Our-Phony-Economy-Harpers-Magazine-2008-10908 |

| THE UK ECONOMY AND GDP | |

|

Changes to National Accounts: Inclusion of Illegal Drugs and Prostitution in the UK National Accounts

Authors: Joshua Abramsky & Steve Drew, Office for National Statistics Date: 29 May 2014 'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319.pdf' | Open PDF ... GDP/UK-SNA-illegalactivitiesarticlefinalf_tcm77-365319 |

|

GDP/UK-SNA-dcp171766_365274

'http://www.truevaluemetrics.org/DBpdfs/Metrics/GDP/UK-SNA-dcp171766_365274.pdf' 'http://www.ons.gov.uk/ons/dcp171766_365274.pdf' | Open PDF ... GDP/UK-SNA-dcp171766_365274 |

|

GDP/UK-SNA-dcp171766_365274 | Open external link |

|

UK National Accounts

Impact of ESA95 Changes on Current Price GDP Estimates 'http://www.ons.gov.uk/ons/dcp171766_365274.pdf' | Open external link |

|

Estimates of World GDP, One Million B.C. – Present

J. Bradford De Long ... Department of Economics, U.C. Berkeley Massive change in the last 800 years ... and especially in the last 200 'http://truevaluemetrics.org/DBpdfs/Economics/GDP-Bradford-De-Long-Estimates-1998-Paper.pdf' | Open PDF ... GDP-Bradford-De-Long-Estimates-1998-Paper |

|

Our-Phony-Economy-HarpersMagazine-2008-06-0082042

OUR PHONY ECONOMY By Jonathan Rowe, from testimony delivered March 12 before the Senate Committee on Commerce, Science, and Transportation, Subcommittee on Interstate Commerce. Rowe is codirector of West Marin Commons,a community-organizing group, in California. 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/Our-Phony-Economy-HarpersMagazine-2008-06-0082042.pdf' | Open PDF ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 |

Kitov-and-Kitov-on-GDP

Per-capita-GDP-for-13-countries-1870-2010.png 'http://truevaluemetrics.org/DBpdfs/Economics/GDP/Our-Phony-Economy-HarpersMagazine-2008-06-0082042.pdf' | Open PDF ... Our-Phony-Economy-HarpersMagazine-2008-06-0082042 | |

Kitov-and-Kitov-on-GDP

Per-capita-GDP-for-13-countries-1870-2010.png .... The most important [finding] is that all slopes (except that for Australia after 1950) of the regression lines obtained for the annual increments of real GDP per capita are small and statistically insignificant, i.e. one cannot reject the null hypothesis of a zero slope and thus constant increment. Hence the growth in real GDP per capita is a linear one since 1870 with a break in slope between 1940 and 1950. | |

| 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/Kitov-and-Kitov-on-GDP.pdf' | Open PDF ... Kitov-and-Kitov-on-GDP.pdf |

|

GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US

Expenditures for research and development are now capitalized—incorporated as investment—in the U.S. gross domestic product (GDP) and other national income and product accounts (NIPAs) produced and published by the Bureau of Economic Analysis (BEA). 'http://truevaluemetrics.org/DBpdfs/Metrics/GDP/GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US.pdf' | Open PDF ... GDP-NSF-GOV-RandD-Recognized-as-Investment-in-US |

| . |

| HOME | SiteNav | Alpha | Chrono | Briefs | SEES | capitals | activities | actors | place | products | SI | SS | metrics | TPB |